IFRS 18 Presentation and Disclosure in Financial Statements

The IASB’s newly issued standard IFRS 18 mainly deals with the presentation of the income statement, balance sheet and certain footnotes. At the same time, certain aspects of the cash flow statement are modified. IFRS 18 does not change the recognition and measurement of the components of financial statements; therefore, the amounts reported as shareholders’ equity and net income are both unchanged. However, it will have a significant impact on the presentation and disaggregation of what is reported (primarily in the income statement and footnotes), including what subtotals companies must provide and how these are defined.

There are five main areas where we think the new standard will help investors as users of IFRS Financial Statements:

Operating–Investing–Financing classification

IFRS 18 aims to establishes a structured statement of profit or loss by implementing the following measures:

- It introduces three defined categories for income and expenses: operating, investing, and financing.

- Operating – income/expenses resulting from the company’s main business operations.

- Investing – income/expenses from:

- investments in associates, joint ventures and unconsolidated subsidiaries;

- cash and cash equivalents;

- assets that generate a return individually and largely independently (e.g. rental income from investment properties).

- Financing – consisting of:

- It mandates to present new defined totals and subtotals, including operating profit, thereby enhancing the clarity and consistency of financial reporting.

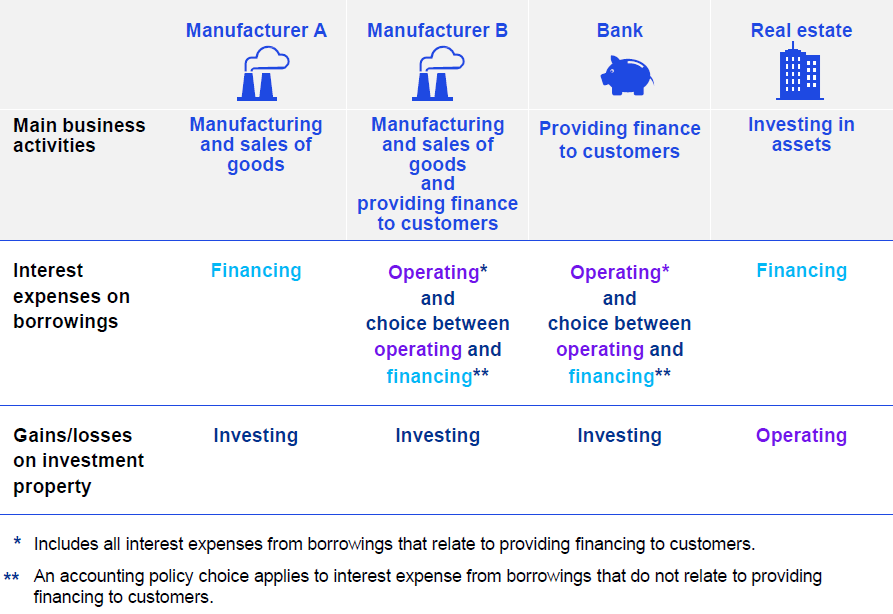

Entities primarily engaged in investing in assets or providing finance to customers are subject to specific categorisation requirements. This entails that additional income and expense items, which would typically be classified as investing or financing activities, are instead categorised under operating activities. Consequently, operating profit reflects the outcomes of an entity’s core business operations. Identifying the main business activity involves exercising judgment based on factual circumstances.

Categories in the statement of profit or loss

Once items of income and expense are classified, the categorisation results in line items and subtotals being presented in the statement of profit or loss, some of which are mandatory.

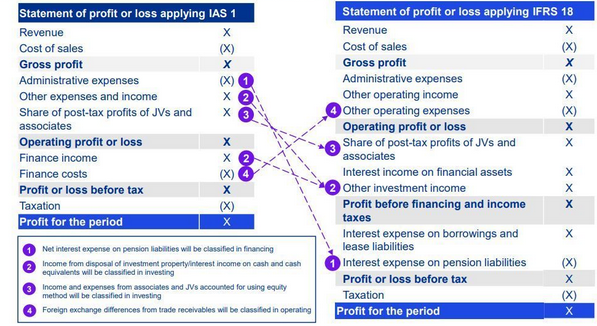

IAS 1 has limited requirements regarding line items and sub-totals. Revenue is presented as the ‘top line’ in the statement of profit or loss, with ‘profit’ being presented as the final line item, with limited guidance about how income and expenses are categorised and which sub-totals are presented.

In addition to mandatory totals and sub-totals required by IAS 1 currently (e.g. profit before income taxes, profit or loss, etc.), IFRS 18 introduces two new mandatory sub-totals:

- Operating profit or loss: the sub-total of all income and expense classified as operating.

- Profit before financing and income tax: the sub-total of operating profit or loss and all income and expenses classified as investing. This sub-total will not be applicable for entities with specified main business activities (e.g. banks).

Under IAS 1, there is no requirement to classify income and expenses into ‘classes’ or ‘categories’. In order to enhance consistency, and to permit consistent line items and sub-totals (see below), IFRS 18 requires items of income and expense to be classified into five categories:

| Category/ Classification | Statement of profit or loss | Explanation |

|

Operating

|

Revenue |

Income/expenses resulting from the company’s main business operations, but some explain it as ‘a residual category if income and expenses are not classified into other categories’. In general both explanations will lead to the same result.

|

| Cost of sales | ||

| Gross profit | ||

| Selling expenses | ||

| Research and development expenses | ||

| General and administrative expenses | ||

| Operating Profit | ||

|

Investing

|

Share of profit or loss of equity accounted investees |

Income and expenses1, relating to:

|

| Interest income from cash and cash equivalents | ||

| Profit before financing and income tax | ||

|

Financing

|

Interest expense on borrowings |

Income and expenses2, relating to:

|

| Interest expense on lease liabilities | ||

| Interest expense on pension liabilities | ||

| Profit before income tax | ||

|

Income tax

|

Income tax |

Income tax expense and income arising from the application of IAS 12 Income Taxes. IAS 12 Income Taxes guides the recognition, measurement, and disclosure of current and deferred tax liabilities and assets, requiring recognition based on temporary differences, reassessment of deferred tax assets, and disclosure of significant judgments, ensuring accurate reporting of income tax in financial statements under IFRS.

|

| Profit from continuing operations | ||

|

|

Profit or loss from discontinued operations |

Income and expenses from discontinued operations arising from the application of IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. IFRS 5 Non-current Assets Held for Sale and Discontinued Operations outlines the accounting treatment and disclosure requirements for assets held for sale and discontinued operations, ensuring transparent reporting of these items in financial statements under IFRS.

|

| Profit for the year |

Despite IFRS 18 containing operating, investing and financing categories, there is not explicit alignment between these categories and the corresponding categories in the statement of cash flows as per IAS 7, however, income and expense and the associated cash flows may be classified similarly in some cases.

While the stated goal of the PFS project was to increase the comparability of financial performance between entities, the classification of income and expenses will not be identical for all entities. This is because IFRS 18 requires entities to assess ‘main business activities’. Entities with specified main business activities may classify investing and/or financing items as operating in certain cases.

For example, Entity A is a manufacturer with excess cash invested in publicly traded equity instruments, however, investing in such assets is not a main business activity for Entity A. Entity Z is a bank with a significant number of publicly traded equity instruments held, which it actively trades as part of its main business activities.

Entity A is likely to classify income arising from its equity investments as investing, whereas Entity Z will likely classify such income as operating because it relates to Entity Z’s main business activities.

IFRS 18 also includes certain accounting policy choices regarding classification of certain income and expenses for entities with specified main business activities. These options are beyond the scope of this publication.

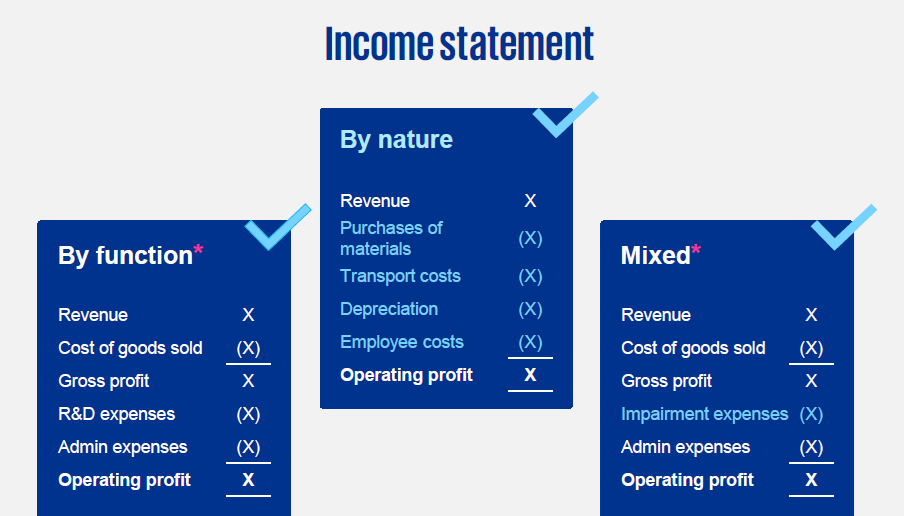

Entities must present expenses within the operating category either by nature, by function, or through a mixed presentation. When items are presented by function, entities must disclose information by nature for certain expenses. Consequently, specific disclosure requirements exist for entities that present the statement of profit or loss by function.

|

New disclosures apply |

Disclosure of operating expenses

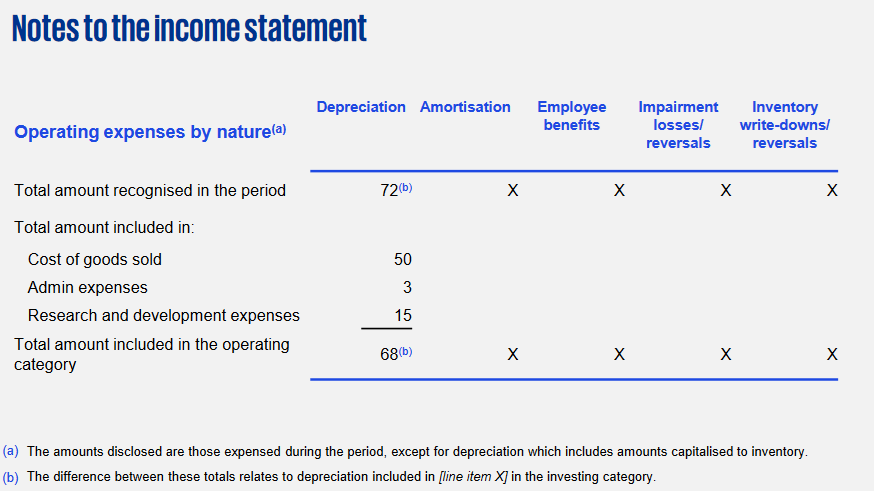

If any operating expenses are presented by function on the face of the income statement, companies:

- present a separate cost of sales line item (where relevant); and

- disclose a qualitative description of the nature of expenses included in each function line item.

In addition, in a single note, companies disclose specific quantitative and qualitative information for each of five ‘nature’ operating expenses. This information is not intended to reconcile to the income statement as it captures both capitalised and expensed amounts.

Defined operating profit

While many companies currently provide a measure of operating profit, there is no clear definition of this subtotal in IFRS; what might appear to be comparable measures may, in practice, be defined quite differently. For example, operating profit measures may currently include interest expense items that other companies include in financing, and practice varies whether or not income from associates is included. The treatment of exchange differences is another area that creates inconsistencies.

IFRS 18 does not directly define operating profit but instead defines what should be classified as investing and financing, with everything else (other than taxation and discontinued activities) classified as operating. Nevertheless, operating is described as a company’s “main business  activities”. We think this approach works well and is consistent with how investors regard this important measure of performance. Defining operating as a residual also ensures that management are not able to exclude from operating profit the inconvenient ‘other’ items (usually more other expenses than other income) that they may not wish investors to focus on too closely.

activities”. We think this approach works well and is consistent with how investors regard this important measure of performance. Defining operating as a residual also ensures that management are not able to exclude from operating profit the inconvenient ‘other’ items (usually more other expenses than other income) that they may not wish investors to focus on too closely.

One of the challenges in specifying the presentation and classification of profit is how to deal with those financial companies for which interest income and expense or investment income is their main business activity. In this case, IFRS 18 requires that interest and investment income (that would be reported as investing and financing by non-financial companies) are instead reported as components of operating activities. As a result, the performance reporting by banks and insurers will be largely unchanged.

Dis-aggregation and the end of other income and expense

IFRS 18 expands the requirements for labelling, aggregation and dis-aggregation as follows:

| Requirement | Explanation |

| Principles of aggregation and dis-aggregation |

|

| Use of ‘other’ label |

|

| Presentation and disclosure of expenses classified as operating |

|

Management performance measures

Entities may disclose management-defined performance measures (MPMs) outside of the financial statements to communicate management’s view of an aspect of the entity’s financial performance. These MPMs are often based on a total or sub-total required by IFRS Accounting Standards with adjustments made. For example:

- Earnings before interest, taxes, depreciation and amortisation (EBITDA);

- ‘Adjusted’ profit (e.g. profit excluding goodwill impairment, share-based payments, etc.); or

- Operating profit excluding non-recurring items (e.g. operating profit excluding the effect of a natural disaster).

These MPMs may be included in press releases, strategic reports, management discussion & analysis, etc. IFRS 18 requires that certain MPMs be included in the financial statements with corresponding disclosures.

Which MPMs will be subject to disclosure requirements in the financial statements?

To be subject to IFRS 18’s disclosure requirements, an MPM will need to be:

- Used in public communications outside financial statements; and

- Used to communicate to users of financial statements, management’s view of an aspect of the financial performance of the entity as a whole.

IFRS 18 excludes certain forms of public communication (e.g. social media posts, oral communications, etc.), meaning that not all public communications may result in MPM disclosure requirements. Additionally, if an entity does not make such public communications containing MPMs, they may not be subject to any new disclosure requirements. This may be the case for many private companies.

MPMs are only included in IFRS 18’s disclosure requirements if they communicate an entity’s financial performance, meaning MPMs based solely on the statement of financial position (e.g. adjusted current ratio) or the statement of cash flows (e.g. adjusted operating cash flows) are not included.

As a rule, IFRS 18 will also exclude from the scope of the disclosure requirements of MPMs certain specified sub-totals, such as gross profit or loss and similar sub-totals.

What are the disclosure requirements for MPMs in the scope of IFRS 18’s requirements?

For ‘scoped in’ MPMs, entities will be required to disclose the following information in a single note to the financial statements:

- A description of why the management-defined performance measure communicates management’s view of an aspect of the entity’s financial performance

- How the management-defined performance measure is calculated

- A reconciliation to the most directly comparable total or subtotal specified by IFRS Accounting Standards (e.g. reconcile ‘adjusted operating profit’ to ‘operating profit’ as defined by IFRS 18 and explain the adjustments)

- The income tax effect and effect on non-controlling interest for each reconciling item disclosed as per above.

- A description of how the entity determines the income tax effect

The inclusion of MPMs in financial statements will be a significant adjustment for many entities, as this type of information has historically been disclosed outside of the financial statements. These requirements will also impose a requirement on auditors to be aware of public communications made by entities, which may trigger the requirement to include MPMs in financial statements.

Operating cash flow

IFRS 18 supersedes IAS 1, and has resulted in certain consequential amendments to other IFRS Accounting Standards, such as IAS 7 Statement of Cash Flows as below:

The current requirements of IAS 7 are compared with the revised requirements of IFRS 18 in the following table:

| Classifications and reconciliations | Current requirements of IAS 7 | Revised requirements of IFRS 18 |

|

Starting point for operating cash flows in the statement of cash flow when the indirect method is used

|

Profit or loss | Newly introduced mandatory subtotal in the statement of profit or loss: operating profit or loss |

|

Classification of interest and dividend cash inflows

|

Accounting policy choice: operating or investing cash flows | Elimination of accounting policy choice: investing cash flows, except for entities with specified main business activities (see below). |

|

Classification of interest cash outflows

|

Accounting policy choice: operating or financing cash flows | Elimination of accounting policy choice: financing cash flows, except for entities with specified main business activities (see below). |

|

Classification of dividend outflows

|

Accounting policy choice: operating or financing cash flows | Elimination of accounting policy choice: financing cash flows |

The classification of interest and dividend cash inflows and interest cash outflows will usually be investing and financing respectively, as set out above, however, exceptions apply for certain entities.

For entities that provide financing to customers as a main business activity (e.g. a bank) or invest in the course of their main business activities in assets that generate a return individually and largely independently of other resources held by the entity (e.g. insurance and investment entities), interest and dividend income and interest expense may be classified into different categories in the statement of profit or loss. For these entities, the corresponding cash flows are to be classified in the statement of cash flows as follows:

| Classification in the statement of profit or loss | Classification of the corresponding cash flows in the statement of cash flows | ||

| Interest and dividend income and interest expense are all classified into a single category. | Cash flows are classified into the same category (e.g. operating in the statement of profit or loss and operating in the statement of cash flows). | ||

| Interest and dividend income and interest expense are classified into more than one category. | All cash flows are classified into a single category as an accounting policy choice. For example: | ||

| Category | Classification in statement of profit or loss | Classification in the statement of cash flows | |

| Interest received | Some as operating and some as investing | Accounting policy to classify all cash flows as operating or investing | |

| Interest paid | Some as operating and some as financing | Accounting policy to classify all cash flows as operating or financing | |

| Dividend received | Investing | Investing | |

IFRS 18 Presentation and Disclosure in Financial Statements

IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements

IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements IFRS 18 Presentation and Disclosure in Financial Statements