Grant-date fair value

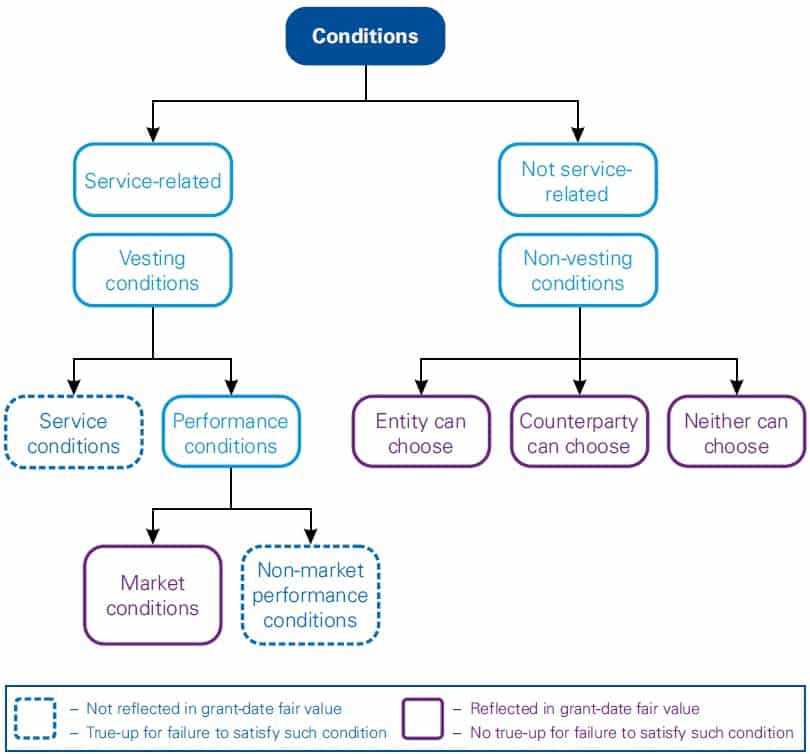

The fair value of an equity instrument at grant date, taking into account the impacts of any market and non-vesting conditions. In other words, the fair value of the equity instrument is adjusted downwards to reflect the market’s view of the probability of meeting any market and non-vesting conditions. (IFRS 2.16-22)

The probability of meeting any service and non-market performance conditions is not taken into account when measuring grant-date fair value.

Instead, it is taken into account by adjusting the number of equity instruments included in the measurement of the transaction amount.

Employee services are measured indirectly with reference to the fair value of the equity instruments granted; this is done by applying the modified grant-date method. If, in rare circumstances, the fair value of the equity instruments granted cannot be measured reliably, then the intrinsic value method is applied.

Under the modified grant-date method, the grant-date fair value of the equity instruments granted is determined once at grant date, which may be after the service commencement date.

If a market price is not available, then the grant-date fair value of the equity instruments granted is determined using a valuation technique.

The grant-date fair value of the equity instruments granted takes into account the impact of any market conditions and non-vesting conditions and does not take into account service and/or non-market performance conditions.

The grant-date fair value is not adjusted for subsequent changes in the fair value of the equity instruments and differences between the estimated and actual outcome of market or non-vesting conditions.

Failure to meet a non-vesting condition that either the entity or the employee can choose to meet results in accelerated recognition of any unrecognised grant-date fair value of the equity instruments granted based on the amount that otherwise would have vested (cancellation accounting).

The grant-date fair value of the liability is recognised over the vesting period. If no services are required, then the amount is recognised immediately.

The grant-date fair value of the liability is capitalised if the services received qualify for asset recognition.

As a basic principle, IFRS 2 requires an entity to recognise, as a minimum, the original grant-date fair value of the equity instruments granted unless those equity instruments do not vest because of failure to meet any service and non-market performance conditions under the original terms and conditions. (IFRS 2.27)

In addition to the original grant-date fair value, an entity recognises the effects of modifications that increase the fair value of the equity instruments granted or are otherwise beneficial to the employee.

Sometimes a modification increases the fair value of the equity instruments granted – e.g. by reducing the exercise price of a share option granted. In these cases, the incremental fair value is recognised over the remaining modified vesting period, whereas the balance of the original grant-date fair value is recognised over the remaining original vesting period. (IFRS 2.B43(a), IFRS 2.IG.Ex 7)

In general, when determining fair value at the date of modification, the same requirements as for determining the grant-date fair value apply – i.e. service conditions and non-market performance conditions are not taken into account in determining the fair value.

If, for example, a share-based payment arrangement with a non-market performance condition is modified such that only the non-market performance target is modified, and all other terms and conditions remain the same, then the incremental fair value is zero. This is because the fair value measured on an IFRS 2 basis – i.e. without adjustments for service and non-market performance conditions – is the same before and after the modification.

|

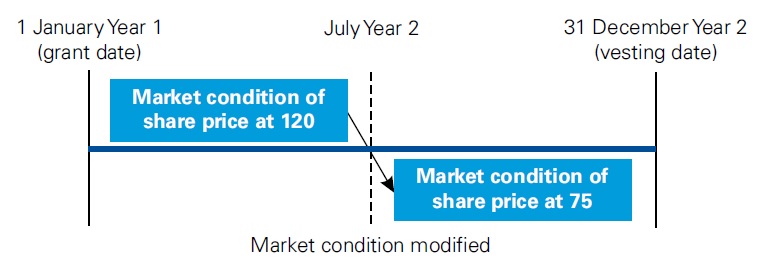

Case – Beneficial modification of market condition |

|

On 1 January Year 1, Company D grants 1,000 shares for no consideration to its CEO, subject to a two-year service condition and the share price achieving a target of 120. At grant date, the share price is 100 and the grant-date fair value of the equity instrument granted, including consideration of the possibility of not meeting the share price target, is 80. In July Year 2, the share price decreases to 70 and D now estimates that it is highly unlikely that the share price target will be met. To motivate the CEO, the market condition is reduced to a share price target of 75. The fair value of equity instrument granted considering the market condition immediately before the modification is 1 and immediately after the modification is 56; the incremental fair value is therefore 55 per share.

D recognises the grant-date fair value of the equity instruments granted of 80,000 (1,000 x 80) over Year 1 and Year 2 in respect of the original grant. Additionally, D recognises the incremental fair value of 55,000 (1,000 x 55) in Year 2, assuming that the CEO fulfils the service requirement. The total compensation cost that will be recognised of 135,000 is greater than the fair value of the modified award of 56,000. |

– Beneficial modifications of service and non-market performance conditions

If the modification changes a service or a non-market performance condition in a manner that is beneficial to the employee – e.g. by reducing the vesting period or by modifying or eliminating a non-market performance condition – then the remaining grant-date fair value is recognised using the revised expectations with true-up to actual outcomes. (IFRS 2.B43(c))

– Modification of service condition

If a service period is reduced, then the entity uses the modified vesting period when applying the requirements of the modified grant-date method. In the period of change, the entity calculates the cumulative amount to be recognised at the reporting date based on the new vesting conditions. (IFRS 2.B43(c))

|

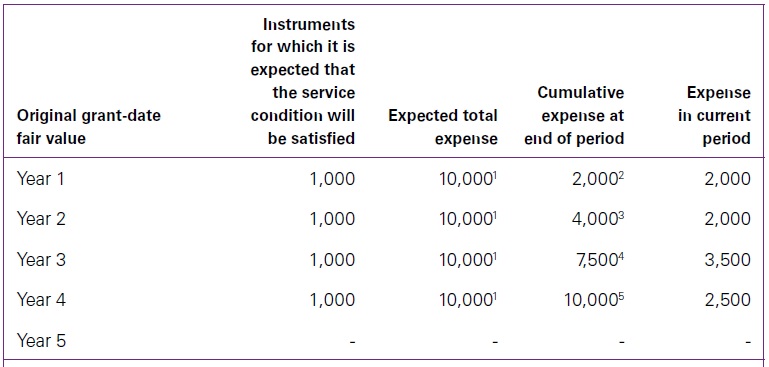

Case – Reduction of service period |

|

On 1 January Year 1, Company F grants 1,000 share options to one of its employees, subject to a five-year service condition. The grant-date fair value of a share option is 10 and the employee is expected to remain in service. In the middle of Year 3, the service period is reduced to four years; the employee remains employed. In this case, ignoring interim financial reporting requirements, F calculates the cumulative amount to be recognised at the end of Year 3 based on the new vesting period, which results in an additional share-based payment expense in Year 3, and to a lesser extent also in Year 4, so that the cumulative amounts recognised at the end of Year 3 and Year 4 mirror the pattern of services as they are rendered under the new vesting period.

Notes |

– Modification of non-market performance condition

Like modifications of a service condition (see above), a modification of a non-market performance condition does not affect the modification-date fair value of the share-based payment. The entity determines whether the modification is beneficial to the employee and, if it is, then the modified vesting conditions are taken into account in determining when to recognise the share-based payment cost. (IFRS 2.B43(c))

|

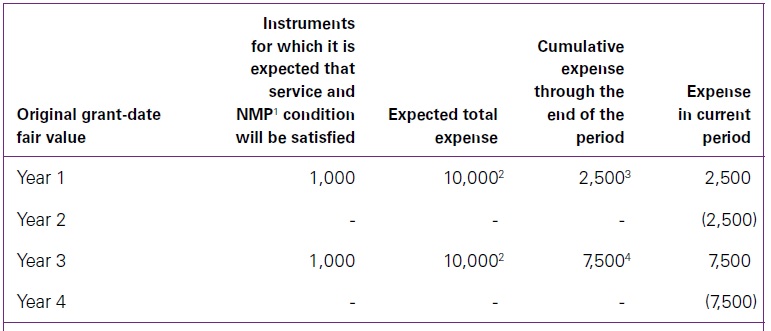

Case – Modification of non-market performance condition |

|

On 1 January Year 1, Company H grants 1,000 share options to an employee, subject to a four-year service condition and the company achieving a cumulative profit target of 100 million at the end of the service period. The grant-date fair value of a share option is 10. At grant date, the employee is expected to stay employed and the profit target is also expected to be met. However, in Year 2 the profit target is no longer expected to be met. Therefore, in Year 3 H reduces the profit target to 80 million (a beneficial modification), which at the time of the modification is expected to be met. At the end of Year 4, the revised profit target is not met. H accounts for the transaction as follows.

Notes |

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.