UK ad-supported streaming – When the Remote Control Changes Hands

show

For more than a decade, the promise of streaming was elegantly simple. Viewers would pay a monthly subscription fee and, in return, be liberated from advertising. No interruptions, no commercial pressure, no persuasion — just content, on demand. This promise was not merely commercial; it was ideological. Streaming positioned itself as the antidote to linear television, a cleaner, calmer alternative to the cluttered advertising ecosystem of broadcast TV.

That era has now decisively ended.

In December 2025, UK media data confirmed what had been building quietly for several years: for the first time, the majority of UK streaming subscribers are now on ad-supported plans. The shift is not marginal or temporary. It marks a structural turning point in how digital media is priced, consumed and monetised.

This article analyses that turning point in depth. Not as a consumer trend piece, but as a market transformation with strategic consequences for platforms, advertisers, regulators and audiences alike. The central question is not whether ad-supported streaming is growing — it already has. The real question is why it has overtaken ad-free models, and what that tells us about the future economics of content.

1. The Original Streaming Promise: Escape from Advertising

The Ideological Foundation of Subscription Streaming

When Netflix expanded aggressively into the UK market in the early 2010s, it did so with a radical proposition: television without advertising. This was not a technical innovation — advertising could easily have been integrated — but a strategic one. Advertising was framed as a defect of legacy media, a tax on attention that streaming would eliminate.

This positioning was echoed by other platforms. Amazon Prime Video embedded streaming inside a broader retail ecosystem, implicitly subsidising content to avoid overt advertising. Disney+ launched with a family-friendly, interruption-free model. The implicit message was consistent: advertising belonged to the past.

For viewers, this was compelling. The psychological value of uninterrupted viewing proved significant. Binge-watching, the defining behavioural pattern of the streaming age, is fundamentally incompatible with frequent ad breaks. The subscription model aligned neatly with user experience.

The Economics Behind the Idealism

However, this ideological purity always masked a fragile economic reality. Subscription-only streaming requires three conditions to remain sustainable:

-

Continuous subscriber growth

-

Stable or rising average revenue per user (ARPU)

-

Content costs that scale efficiently

By the early 2020s, all three conditions were under pressure.

Subscriber growth in mature markets such as the UK began to plateau. Price increases triggered churn. Content costs — particularly for premium drama and sports rights — escalated faster than revenues. The result was a growing tension between the experience promise and the economic base of streaming.

Advertising, once rejected as a contaminant, began to reappear — first tentatively, then strategically.

2. From Resistance to Acceptance: How Advertising Re-Entered Streaming

The Strategic Pivot

Netflix’s introduction of an ad-supported tier was initially framed as a defensive move. Public statements emphasised that advertising would remain a minority revenue stream, a supplementary option for price-sensitive consumers. Yet the timing revealed deeper forces at work.

By the time ad tiers were introduced, streaming platforms had already absorbed most willing ad-free subscribers. Growth now required either:

-

Extracting more value from existing users, or

-

Lowering the price barrier for new ones

Advertising enabled both.

The UK as a Test Market

The UK proved particularly receptive to ad-supported streaming. Several structural factors explain this:

-

A historically strong advertising-funded TV culture (BBC excluded)

-

High broadband penetration and connected TV adoption

-

Price sensitivity amplified by cost-of-living pressures

-

Widespread use of multiple streaming services per household

Unlike markets where advertising on TV is culturally resisted, UK audiences are accustomed to a mixed funding model. The psychological barrier was therefore lower than many platforms expected.

Ad-Free vs Ad-Supported Adoption Curve

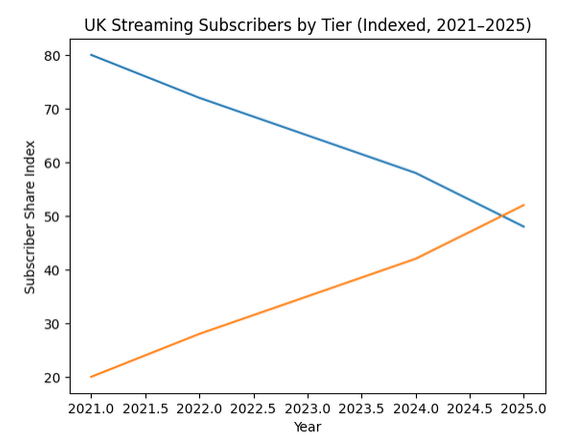

Figure 1 – UK streaming subscribers by tier (indexed, 2021–2025).

This indexed trend illustrates the rapid adoption of ad-supported streaming tiers in the UK. While ad-free subscriptions dominated until 2022, ad-supported models overtook them by 2025, reflecting changing consumer price sensitivity and platform monetisation strategies.

Sources: Ofcom – Media Nations UK, Kantar – Entertainment on Demand (UK), and Ampere Analysis – UK streaming market insights (public summaries).

Governance framing

“For boards, this curve is not merely a demand signal. It represents a shift in the organisation’s revenue dependency from subscribers alone to a dual reliance on advertisers and data.”

3. Why UK Consumers Are Choosing Ads

The Economics of the Household Subscription Stack

By 2025, the average UK household subscribing to multiple streaming services faced a monthly spend exceeding £60. This figure reflects not extravagance, but stacking behaviour: Netflix, Amazon Prime, Disney+, a sports add-on, and one or two niche platforms.

In that context, ad-supported tiers function as a pressure valve. They allow households to maintain breadth of access while reducing cash outflow. The trade-off is time — specifically, a willingness to exchange attention for affordability.

Value Reframed: Ads as a Discount Mechanism

Crucially, consumers no longer perceive advertising as a binary presence or absence. Instead, it is evaluated relative to price. A small number of targeted ads is increasingly framed as acceptable friction in exchange for a lower fee.

This reframing matters. It indicates that the original streaming promise has been renegotiated, not abandoned. Viewers are not returning to traditional TV; they are adopting a hybrid value logic.

4. The Advertising Economics of Streaming

A New Revenue Layer

From a platform perspective, advertising introduces a second monetisation axis. Instead of relying solely on ARPU derived from subscriptions, platforms can extract value from:

-

Viewer attention

-

Behavioural data

-

Targeted inventory sold to advertisers

This dual-revenue model stabilises cash flows and reduces dependency on constant price increases.

Advertiser Appeal: Targeting Meets Scale

For advertisers, ad-supported streaming offers something linear TV increasingly struggles to provide: addressable reach at scale. Streaming platforms combine television-like immersion with digital-like targeting.

Major UK advertisers have already shifted meaningful budgets into streaming environments. Retailers, technology firms and FMCG brands value the ability to align messaging with content genres and audience profiles.

Measurement and Trust

However, the transition is not without friction. Advertisers remain cautious about measurement standards, frequency control and brand safety. The credibility of streaming advertising depends on transparent metrics and consistent delivery — areas still evolving.

5. Streaming Versus Broadcasting: Competitive Rebalancing

Not a Zero-Sum Game

Contrary to early fears, ad-supported streaming has not simply cannibalised broadcast advertising. Instead, it has re-segmented the advertising market. Streaming attracts budgets oriented toward performance, targeting and younger demographics, while broadcast retains strength in mass-reach campaigns.

Strategic Tension

Nevertheless, competition is intensifying. Broadcasters fear being undercut on price and precision. Streamers risk replicating the clutter that drove viewers away from linear TV in the first place.

The equilibrium will depend on ad load discipline. Platforms that over-monetise risk eroding the very experience that differentiates them.

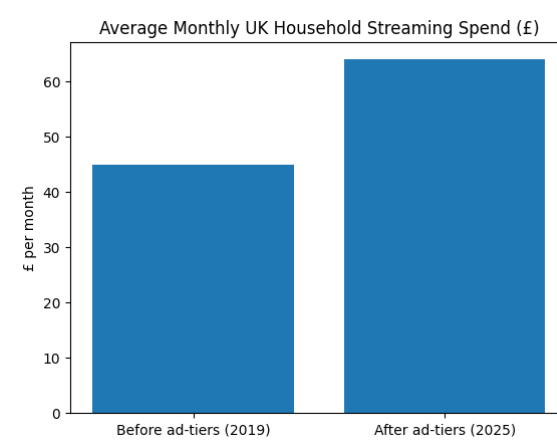

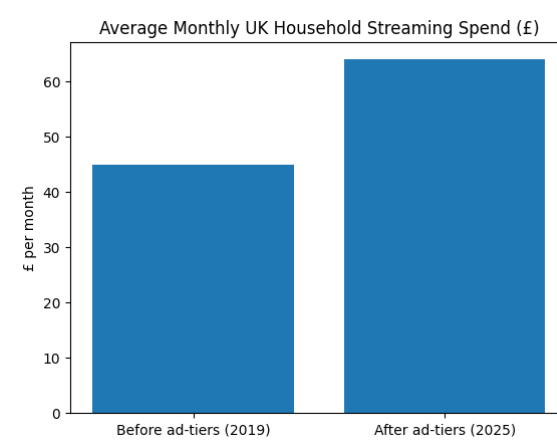

Average Monthly Household Streaming Spend (UK)

Figure 2 – Average monthly household streaming spend in the UK (£).

Despite the introduction of lower-priced ad-supported tiers, total household spending on streaming services has increased. This reflects service stacking and content fragmentation rather than premiumisation.

Sources: Ofcom – household media spend data, Deloitte – Digital Consumer Trends UK, and Kantar – UK streaming subscription behaviour.

Governance insight

“From a governance perspective, this chart explains why pricing strategy has become a behavioural lever. Boards are no longer managing price points; they are managing affordability thresholds across households.”

6. Risks and Frictions in the Ad-Supported Model

Viewer Experience and Ad Fatigue

Early evidence suggests that excessive ad frequency reduces viewing time and increases churn. The success of ad-supported streaming therefore depends on restraint. Advertising must feel additive, not invasive.

Data, Privacy and Regulation

Targeted advertising raises familiar governance questions. Consent, transparency and data protection obligations under GDPR remain critical. Platforms operating across jurisdictions must balance monetisation with compliance.

7. What This Turning Point Really Means

A Structural Shift, Not a Tactical One

The rise of ad-supported streaming is not a temporary response to inflation or price sensitivity. It reflects a deeper truth: pure subscription models struggle to fund mass-market content at scale.

Hybrid funding is not a retreat from innovation; it is a maturation of the streaming economy.

Strategic Implications

For platforms, the future lies in portfolio pricing — offering multiple tiers aligned with different value perceptions. For advertisers, streaming represents the next frontier of premium video advertising. For consumers, the era of “pay once, watch everything ad-free” is over.

8. From Product Decision to Board Responsibility

Why Ad-Supported Streaming Is a Governance Issue, Not a Marketing Choice

At first glance, the move toward ad-supported streaming appears to be an operational or commercial decision. Pricing tiers, advertising load, customer segmentation — these are typically delegated to management. Yet that framing is increasingly inadequate. What we are witnessing in the UK streaming market is not a product tweak, but a redefinition of the implicit contract between platform and user. Such redefinitions sit squarely within the remit of boards.

Boards are responsible for safeguarding long-term value creation, reputation and stakeholder trust. Advertising fundamentally alters all three.

Historically, many boards viewed advertising as a neutral revenue source, largely governed by sales ethics and regulatory compliance. In streaming, however, advertising is inseparable from data usage, algorithmic decision-making and behavioural influence. This elevates it from a revenue topic to a governance risk domain.

The key board-level question is therefore not: “Does advertising increase ARPU?”

It is: “What second- and third-order effects does advertising introduce into our platform ecosystem?”

These effects include:

-

Incentives to optimise for attention rather than quality

-

Pressure to collect and monetise increasingly granular user data

-

Tension between short-term revenue and long-term user trust

-

Reputational exposure through advertiser association and content adjacency

Boards that fail to recognise ad-supported streaming as a governance issue risk repeating mistakes made earlier in social media and digital advertising — where monetisation raced ahead of oversight.

9. Pricing Strategy as a Governance Instrument

When Price Signals Shape Behaviour and Risk

Pricing is often discussed as an economic lever. In governance terms, it is also a behavioural instrument. The introduction of ad-supported tiers sends powerful signals to users about what the platform values and how it expects attention to be exchanged.

In the UK, pricing strategy has become the primary mechanism through which platforms nudge users toward advertising acceptance. The widening price gap between ad-free and ad-supported tiers is not accidental; it is a deliberate behavioural gradient.

From a board perspective, this raises several governance-relevant issues:

a. Fairness and Transparency

Is the price differential proportionate to the advertising burden imposed?

Are users fully informed about how their data will be used in ad-supported tiers?

Is “choice” genuinely free, or economically coerced?

Boards increasingly face scrutiny on whether pricing strategies create de facto inequalities in user experience — where privacy and uninterrupted content become premium privileges.

b. Long-Term Elasticity Risk

Heavy reliance on ad-supported pricing can create path dependency. Once a majority of users are conditioned to accept advertising, reversing course becomes difficult. Boards must therefore assess whether short-term subscriber retention gains undermine future strategic flexibility.

c. Cross-Subsidisation Transparency

In hybrid models, ad-supported users often subsidise content consumed by ad-free users through data and attention. This implicit cross-subsidy deserves governance attention, particularly in light of emerging fairness and consumer protection debates.

Pricing strategy, in other words, is no longer a neutral commercial choice. It is a governance design decision that shapes platform culture and stakeholder expectations.

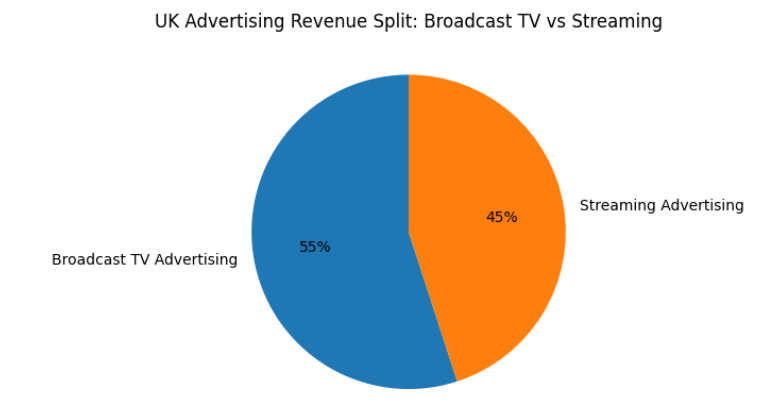

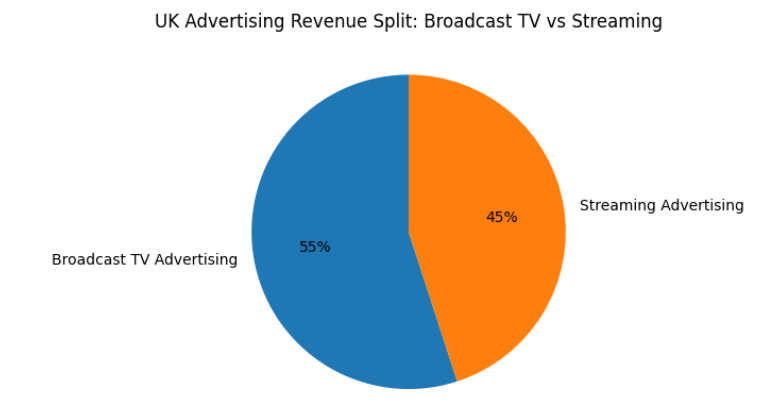

Advertising Revenue Split: Broadcast TV vs Streaming (UK)

Figure 3 – UK advertising revenue split between broadcast television and streaming (estimated).

Streaming advertising now accounts for a substantial share of total UK video advertising spend. This convergence signals a structural reallocation of advertiser budgets rather than a cyclical shift.

Sources: Advertising Association UK – Advertising Pays, IAB UK – Video and CTV advertising spend, and PwC – Global Entertainment & Media Outlook (UK).

Governance framing

“Once advertising revenue approaches parity with broadcast television, governance expectations follow. Streaming platforms can no longer claim exemption from the accountability traditionally imposed on mass media.”

Read more on: Dynamic Pricing & Corporate Governance: How Algorithms Became the Invisible Steering Wheel of Modern Markets.

10. Risk Oversight in an Ad-Supported Streaming Model

Expanding the Risk Register Beyond Finance

Traditional enterprise risk frameworks tend to classify advertising under revenue or commercial risk. That categorisation is increasingly insufficient. Boards overseeing ad-supported streaming models must broaden their risk lens to include at least five interconnected domains.

1. Reputational Risk

Advertising ties a platform’s brand to third-party messages. In an era of polarised politics, misinformation and brand activism, adjacency risk is non-trivial. A single poorly placed ad can undermine years of brand positioning.

Boards should demand clear policies on advertiser vetting, exclusion categories and escalation mechanisms — not as operational footnotes, but as formally governed controls.

2. Data and Privacy Risk

Ad-supported streaming relies on user data to deliver value to advertisers. This data often includes viewing habits, inferred preferences and behavioural patterns. The more targeted the advertising, the higher the privacy risk.

Boards must ensure that:

-

Data minimisation principles are respected

-

Consent mechanisms are meaningful, not performative

-

Data governance frameworks align with GDPR not only legally, but ethically

Failure in this area rarely manifests immediately, but when it does, it tends to be sudden and severe.

3. Algorithmic Bias and Manipulation Risk

Advertising algorithms optimise for engagement and conversion. Over time, this can skew content recommendations toward emotionally charged or addictive patterns. While less visible than in social media, similar dynamics exist in streaming platforms.

Boards should question whether algorithmic incentives align with stated content values and public commitments — particularly for platforms positioning themselves as trusted household brands.

4. Regulatory and Policy Risk

The regulatory perimeter around streaming advertising is expanding. Data protection authorities, competition regulators and consumer watchdogs are increasingly attentive to hybrid monetisation models.

Boards should treat regulatory foresight as a strategic capability, not a compliance afterthought.

5. Cultural and Ethical Risk

Internally, ad-supported models can shift organisational priorities. Product teams may optimise for ad impressions rather than storytelling quality. Editorial independence may come under subtle pressure.

Boards must actively guard against mission drift.

Read something different but clearly corporate governance related: ASML and the Geopolitics of Governance: Europe’s Most Strategic Company Under Pressure.

11. The ESG Dimension: Advertising, Data and Trust as “Social” Governance

The shift toward ad-supported streaming sits uncomfortably within many ESG narratives. While environmental impacts are limited, the social and governance pillars are directly implicated.

Social Impact: Attention as a Finite Resource

Advertising competes for attention — a finite cognitive resource. Excessive ad exposure, particularly in family-oriented or youth-heavy viewing environments, raises legitimate social concerns. Boards increasingly face questions about whether they are extracting value responsibly from audience attention.

Ad-supported streaming intensifies the classic ESG tension: monetisation versus trust. Platforms benefit financially from deeper data extraction, but risk eroding social licence.

Boards that treat ESG as reporting optics rather than strategic compass are particularly vulnerable here. The choices made in ad load, targeting and transparency are ESG choices in practice, whether labelled as such or not.

Data Governance as the ESG Bridge

Data governance is the connective tissue between advertising, ESG and trust. Strong data governance frameworks — clear ownership, accountability, ethical guidelines — enable platforms to monetise responsibly without sliding into exploitative practices.

Boards should explicitly position data governance within their ESG oversight structures, rather than relegating it to IT or legal functions.

12. Consumer Trust as a Strategic Asset

Why Trust Will Become the Scarce Resource

The long-term success of ad-supported streaming will not be determined by CPMs or subscriber counts alone. It will be determined by trust elasticity: how much advertising and data usage consumers are willing to tolerate before disengaging.

Trust is cumulative and fragile. It is built slowly through consistent experience and lost quickly through perceived betrayal. UK consumers, while pragmatic about ads, remain sensitive to fairness and transparency.

Platforms that overstep — by increasing ad load too aggressively, obfuscating data usage, or blurring the line between content and persuasion — risk triggering backlash. Boards must therefore treat trust as a strategic asset, worthy of explicit protection.

This requires:

-

Clear ethical boundaries for advertising

-

Honest communication about data usage

-

Willingness to forgo marginal revenue in favour of long-term legitimacy

In governance terms, trust is not soft. It is a leading indicator of sustainability.

UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming

13. Looking Forward: The Board Agenda for Ad-Supported Streaming

For boards overseeing streaming platforms — or investors evaluating them — the UK turning point offers a preview of future debates elsewhere.

Key board agenda items should include:

-

Periodic review of advertising load versus user satisfaction

-

Explicit linkage between pricing strategy and fairness principles

-

Integrated risk reporting covering data, reputation and regulation

-

ESG frameworks that address attention economics and data ethics

-

Scenario planning for regulatory tightening or trust erosion

Boards that treat ad-supported streaming as merely a monetisation tactic will struggle. Those that recognise it as a governance transformation will be better positioned to steer platforms through the next decade.

Conclusion – From Ad-Free Idealism to Governed Reality

The UK streaming market has crossed a psychological and economic threshold. Advertising is no longer the exception; it is becoming the norm. Yet this does not signal the failure of streaming’s original promise. Instead, it marks its evolution.

The future of streaming will not be defined by the absence of ads, but by how intelligently they are integrated. The platforms that succeed will be those that treat advertising not as a blunt revenue lever, but as a carefully governed component of value creation.

In that sense, the remote control has not been taken from viewers. It has simply acquired a new button — one labelled choice.

The rise of ad-supported streaming in the UK is not a retreat from innovation, nor a capitulation to old media models. It is a recognition that attention, data and trust must be governed as carefully as capital.

Streaming has matured. With maturity comes responsibility — and governance.

The platforms that thrive will not be those that extract the most value in the shortest time, but those whose boards understand that sustainable media economics rest on a delicate equilibrium between monetisation and legitimacy.

UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming

In that sense, the true turning point is not advertising itself. It is the moment when boards are forced to acknowledge that how money is made matters as much as how much is made.

FAQ’s – From Ad-Free Idealism to Governed Reality

FAQ 1 – Why is the shift to ad-supported streaming a board-level governance issue?

The move toward ad-supported streaming is not merely a commercial or pricing decision; it fundamentally reshapes the organisation’s value creation model and stakeholder relationships. Advertising introduces new incentives, new dependencies and new risks that extend far beyond revenue optimisation. For boards, this shift touches on fiduciary responsibility, reputational stewardship and long-term sustainability.

Advertising affects how user attention is monetised, how data is collected and processed, and how content is prioritised. These dynamics influence trust, brand integrity and regulatory exposure. Boards are expected to oversee such second-order effects, particularly where monetisation strategies may conflict with stated values or public commitments.

Moreover, ad-supported models tend to accelerate complexity: multiple pricing tiers, differentiated user experiences and algorithmic decision-making. Without active board oversight, these systems can evolve in ways that undermine transparency and accountability. History in adjacent sectors, such as social media, demonstrates the cost of underestimating these risks.

In short, ad-supported streaming alters the organisation’s risk profile. Boards that treat it as an operational matter rather than a governance issue risk losing strategic control over one of the company’s most sensitive assets: user trust.

FAQ 2 – How does pricing strategy in streaming relate to fairness and governance?

Pricing strategy in streaming platforms is a powerful governance instrument because it shapes user behaviour and implicitly defines what is considered a “premium” right. When ad-free viewing and enhanced privacy are increasingly reserved for higher-priced tiers, boards must confront questions of fairness, transparency and informed consent.

From a governance perspective, the issue is not whether different price points are legitimate — they are — but whether users genuinely understand the trade-offs involved. If lower-priced tiers rely on more intensive data collection or higher ad exposure, this must be communicated clearly and honestly. Otherwise, pricing becomes a form of indirect coercion rather than choice.

Boards should also consider the long-term implications of pricing asymmetry. Over time, the normalisation of advertising for lower-income users can create reputational risk and regulatory scrutiny, particularly in markets with strong consumer protection traditions like the UK.

Effective governance requires boards to ensure that pricing strategies align with ethical standards, regulatory expectations and the organisation’s stated values. Pricing is not neutral; it is a signal of what the organisation believes is acceptable.

FAQ 3 – What new risks does ad-supported streaming introduce that boards must oversee?

Ad-supported streaming expands the risk landscape significantly. Beyond traditional financial and operational risks, boards must now actively oversee reputational, data, algorithmic and regulatory risks.

Reputational risk arises from advertiser adjacency, content alignment and perceived over-commercialisation. A single controversy around inappropriate advertising placement can damage brand equity disproportionately. Data risk increases as platforms rely more heavily on user profiling to deliver targeted ads, raising exposure under GDPR and related regulations.

Algorithmic risk is subtler but equally important. Systems optimised for engagement and ad delivery may unintentionally favour sensational or addictive viewing patterns, creating ethical and societal concerns. Finally, regulatory risk is growing as policymakers focus on digital advertising, consumer protection and platform accountability.

Boards must ensure that these risks are formally identified, measured and reported — not treated as diffuse “digital issues.” A mature risk framework explicitly recognises advertising-driven risks as strategic, not incidental.

FAQ 4 – How does ad-supported streaming intersect with ESG responsibilities?

Ad-supported streaming primarily engages the Social and Governance pillars of ESG. While environmental impact is limited, the social consequences of monetising attention and data are increasingly scrutinised by regulators, investors and the public.

From a social perspective, boards must consider whether advertising practices respect audience wellbeing, particularly for vulnerable groups such as children and young adults. Excessive ad exposure or manipulative targeting can undermine social legitimacy.

From a governance standpoint, transparency, accountability and ethical data use are central. ESG is not fulfilled by reporting alone; it is expressed through day-to-day design choices in pricing, advertising load and data governance.

Boards that integrate advertising strategy into ESG oversight signal that they understand sustainability as a behavioural and ethical challenge, not just an environmental one. Those that do not risk being perceived as performative rather than principled.

FAQ 5 – Why is data governance critical in ad-supported streaming models?

Data governance is the backbone of ad-supported streaming. Advertising effectiveness depends on user data, but trust depends on how responsibly that data is handled. Poor data governance can quickly erode legitimacy, invite regulatory sanctions and damage long-term value.

Boards must ensure that data collection is proportionate, purpose-bound and transparent. Consent mechanisms should be meaningful, not buried in complex user interfaces. Equally important is internal governance: clear data ownership, escalation procedures and ethical guidelines for data use.

Ad-supported models often create pressure to expand data collection incrementally. Without strong governance guardrails, this “data creep” can outpace both regulation and internal oversight. Boards should therefore treat data governance as a strategic control function, not merely a technical or legal one.

In mature platforms, data governance is inseparable from corporate governance.

FAQ 6 – How can boards protect consumer trust while pursuing ad-supported growth?

Consumer trust is the limiting factor in ad-supported streaming. Revenue growth may be immediate, but trust erosion compounds silently until it manifests as churn, backlash or regulatory intervention. Boards must therefore actively balance monetisation with restraint.

Protecting trust requires explicit choices: limiting ad frequency, avoiding deceptive ad formats, clearly distinguishing content from advertising, and communicating openly about data usage. It also requires a willingness to accept trade-offs — foregoing marginal revenue to preserve long-term legitimacy.

Boards should monitor trust indicators as seriously as financial KPIs. User complaints, opt-out rates, churn patterns and regulatory inquiries are early warning signals. Trust cannot be rebuilt quickly once lost.

In governance terms, sustainable ad-supported growth depends on recognising trust as a strategic asset, not a soft concept. Boards that internalise this lesson are far more likely to succeed in the next phase of the streaming economy.

UK Ad-Supported Streaming

UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming UK Ad-Supported Streaming