FS Close documentation and PBC files as two distinct pillars of financial reporting governance

Introduction – why this topic matters more than ever

In many organisations, the financial statement close has quietly turned into an audit-driven exercise. Close calendars are designed around audit deadlines, documentation is shaped by PBC lists, and management judgement is often articulated only when auditors start asking questions. What should be the culmination of management accountability increasingly becomes a logistical coordination effort.

That shift is subtle, but consequential.

The financial statement close is not an administrative endpoint. It is the moment at which management formally asserts ownership over the numbers. Every material judgement, estimate and classification embedded in the financial statements represents a conscious or unconscious decision by management. Governance does not begin when the auditor arrives; it must already be visible before the first audit question is asked.

This article introduces a disciplined way of thinking about close documentation by separating two concepts that are often conflated:

-

the FS Close file as documentation of a properly governed internal close; and

-

the PBC file (Prepared by Client) as the information set enabling external audit procedures.

They are related, but they are not the same. Understanding the difference — and knowing when documentation may overlap and when it must not — is a defining capability of mature finance leadership.

1. The financial close as a governance event

At its core, financial reporting is an act of accountability. Management prepares financial statements to explain how resources were used, what risks materialised, and what uncertainties remain. The financial close is therefore not simply a technical consolidation exercise; it is the final governance act of the reporting period.

From a governance perspective, three assertions are embedded in every close:

-

that systems and processes operated as intended;

-

that significant transactions were understood and appropriately accounted for; and

-

that estimates and judgements reflect a fair, unbiased and consistent view.

The FS Close file is the place where management documents how it arrived at these assertions. It is addressed primarily to itself: the CFO, the executive board, the audit committee. Only secondarily does it serve others.

The PBC file, by contrast, exists to enable the auditor to perform independent procedures. Its purpose is not to demonstrate governance, but to allow sceptical verification.

Conflating these two roles weakens both.

2. FS Close file versus PBC file – a principled distinction

A clear distinction helps anchor the entire discussion.

The FS Close file:

-

documents management ownership of the numbers;

-

captures judgement, challenge and decision-making;

-

exists before the external audit starts;

-

is part of internal governance and oversight.

The PBC file:

-

supports audit evidence gathering;

-

responds to audit risk assessment and procedures;

-

may reuse management documentation, but is not defined by it;

-

evolves during the audit.

In practice, some documents will legitimately appear in both files. Others should never be treated as interchangeable. The key is not duplication, but intent.

To make this distinction operational, it helps to look at the nature of the underlying processes that generate financial information.

3. Three process categories that determine documentation logic

From a governance and audit perspective, financial reporting processes fall into three broad categories:

-

Routine data processes – continuous, system-embedded, repeatable;

-

Non-routine data processes – episodic, transaction-driven, explanatory;

-

Estimation processes – judgement-heavy, forward-looking, uncertain.

This categorisation is not academic. It mirrors how auditors assess risk and how regulators evaluate documentation quality. More importantly, it gives CFOs a decision framework for structuring close documentation.

Routine data processes – where governance becomes visible through discipline

Routine processes are often dismissed as “boring”. That is precisely why they are dangerous. When governance fails in routine processes, it usually fails quietly — until an auditor or regulator notices patterns that management never documented.

What follows are examples of what good looks like on paper, not in theory.

Example box 4.1 – Accounts payable: from listing to governance

FS Close artefact

AP Close Review Snapshot – December 20X4

(1 page, Group Controller owned)

Purpose: demonstrate management review, not re-perform transactions.

| Item | Dec 20X4 | Nov 20X4 | Management comment |

|---|---|---|---|

| Total AP balance | €42.1m | €41.8m | Stable |

| > 90 days overdue | €1.2m | €0.4m | One disputed vendor, settled Jan |

| GR/IR balance | €3.6m | €3.5m | No abnormal unmatched items |

| Debit balances | €0.3m | €0.2m | Cleared in Jan |

Review statement:

“Reviewed for completeness, unusual movements and cut-off. No issues identified that require adjustment.”

Signed: Group Controller

Date: 15 January

Why this inspires action

-

This is not extra work — the numbers already exist.

-

It replaces dozens of pages of raw listings.

-

The same page is reused in the PBC file.

The auditor now relies on review, not sampling alone.

This is governance through selection, not volume.

Example box 4.2 – Payroll: routine, but not thoughtless

FS Close artefact

Payroll Reasonableness Review – Q4 20X4

Key observations documented:

-

Headcount increased by 12 FTE due to plant expansion.

-

Average cost per FTE stable versus Q3.

-

Bonus accrual increased by €0.9m consistent with approved scheme.

Conclusion:

“No indicators of processing errors or misstatement.”

Here, the governance value lies in the narrative connection between numbers and business reality — something no system report can provide.

5. Non-routine data processes – where explanation replaces repetition

Non-routine processes are where most FS Close files fail — not because management lacks competence, but because decisions are made orally and never crystallised.

The following example boxes show what it means to capture the decision, not just the outcome.

Example box 5.1 – Asset disposal: documenting the moment of control

FS Close artefact

Accounting Memo – Disposal of DC Rotterdam

Transaction summary:

Warehouse sold to third party for €18.5m.

Key judgement:

Determination of disposal date and gain recognition.

Management assessment:

-

Legal transfer executed 28 December.

-

Keys, access rights and insurance transferred on same date.

-

Buyer obtained operational control from 28 December.

-

Cash received 5 January — assessed as irrelevant for control.

Alternatives considered:

Held-for-sale classification under IFRS 5 considered but rejected due to timing.

Conclusion:

Disposal recognised in December financial statements.

Approved: CFO

What this changes

-

The accounting outcome is no longer “obvious by hindsight”.

-

The auditor tests the judgement, not the existence of a memo.

-

The audit committee sees why December mattered.

Example box 5.2 – Contract modification: making IFRS judgement explicit

FS Close artefact

IFRS 15 Contract Modification Assessment – Customer A

Original contract: 5-year service agreement.

Modification: additional modules added mid-year.

Management judgement:

-

Additional services assessed as distinct.

-

Modification treated prospectively.

-

No cumulative catch-up recognised.

Reasoning documented:

Pricing consistent with standalone selling prices. No renegotiation of original services.

This is not “audit defence”.

This is management thinking preserved.

6. Estimation processes – where documentation must show intellectual honesty

Estimation processes are where CFO credibility is built or lost. Not because estimates must be “right”, but because they must be governable.

Here example boxes are not optional — they are essential.

Example box 6.1 – Impairment testing: separating belief from evidence

FS Close artefact

Impairment Governance Memo – Retail NL CGU

Trigger assessment:

EBIT margin decline driven by temporary logistics costs and store refits.

Key assumptions challenged:

-

Long-term EBIT margin (management proposal: 6%)

-

Terminal growth rate (1.5%)

Alternative scenario considered:

Flat EBIT margin for three years.

Outcome of sensitivity:

1% margin reduction reduces headroom by €18m but does not eliminate it.

Management conclusion:

No impairment recognised. Risk flagged for enhanced monitoring in 20X5.

Signed: CFO

Reviewed with Audit Committee: Yes

Read more in our blog: IAS 36 – Impairment of Assets: Significant Judgements and Estimates that Define Value.

Why this inspires confidence

-

The memo shows doubt, not just conviction.

-

Auditors can disagree — but not accuse management of bias without evidence.

-

The audit committee sees uncertainty governed, not hidden.

Example box 6.2 – Expected credit losses: governing overlays

FS Close artefact

ECL Overlay Decision Log – December 20X4

Model output: €6.8m ECL

Proposed overlay: +€1.2m

Rationale:

-

Deterioration in Tier 2 suppliers.

-

Model does not yet reflect sector-specific stress.

Alternative considered: no overlay — rejected due to lag in macro indicators.

Conclusion:

Overlay recognised. To be reassessed quarterly.

This single page often does more for audit quality than a perfect model.

Read more in our blog: Significant Judgments and Estimates in Financial Instruments.

Why these example boxes change the article

At this point, the reader no longer asks:

“Is this theoretically correct?”

They start asking:

“Do we have something like this — and if not, why not?”

That is the difference between a correct article and a useful one.

Conclusion – from framework to practice

The distinction between FS Close documentation and PBC documentation is not about pleasing auditors. It is about making management accountability visible.

Routine processes need discipline.

Non-routine processes need explanation.

Estimation processes need honesty.

What turns these principles into reality is not policy — it is well-chosen artefacts, documented at the right moment, owned by management.

A well-governed close does not feel heavier.

It feels calmer — because the thinking is already done.

Read more from Oracle NetSuite: What Is the Financial Close Process?

7. The FS Close Playbook

Six governance artefacts that make the financial close work

The most effective financial closes are not those with the most documentation, but those with the right documentation in the right places. Mature organisations converge on a small number of repeatable artefacts that together demonstrate governance, judgement and accountability.

Below are six such artefacts. Together, they form a minimum viable FS Close file for a complex organisation.

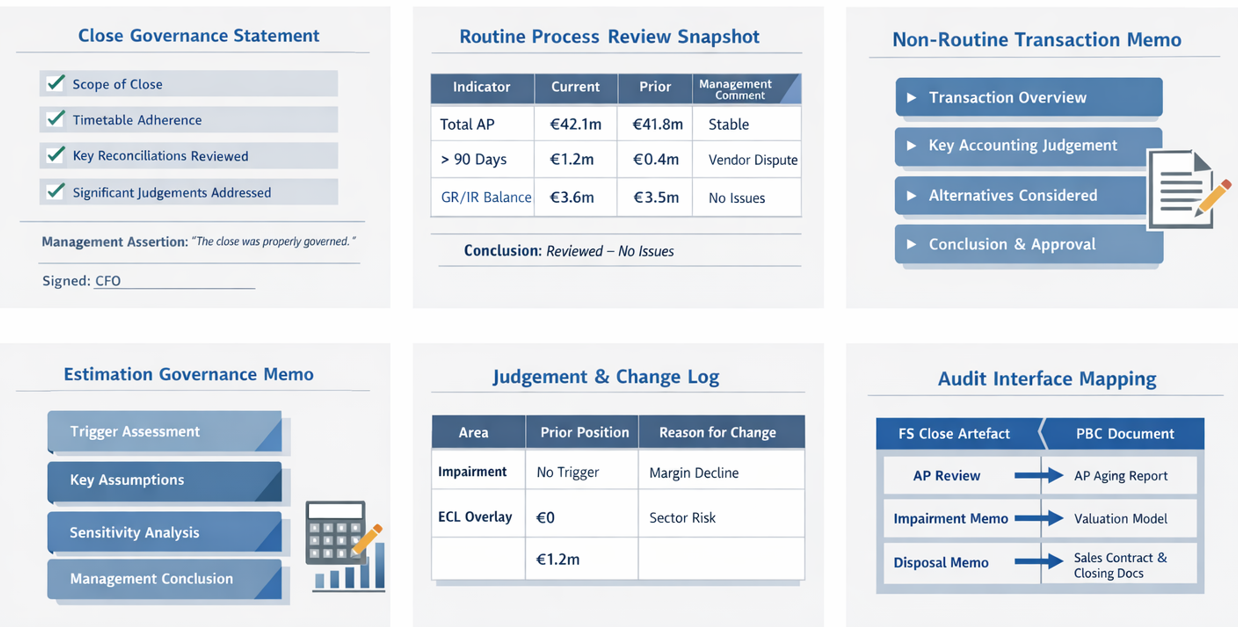

Artefact 7.1 – Close Governance Statement

(The anchor document)

FS Close documentation and PBC file audit documentation management judgement documentation external audit PBC internal close documentation

FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC fileFS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file

Purpose

To establish that the financial close was designed, executed and reviewed as a governed process.

Applies to

-

All closes

-

All process types (routine, non-routine, estimation)

Governance logic

This document answers one simple but fundamental question:

“Who owned the close, and on what basis do they assert that it was properly governed?”

Without this statement, all other documents float.

Typical contents (½–1 page)

FS Close Governance Statement – FY 20X4

-

Scope of the close (entities, systems, standards)

-

Close timetable adherence (with exceptions, if any)

-

Confirmation that:

-

key reconciliations were performed and reviewed;

-

significant non-routine transactions were identified;

-

material estimates were reviewed and challenged.

-

-

Summary of unresolved issues (if any)

Management assertion:

“Based on the procedures performed and documented, management concludes that the financial close for FY 20X4 was properly governed.”

Signed: CFO

Date: xx

Read more from the University of California, Berkely: Financial Close Process.

Relationship to PBC

This document is never a PBC item.

It frames the audit but is not audit evidence.

That distinction alone signals maturity.

Artefact 7.2 – Routine Process Review Snapshot

(Governance without volume)

Purpose

To demonstrate management review of routine processes without reproducing transactional detail.

Applies to

-

Routine data processes

(AP, AR, payroll, cash, inventory movements)

Governance logic

Auditors do not need to see everything.

They need to see that management looked at the right things.

Read more in our blog: Understanding Significant Business Processes: The Nerve System of Governance

Template (1 page per process, example AP)

FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC fileFS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file FS Close documentation and PBC file

Routine Process Review – Accounts Payable

| Indicator | Current | Prior | Management comment |

|---|---|---|---|

| Total AP | €42.1m | €41.8m | Stable |

| >90 days | €1.2m | €0.4m | One dispute |

| GR/IR | €3.6m | €3.5m | No anomalies |

| Debit balances | €0.3m | €0.2m | Cleared Jan |

Conclusion:

“No indicators of misstatement identified.”

Reviewed by: Group Controller

Date: xx

Relationship to PBC

This document is often reused in the PBC file.

Its value lies in review, not numbers.

Artefact 7.3 – Non-Routine Transaction Accounting Memo

(Capturing decisions while they are fresh)

Purpose

To document why a transaction was accounted for in a particular way, not just how.

Applies to

Governance logic

If management cannot explain a transaction without hindsight, governance has failed.

Template (1–2 pages)

Non-Routine Transaction Memo – Asset Disposal DC Rotterdam

-

Transaction overview

-

Key accounting question

-

Relevant accounting guidance

-

Management judgement and alternatives considered

-

Conclusion and approval

Approved by: CFO

Discussed with Audit Committee: Yes/No

Relationship to PBC

The memo explains.

The PBC supports (contracts, calculations, confirmations).

Never the other way around.

Artefact 7.4 – Estimation Governance Memo

(Where credibility is built)

Purpose

To demonstrate that estimates were governed, not merely calculated.

Applies to

-

Impairment tests

-

ECL

-

Provisions

-

Fair values

-

Pensions

Governance logic

Estimates are acceptable if uncertainty is acknowledged and managed.

Template (example impairment)

Estimation Governance Memo – Retail NL CGU

-

Trigger assessment

-

Key assumptions and rationale

-

Sensitivity analysis

-

Changes vs prior year

-

Management conclusion

Signed: CFO

Reviewed with Audit Committee: Yes

Relationship to PBC

Auditors use the PBC to challenge this memo.

That is the point.

Artefact 7.5 – Judgement & Change Log

(Preventing silent drift)

Purpose

To track what changed, and why it changed.

Applies to

-

All non-routine and estimation processes

Governance logic

Unexplained change is the enemy of trust.

Template (living document)

| Area | Prior position | Current | Why changed | Approved |

|---|---|---|---|---|

| Impairment | No trigger | Trigger | Margin decline | CFO |

| ECL overlay | €0 | €1.2m | Sector stress | CFO |

Relationship to PBC

This log rarely goes to the auditor verbatim.

It explains patterns auditors would otherwise infer themselves.

Artefact 7.6 – Audit Interface Mapping

(Preventing audit-led governance)

Purpose

To explicitly map FS Close artefacts to PBC requests.

Applies to

-

Entire close

Governance logic

This artefact prevents the audit from becoming the author of governance.

Template (excerpt)

| Audit area | FS Close artefact | PBC items |

|---|---|---|

| AP completeness | AP Review Snapshot | AP aging |

| Impairment | Estimation Memo | Model, recalcs |

| Disposal | Transaction Memo | Contract |

Relationship to PBC

This document is shared early with the auditor.

It signals: “Governance exists — audit plugs into it.”

Read more in our blog: Model Context Protocol (MCP): The Missing Governance Layer Between AI and ERP Systems and

FAQ’s – Audit documentation

FAQ 1 – What is the real difference between an FS Close file and a PBC file?

The FS Close file and the PBC file serve fundamentally different purposes, even though they are often confused in practice. The FS Close file documents management governance of the financial close. It shows that management has exercised judgement, reviewed outcomes, resolved exceptions and consciously signed off on the numbers. Its primary audience is internal: the CFO, executive management and the audit committee.

The PBC file, by contrast, exists to enable external audit procedures. It contains the information auditors need to obtain sufficient and appropriate audit evidence, based on their own risk assessment. While some documents may appear in both files, their intent differs. An FS Close artefact explains why management reached a conclusion; a PBC document supports how that conclusion can be tested.

Problems arise when governance documentation is created only in response to PBC requests. In that situation, management appears reactive rather than in control. A mature close distinguishes clearly between governing first and enabling audit second.

FAQ 2 – Does separating FS Close and PBC documentation create extra work?

In practice, no — provided the separation is done intelligently. Most organisations already perform the analysis, discussions and reviews required for a governed close. What is usually missing is timely capture of that thinking in a small number of structured artefacts.

The FS Close playbook deliberately limits documentation to six repeatable artefacts. These replace large volumes of unfocused listings and reactive explanations. By documenting management judgement early, organisations often experience fewer late-stage audit questions and fewer iterations.

The perception of “extra work” usually stems from writing documentation after audit questions arise. When governance documentation is produced as part of the close itself, the workload typically shifts rather than increases. Many CFOs find that the close becomes calmer and more predictable once decisions are clearly documented upfront.

FAQ 3 – When can FS Close documentation and PBC evidence overlap?

Overlap is most appropriate in routine data processes where transactions are system-driven, repeatable and subject to established controls. Examples include accounts payable, accounts receivable, payroll and cash.

In these areas, reconciliations, aging analyses and review snapshots can legitimately serve both as FS Close governance evidence and as PBC audit evidence — provided management review is explicit and documented. The key condition is that the document shows management oversight, not just raw data.

Overlap becomes risky when applied to non-routine transactions or estimation processes. In those cases, governance documentation must explain judgement and decision-making, while audit evidence must support independent testing. Knowing where overlap is appropriate is a core governance skill.

FAQ 4 – Why are estimation processes treated differently from other close activities?

Estimation processes differ because they are inherently uncertain and forward-looking. No amount of calculation removes judgement from impairment testing, expected credit losses, provisions or fair value measurements. As a result, these areas attract heightened audit scrutiny and regulatory attention.

In estimation processes, FS Close documentation must demonstrate how management governed uncertainty: which assumptions were selected, which alternatives were considered, how sensitivities were assessed and why conclusions were reached. This documentation establishes credibility.

The PBC file then allows auditors to independently assess reasonableness through recalculation, benchmarking and challenge. Attempting to merge these roles undermines both governance and audit quality. Clear separation protects management ownership while enabling robust assurance.

FAQ 5 – How does this approach help audit committees in practice?

Audit committees often struggle to see beyond technical detail into the quality of management judgement. A well-structured FS Close file gives them a clear line of sight into where judgement mattered and how it was exercised.

Instead of reviewing long PBC lists or audit reports filtered through the auditor’s lens, audit committees can focus on a small number of governance artefacts: estimation memos, non-routine transaction notes and judgement logs. This shifts discussion from “did the auditor agree?” to “does management’s reasoning make sense?”.

As a result, audit committee oversight becomes more substantive and less procedural, strengthening both governance and trust.

FAQ 6 – How do you introduce this approach without disrupting the close or upsetting auditors?

The most effective way is to start small and quietly. Do not launch this as a formal programme or “new framework”. Begin with one close cycle and introduce just one or two artefacts, such as a Close Governance Statement and an Estimation Governance Memo.

Capture discussions that already take place, but write them down earlier — before audit fieldwork begins. Share the audit interface mapping early with the auditor and position it as a way to improve clarity, not restrict audit scope. Most auditors welcome stronger governance because it improves audit efficiency and focus.

When audit committees endorse the approach, internal resistance tends to fade quickly. Over time, the remaining artefacts can be added naturally, turning the close into a more intentional and controlled process without increasing bureaucracy.