Practical alternative for similar goods or services

If the goods or services that the customer has a material right to acquire are similar to the original goods or services in the contract – e.g. when the customer has an option to renew the contract – then an entity may allocate the transaction price to the optional goods or services with reference to the goods or services expected to be provided and the corresponding consideration expected to be received. (IFRS 15.B43)

Case – Applying the practical alternative |

|

Company B enters into a contract with Customer C to transfer two units of Product P for 2,000 (1,000 per unit, which is the stand-alone selling price) with an option to purchase up to two more units of P at 500 per unit (i.e. 50% discount). B concludes that each unit of P is distinct and satisfied at a point in time. B concludes that the option for up to two additional units of P is a material right because the discount is incremental The options allow C to acquire additional units of P, which are the same as the goods purchased in the original contract, and the purchases would be made in accordance with the original terms of the contract; therefore, B uses the alternative approach to allocate the transaction price to the options. B expects that there is a high likelihood of the customer exercising each option because of the significant discount provided. As such, B does not expect breakage and includes all of the options in the expected number of goods that it expects to provide. Therefore, B allocates the expected transaction price to the units expected to be transferred. Expected transaction price Therefore, in effect 1,500 of the total consideration in the original contract of 2,000 is allocated to the purchase of the original two units and the remaining 500 is allocated to the two options. |

Alternative approach not limited to renewal options

In general the alternative approach is not limited to contract renewals (e.g. a right to renew a service contract on the same terms for an additional period). (IFRS 15.B43)

It may also be applied to other types of material rights – e.g. options to purchase additional goods or services at a discounted price when the optional goods or services are similar to those offered in the contract.

For example, we believe that an entity could apply the alternative approach to a prospective volume rebate arrangement. Under the alternative approach, the entity would allocate the transaction price with reference to the total number of goods that it expects the customer to purchase under the agreement and the corresponding expected total consideration from those purchases – i.e. revenue would be recognised at the average price per unit based on total expected purchases.

More than one acceptable approach to determine the expected goods or services to be provided

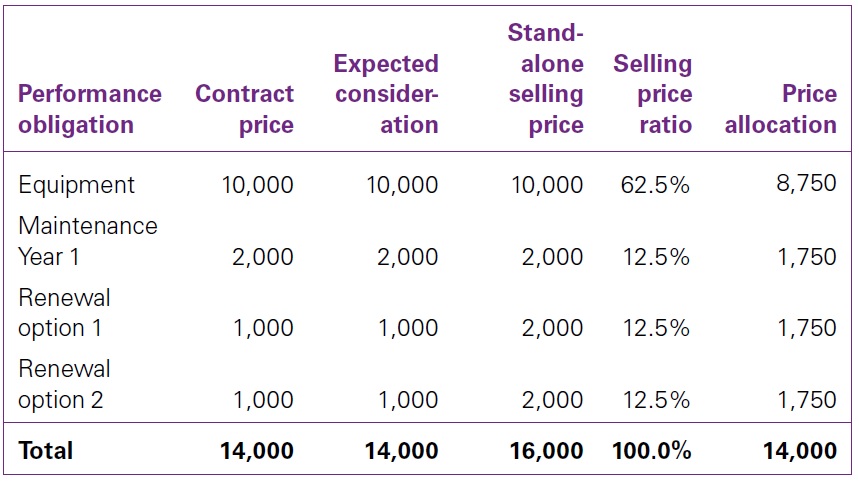

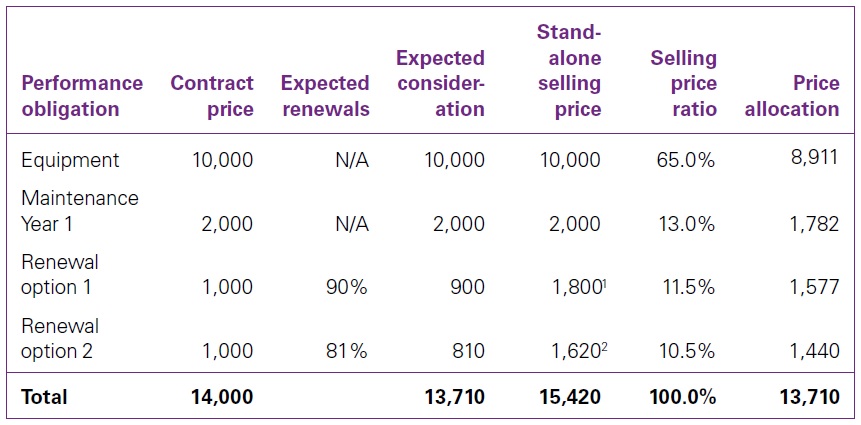

|

IFRS 15 does not provide detailed guidance on how to determine the amount of expected goods or services to be provided. The following are acceptable approaches to determining this amount.

Under both approaches, if the actual number of options exercised is different from what the entity expected, then the entity updates the transaction price and revenue recognised accordingly. We believe that it is acceptable to adjust the number of expected goods or services during the period(s) for which a material right exists, on either a cumulative catch-up or prospective basis, as long as the entity establishes a policy for the approach that it uses and applies it consistently.

|

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Similar goods or services Similar goods or services Similar goods or services Similar goods or services Similar goods or services Similar goods or services Similar goods or services Similar goods or services Similar goods or services Similar goods or services Similar goods or services Similar goods or services Similar goods or services Similar goods or services

to discounts provided to other customers in this class of customers and does not exist independently from the current

to discounts provided to other customers in this class of customers and does not exist independently from the current