Designated hedged items

This narrative provides an overview of the eligible hedged items that are permitted in IFRS 9.

Definition of hedged item

Under IFRS 9, a hedged item can be a recognised asset or liability, an unrecognised firm commitment, a forecast transaction or a net investment in a foreign operation. The hedged item can be:

- A single item, or

- A group of items.

If the hedged item is a forecast transaction, it must be highly probable.

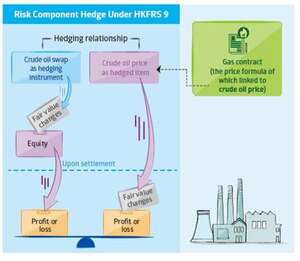

Risk components of non-financial items

Under IFRS 9, risk components of financial items (such as the SONIA rate (replacement of LIBOR rate) in a loan that bears interest at a floating rate of SONIA plus a spread) could be designated as a hedged item, provided they are separately identifiable and reliably measurable and risk components can be designated for non-financial hedged items, provided the component is separately identifiable and the changes in fair value or cash flows of the item attributable to the risk component are reliably measurable. This requirement could be met where the risk component is either explicitly stated in a contract (contractually specified) or implicit in the fair value or cash flows (non-contractually specified).

Entities that hedge commodity price risk that is only a component of the overall price risk of the item, are likely to welcome the ability to hedge separately identifiable and reliably measurable components of non-financial items.

|

In practice An example of a contractually specified risk component that exists in practice is a contract to purchase a product (such as aluminium cans), in which a metal (such as aluminium) is used in the production process. Contracts to purchase aluminium cans are commonly priced by market participants based on a building block approach, as follows:

Many entities may want to use aluminium LME futures or forwards to hedge their price exposure to aluminium. However, IAS 39 did not allow just the LME component of the price to be the hedged item in a hedge relationship. All of the pricing elements had to be designated as being hedged by the LME future. This caused ineffectiveness, which was recorded within P&L; and, in some cases, it caused sensible risk management strategies to fail to qualify for hedge accounting. By contrast, IFRS 9 allows entities to designate the LME price as the hedged risk, provided it is separately identifiable and reliably measurable. |

When identifying the non-contractually specified risk components that are eligible for designation as a hedged item, entities need to assess such risk components within the context of the particular market structure to which the risks relate and in which the hedging activity takes place. Such a determination requires an evaluation of the relevant facts and circumstances, which differ by risk and market.

The Board believes that there is a rebuttable presumption that, unless inflation risk is contractually specified, it is not separately identifiable and reliably measurable, and so it cannot be designated as a risk component of a financial instrument.

separately identifiable and reliably measurable, and so it cannot be designated as a risk component of a financial instrument.

However, the Board considers that, in limited cases, it might be possible to identify a risk component for inflation risk, and provides the example of environments in which inflation-linked bonds have a volume and term structure that result in a sufficiently liquid market that allows a term structure of zero-coupon real interest rates to be constructed.

IFRS 9 requires an entity to assess risk components (that are separately identifiable and reliably measurable) within the context of the particular market structure to which the risk or risks relate and in which the hedging activity takes place. However, there are no criteria specified to be used in the analysis of the market structure, nor are there any definitions of the market to be analysed.

Hedging groups of net positions

IFRS 9 provides more flexibility for hedges of groups of items, although, as noted earlier, it does not cover macro hedging. Treasurers commonly group similar risk exposures and hedge only the net position and so IFRS 9 allows the potential to align the accounting approach with the risk management strategy.

For cash flow hedges of a group of items that are expected to affect P&L in different reporting periods, the qualifying criteria are:

- Only hedges of foreign currency risk are allowed.

- The items within the net position must be specified in such a way that the pattern of how they will affect P&L is set out as part of the initial hedge designation and documentation (this should include at least the reporting period, nature and volume).

In addition, net nil positions (that is, where hedged items among themselves fully offset the risk that is managed on a group basis) are now allowed to be designated in a hedging relationship that does not include a hedging instrument, provided that all the following criteria are met:

- The hedge is part of a rolling net risk hedging strategy (that is, the entity routinely hedges new positions of the same type);

- The hedged net position changes in size over the life, and the entity uses eligible hedging instruments to hedge the net risk;

- Hedge accounting is normally applied to such net positions; and

- Not applying hedge accounting to the net nil position would give rise to inconsistent accounting outcomes.

The Board expects that hedges of net nil positions would be coincidental and therefore rare in practice.

Hedging layers of a group

IAS 39 allowed hedging layers of a group in very limited circumstances (for example, in specified cash flow hedges). IFRS 9 allows a layer of a group to be designated as the hedged item. A layer component can be specified from a defined, but open, population or from a defined nominal amount. Examples include:

- A part of a monetary transaction volume (such as the next CU10 cash flows from sales denominated in a foreign currency after the first CU20 in March 201X);

- A part of a physical or other transaction volume (such as the first 100 barrels of the oil purchases in June 201X, or the first 100 MWh of electricity sales in June 201X); or

- A layer of the nominal amount of the hedged item (such as the last CU80 million of a CU100 million firm commitment, or the bottom layer of CU20 million of a CU100 million fixed rate bond, where the defined nominal amount is CU100 million).

If a layer component is designated in a fair value hedge, an entity must specify it from a defined nominal amount. To comply with the requirements for qualifying fair value hedges, an entity must re-measure the hedged item for fair value changes attributable to the hedged risk. The fair value adjustment must be recognised in P&L no later than when the item is derecognised.

comply with the requirements for qualifying fair value hedges, an entity must re-measure the hedged item for fair value changes attributable to the hedged risk. The fair value adjustment must be recognised in P&L no later than when the item is derecognised.

Therefore, it is necessary to track the item to which the fair value hedge adjustment relates. Entities are required to track the nominal amount from which the layer is defined in order to track the designated layer (for example, the total defined amount of CU100 million sales must be tracked in order to track the bottom layer of CU20 million sales or the top layer of CU30 million sales).

A layer of a contract that includes a prepayment option (if the fair value of the prepayment option is affected by changes in the hedged risk) is only eligible as a hedged item in a fair value hedge if the layer includes the effect of the prepayment option when determining the change in fair value of the hedged item. In this situation, if an entity hedges with a hedging instrument that does not have option features that mirror the layer’s prepayment option, hedge ineffectiveness would arise.

Aggregated exposures

Under IAS 39, a derivative could not be a hedged item, and derivatives could not be combined with another exposure to form a hedged item. This restriction was criticised by preparers because of the difficulty of achieving hedge accounting for more than one risk in a single hedging relationship, if not all risks are designated at inception. Under IFRS 9, this restriction has been removed. An aggregated position that incorporates a derivative along with a non-derivative exposure can be designated as a hedged item.

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items

Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items Designated hedged items