ASML governance history – the start

hide

Chip-making machines are the hidden backbone of our digital world. Without them, there would be no smartphones, data centers, electric cars, or AI. These machines are so complex and expensive that only a handful of companies on the planet can build them. At the heart of this industry is ASML, a Dutch firm headquartered in Veldhoven, which transformed from a near-forgotten Philips spin-off into the only company capable of delivering extreme ultraviolet (EUV) lithography.

This story is not only about technology. It is about corporate governance, patience, and geopolitics. It is about how Europe produced one of the most strategically important companies in the world, and how governance choices shaped its rise.

1. Origins: Philips’ Reluctant Child

ASML was founded in 1984 as a joint venture between Philips and ASM International. Initially, it was a modest experiment: Philips saw lithography as peripheral to its broader portfolio in consumer electronics and lighting.

The first years were difficult. Japanese giants Nikon and Canon dominated the global lithography market, leaving ASML with crumbs. Within Philips, managers doubted whether to keep funding this loss-making division. It was governance at the crossroads: short-term rationality vs. long-term vision.

By the mid-1990s, ASML went public, gaining independence from Philips and access to fresh capital. That decision—born out of necessity—allowed it to chart its own path.

A blast from the past from EE Times: “Nikon regains top spot in lithography over ASML” — note it’s from 2004, illustrating how fluid leadership once was.

2. The Japanese Era (1980s–1990s)

In the 1980s, Japan ruled chipmaking equipment. Nikon and Canon controlled most of the lithography market, reflecting Japan’s dominance in semiconductors at the time. American firms like GCA and Ultratech were present but less dominant.

ASML, by contrast, operated from a small European economy with no large domestic chipmakers. Ironically, this weakness later became a strength: ASML was forced to build a global ecosystem of partners.

Read more on ASML’s partner ecosystem via ASML and Imec Partner For Advancing Research And Sustainability (Nasdaq) or ASML and Mistral: A Strategic Partnership for European AI by Emanuele Canino.

3. The American Model: Specialization Wins

Although the U.S. lagged in lithography, it led in other chip equipment categories:

- Applied Materials for the deposition processing – that is the process of laying down ultra-thin material layers on a wafer, often just a few atoms thick.

Everyday analogy: like spray-painting a car door with an ultra-even coat, except here the “paint” is invisible and only a few atoms deep. - Lam Research for the etching processing – that is the process of removing material in precise patterns so only the circuit design remains after deposition.

Everyday analogy: like sculpting or chiseling away excess stone to reveal a statue, but done with plasma and chemistry at the nanoscale. - KLA for the metrology processing – that is measuring thickness, width, alignment, and defects of each chip layer during production.

Everyday analogy: like using a microscope and calipers to check whether every Lego block in a huge tower is perfectly aligned—only here the “blocks” are thousands of times smaller than a human hair.

These firms specialized narrowly and dominated their niches. Governance lesson: focus pays. Philips still believed in diversification, but ASML narrowed its identity to one thing: lithography. That choice created depth and resilience.

4. ASML’s Breakthrough (1995–2010)

In the mid-1990s, ASML invested heavily in deep ultraviolet (DUV) technology. Crucial partnerships followed:

- Carl Zeiss (precision optics)

- TSMC, Intel, and Samsung (co-investors in R&D)

By 2005, ASML overtook Nikon in market share. Its culture of long-termism and stakeholder engagement proved vital. Customers co-financed development, suppliers co-innovated, and shareholders tolerated years of high R&D costs. By 2010, ASML had become the undisputed global leader.

5. EUV: The 20-Year Bet

The defining chapter was EUV lithography. This project took two decades, billions in investment, and multiple technological breakthroughs. Many thought it would never work. In 2012, Intel, Samsung, and TSMC invested directly in ASML’s R&D to accelerate EUV—an unusual pre-competitive alliance recognizing no single player could carry the risk alone.

By the late 2010s, EUV became reality. Without ASML, there would be no advanced 5 nm or 3 nm chips today.

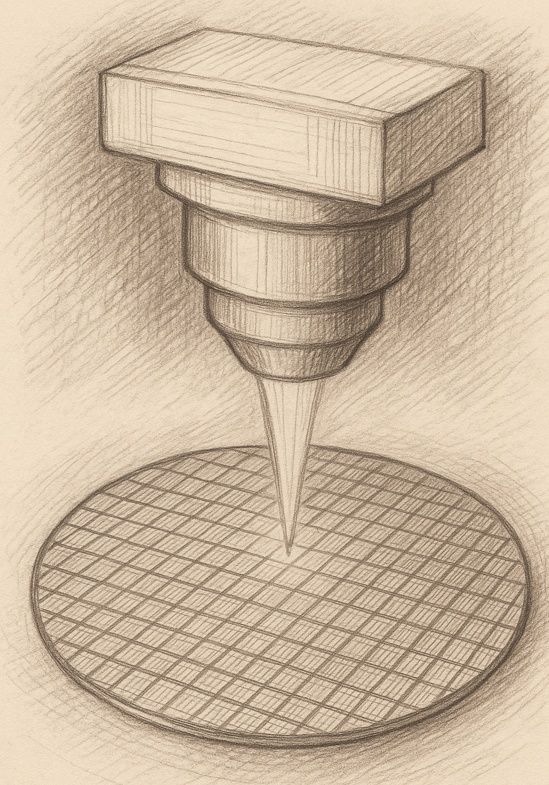

What is EUV?

EUV lithography prints tiny circuit patterns using extremely short-wavelength light (13.5 nm). Compared with older light sources, EUV acts like an ultra-fine pen that draws features just a few nanometers wide. ASML is the only company that can mass-produce EUV systems.

Everyday analogy

Imagine drawing with sunlight through a stencil: with ordinary sunlight (longer wavelengths) the beam spreads and lines look fuzzy; with a laser pointer (short wavelength) you can draw sharp, thin lines. EUV is like using the finest possible “laser” to pattern a surface—so sharp it’s measured in atoms.

ASML’s EUV leadership is why it’s often called the “crown jewel of Europe’s tech industry” and why geopolitics (export controls, U.S.–China rivalry) revolves around its machines.

6. By Approximation: Market Leaders Over Time

Exact rankings differ by year and source, but the pattern is clear:

- 1980s–1990s: Japan (Nikon, Canon) ruled.

- 2000s: ASML started catching up.

- 2010s–2020s: ASML pulled ahead decisively.

- 2020s: Nikon and Canon shrank to niches; China’s SMEE appeared but lags 10–15 years.

Governance insight: technological leadership is never eternal. It requires patience, vision, and systemic support.

7. Geopolitics and Governance in 2025

- The United States restricts exports of ASML’s advanced EUV and DUV machines to China.

- The European Union treasures ASML as one of its few global tech champions.

- China accelerates its domestic push via SMEE but struggles with optics, software, and integration.

ASML’s board balances shareholder returns, customer commitments, and great-power politics. Few companies embody the intersection of corporate governance and global strategy so clearly.

8. Governance Lessons from ASML

- Focus beats diversification: sticking to lithography created world-class depth.

- Stakeholder collaboration: Zeiss, TSMC, Intel, Samsung were not just customers but partners.

- Long-term governance: resisting short-term pressure kept EUV alive.

- Transparency matters: clear roadmaps for markets and governments.

- Boardroom geopolitics: strategy requires market logic and diplomacy.

For a governance backbone at this level, see the COSO Internal Control Framework.

9. Recent Developments: The Chinese Challenge

In September 2025, Dutch newspaper De Telegraaf cited analyst Jos Versteeg, who argued that China’s latest lithography test poses no immediate threat to ASML. China remains far behind in EUV—but governance requires foresight: what if China closes the gap within a decade? Should ASML diversify or double down? How can Europe protect this crown jewel without stifling growth?

10. ASML governance history – ASML as a Governance Case Study

ASML’s rise is not just a technological miracle. It is a testament to governance choices: patience, focus, stakeholder trust, and geopolitical navigation. In a world where semiconductors are the new oil, ASML shows how a small European firm can become a global system player. The company deserves study not only in engineering schools but also in governance programs worldwide.

What is ASML and why is it unique?

ASML is a Dutch company headquartered in Veldhoven, known for designing and building lithography machines that are critical for semiconductor manufacturing. These machines project patterns of circuits onto silicon wafers, forming the basis of microchips.

While several firms once competed in lithography, today ASML is the only company worldwide capable of producing extreme ultraviolet (EUV) systems.

These tools use light of such a short wavelength that they can draw features just a few atoms wide. Without ASML’s equipment, the world’s leading chipmakers—such as TSMC, Intel, and Samsung—could not produce the most advanced processors. This makes ASML not only a commercial leader but also a strategic global player in the digital economy.

How did ASML start?

ASML was founded in 1984 as a joint venture between Philips, a Dutch electronics conglomerate, and ASM International, a supplier of semiconductor equipment. In its early years, ASML struggled: its machines lagged behind the dominant Japanese competitors, and Philips often questioned whether to continue funding it.

The turning point came in 1995, when ASML went public, securing capital and gaining independence from Philips’ short-term priorities. Over the following decades, ASML adopted a culture of long-term research and collaboration with key partners, such as Zeiss for optics and leading chipmakers for co-investment.

This governance model—combining focus, patience, and stakeholder partnerships—enabled ASML to rise from a near-forgotten subsidiary to a global technology leader.

Who were ASML’s early competitors?

During the 1980s and 1990s, Nikon and Canon from Japan dominated the lithography market, benefiting from Japan’s strong semiconductor industry and coordinated industrial policies. U.S. companies like GCA and Ultratech were also active, particularly in certain segments, but they gradually lost ground. So these were the chip machine market leaders.

For a long time, ASML appeared to be a minor European challenger. However, as Nikon and Canon slowed their innovation cycles, ASML invested relentlessly in new technologies such as deep ultraviolet (DUV) and later EUV.

By the mid-2000s, ASML overtook Nikon in market share, and since 2010 it has become the undisputed market leader. Today, Nikon and Canon survive in smaller niches, while ASML commands the most critical segment of advanced chipmaking.

What is EUV technology?

EUV, or extreme ultraviolet lithography, represents the cutting edge of semiconductor manufacturing. It uses light with a wavelength of just 13.5 nanometers—far shorter than visible light—to print ultrafine patterns on silicon wafers.

This allows chipmakers to produce transistors at scales of 5 nanometers, 3 nanometers, and even smaller, enabling faster, more energy-efficient processors. Developing EUV took ASML more than 20 years and tens of billions of euros in investment, supported by customers like Intel, Samsung, and TSMC, who co-financed the R&D.

The result is a tool so advanced that it requires a global supply chain of hundreds of specialized suppliers. EUV is the single most important technology enabling the continuation of Moore’s Law in the 2020s and beyond. So this is the story about the EUV corporate governance.

How does geopolitics affect ASML?

ASML sits at the heart of the geopolitical struggle over technology and national security. The United States has pressured the Dutch government to block sales of ASML’s most advanced machines to China, arguing that chips produced with EUV are critical for AI, defense, and supercomputing.

The European Union views ASML as a strategic asset and one of the continent’s few global tech champions. Meanwhile, China invests heavily in building its own lithography industry, though with limited success so far.

This geopolitical tension means ASML’s board and management must navigate not only commercial goals but also international diplomacy and export controls. Few companies illustrate the collision of governance, business strategy, and geopolitics as clearly as ASML does today. So this is the ASML history and governance.

Is China catching up with ASML?

China has made significant efforts to build its own lithography capabilities, primarily through the company SMEE (Shanghai Micro Electronics Equipment). SMEE has achieved some progress in older technologies, such as less advanced deep ultraviolet (DUV), but experts estimate it is still 10–15 years behind ASML in cutting-edge EUV. So that is the ASML China EUV Threat.

Building EUV requires breakthroughs in optics, plasma sources, vacuum systems, and precision engineering, fields where ASML has decades of accumulated expertise and partnerships with firms like Zeiss.

While China’s push is serious and should not be underestimated, analysts generally agree that it poses no immediate threat to ASML’s dominance. The real question is how governance, investment, and international cooperation will shape the competitive landscape over the next two decades.

ASML governance history

ASML governance history ASML governance history ASML governance history ASML governance history ASML governance history ASML governance historyASML governance history ASML governance history ASML governance history ASML governance history ASML governance history ASML governance history ASML governance history ASML governance history ASML governance history ASML governance history ASML governance history ASML governance history ASML governance history