After determining the classification of the share-based payment in the financial statements of the reporting entity (see Classify Group share-based payments), the recognition and measurement of the share-based payment transaction follows the accounting requirements for equity-settled share-based payments (see Equity-settled share-based payments) or for cash-settled share-based payments (see Cash-settled share-based payments). (IFRS 2.43A)

Consequences of different classification in different financial statements

The amounts recognised for a single transaction in the financial statements of the receiving entity and the settling  entity will usually differ if the classification of the transaction is different in the financial statements of the receiving entity and the settling entity, or different in the consolidated financial statements at different levels within the group. (IFRS 2.43A)

entity will usually differ if the classification of the transaction is different in the financial statements of the receiving entity and the settling entity, or different in the consolidated financial statements at different levels within the group. (IFRS 2.43A)

Equity-settled share-based payments involving employees are measured once at grant date and the number of instruments is adjusted only to reflect the number of instruments for which any service and non-market performance conditions are satisfied. Neither changes in the fair value of the equity instruments nor changes between the estimated and actual outcome of any market or non-vesting conditions affect the accounting (see Equity-settled share-based payments).

In contrast, the liability arising from a cash-settled share-based payment is adjusted to reflect changes in the fair value of the underlying equity instruments as well as in the estimated and actual outcome of vesting and non-vesting conditions, so that the liability is remeasured to equal the amount ultimately paid (see Cash-settled share-based payments).

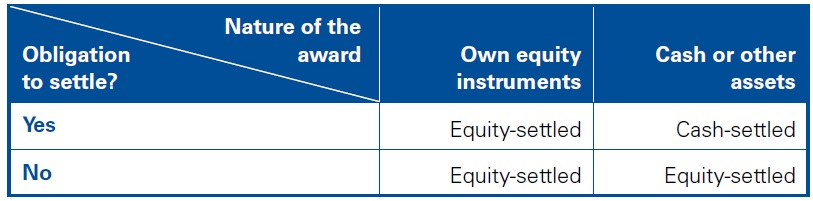

Accounting by receiving entity with no obligation to settle

A receiving entity that has no obligation to settle the transaction with the counterparty to the share-based payment transaction accounts for the transaction as equity-settled and recognises an expense, unless the goods or services received qualify for recognition as an asset, and an increase in its equity as a contribution from the parent. (IFRS 2.B53)

Accounting by direct parent that settles

A settling entity recognises the credit entry in equity or liabilities, depending on the classification of the share-based payment transaction. However, there is no explicit guidance on how a settling entity that is different from a receiving entity accounts for the debit entry.

Equity-settled transactions

If a parent grants rights to its equity instruments to employees of a subsidiary, then the identifiable consideration received by the parent from the perspective of its separate financial statements for the equity instruments may be zero. If the identifiable consideration received is less than the fair value of the equity instruments granted (or liability  incurred), then this typically indicates that other consideration – i.e. unidentifiable goods or services – has been or will be received. (IFRS 2.13A)

incurred), then this typically indicates that other consideration – i.e. unidentifiable goods or services – has been or will be received. (IFRS 2.13A)

In our view, if a parent grants rights to its own equity instruments to employees of a subsidiary, then the parent receives goods or services indirectly through the subsidiary in the form of an increased investment in the subsidiary. This is because the subsidiary receives services from employees that are paid for by the parent, thereby increasing the value of the subsidiary.

Therefore, we believe that the parent should recognise in equity the equity-settled share-based payment, with a corresponding increase in its investment in the subsidiary in its separate financial statements. The amount recognised as an additional investment is based on the grant-date fair value of the share-based payment.

In our view, the increase in investment and corresponding increase in equity for the equity-settled share-based payment should be recognised by the parent over the vesting period of the share-based payment. In recognising these amounts, the normal requirements for accounting for equity-settled share-based payments with employees should be applied.

Case – Illustration of parent and subsidiary accounting |

||||||||||||||||||||||||

|

On 1 January Year 1, Parent P grants 100 options over its own shares to an employee in Subsidiary S, subject to a one-year service condition. The grant-date fair value of a share option is 10. The employee is expected to remain employed and ultimately does. P classifies the share-based payment to S’s employee as equity-settled and accounts for the transaction as follows.

S classifies the share-based payment as equity-settled, because S receives the services without having an obligation to settle the transaction. S accounts for the transaction as follows.

|

Cash-settled transactions

Accounting for a share-based payment transaction that has been classified as cash-settled in a parent’s separate financial statements is more complex than if it were classified as an equity-settled share-based payment (see above), as illustrated in the next paragraph.

Assuming that an investment in a subsidiary is not different from any other asset measured on a cost basis, the same principles of recognition of the increase in the carrying amount of the asset for the services received in a cash-settled share-based payment apply.

As demonstrated in the guidance in Remeasurement in Cash-settled share-based payments illustrating the effect of capitalising and remeasuring the cost of a cash-settled share-based payment, a parent would capitalise the grant-date fair value of the liability. The effects of changes in the estimated and actual outcome of service and non-market conditions would adjust the grant-date fair value cost of the investment. Other remeasurements of the grant-date fair value would be recognised in profit or loss.

Accounting by ultimate parent that settles

In some cases, the ultimate parent grants a share-based payment to a subsidiary in the group. As discussed above, the settling entity – in this case, the ultimate parent – recognises an increase in equity or liabilities depending on the classification of the share-based payment transaction.

However, there is no explicit guidance in IFRS 2 regarding the debit entry. In our view, the grant of a share-based payment by an ultimate parent to a group subsidiary increases the value of the ultimate parent’s direct or indirect investment in the subsidiary. Therefore, we believe that the ultimate parent should recognise the cost of the share-based payment as a cost of the investment in the subsidiary.

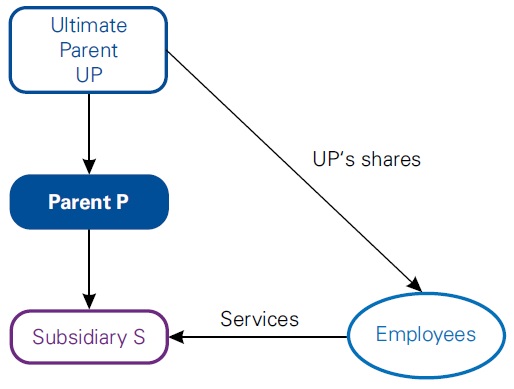

Case – Ultimate parent settling transaction |

|

Ultimate Parent UP grants a share-based payment to the employees of Subsidiary S and will settle the transaction in UP’s own equity instruments. S is held indirectly by UP via Parent P.

In our view, P, as an intermediate parent, should choose an accounting policy regarding whether to recognise a share-based payment in its separate financial statements (see 10.6.10). We believe that, regardless of whether P recognises the transaction, the value of UP’s investment in P increases by granting the share-based payment arrangement to S’s employees, and therefore UP should recognise the cost of the share-based payment as a cost of investment in P. |

Accounting by another group entity that settles

In our view, a settling entity with no direct or indirect investment in the entity receiving the services in a group share-based payment transaction should recognise the cost of the share-based payment in equity as a distribution to its parent over the vesting period. This is because the entity can be seen to be settling the transaction on behalf of its parent.

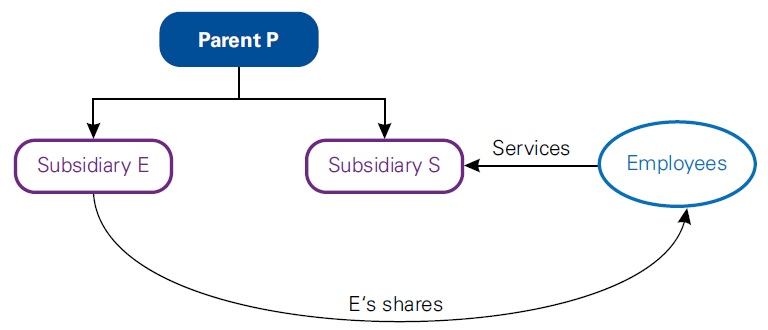

Case – Other group entity settling transaction |

|

Parent P has Subsidiaries E and S. E grants a share-based payment to the employees of S and will settle the transaction in E’s own equity instruments.

Because E neither receives services nor has an investment in S, we believe that E should recognise the cost of the share-based payment in equity as a distribution to P over the vesting period. |

Accounting for transfers of employees

Employees may transfer within the group during the vesting period of a share-based payment arrangement. In some circumstances, the share-based payment may lapse or vest on such a transfer and the employee may be offered a new share-based payment. In such cases, the normal requirements for employees leaving and joining share-based payment arrangements apply from the perspective of each entity.

In other circumstances, a parent (or another group entity) may grant to employees of a subsidiary rights to its equity instruments that are conditional on the employee providing service within the group, rather than to a specific entity. In such arrangements, the transfer of the employee will have no effect on the vesting of the share-based payment from the employee’s point of view. Accordingly, IFRS 2 provides guidance relating to transfers within the group when the service requirement is subject to group-wide services (see the next paragraph). (IFRS 2.B59, B61)

If the subsidiaries have no obligation to settle the transaction with their employees, then the transaction is accounted for as equity-settled. Each subsidiary measures the services received from the employee with reference to the parent’s grant-date fair value of the equity instruments.

If an employee subsequently fails to satisfy a vesting condition other than a market condition, such that there is a true-up of the share-based payment at the group level, then each subsidiary adjusts the amount previously recognised in its financial statements. If the employee transfers between two group entities during the vesting period, then this is not deemed to be a forfeiture from the perspective of the financial statements of the former employer or a new grant by the new employer. (IFRS 2.B60-B61)

|

Case – Transfer of employees when subsidiaries have no obligation to settle |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

On 1 January Year 1, Parent P grants 100 options over its own shares to an employee, subject to a three-year service condition within P’s group. P’s group comprises Subsidiaries S1, S2 and S3. The grant-date fair value of a share option is 9. The employee is employed in S1 from 1 January Year 1 to 31 December Year 1. On 1 January Year 2, the employee is transferred to S2. On 31 May Year 3, the employee leaves S2 and the group and therefore does not meet the service condition. P classifies the share-based payment to the employee as equity-settled and accounts for the transactions in its separate financial statements as follows.

S1 classifies the share-based payment as equity-settled because it receives the services without having an obligation to settle the transaction. It accounts for the transaction as follows.

In Year 2 – i.e. when the employee leaves S1 – S1 does not adjust any previous entries, nor does it recognise any further expenses. After the employee transfers to S2, S2 also classifies the share-based payment as equity-settled and accounts for the transaction as follows.

S2 does not recognise any catch-up on 1 January Year 2 for the cumulative expenses to date, because these have already been recognised by S1. In Year 3, when the employee leaves the group, S1 and S2 each recognise a true-up for the failure to meet the service condition.

|

If the subsidiaries have an obligation to settle the transaction in cash or other assets, including in the equity instruments of a parent or another group entity, then each subsidiary (IFRS 2.B60):

- measures the services received with reference to the grant-date fair value of the equity instruments granted and for the proportion of the vesting period served with each subsidiary; and

- recognises any change in the fair value of the equity instruments during the employment period of the employees with each subsidiary, because the award is classified as cash-settled from the perspective of the subsidiaries.

In our experience, a group-wide service condition is less likely to be included in share-based payments in which the subsidiaries have an obligation to settle than in share-based payments in which the parent has the obligation to settle. IFRS 2 provides the high-level principles outlined above but no explicit guidance on how to apply them in practice. It also does not address the attribution to the subsidiaries of the changes in fair value occurring from vesting date to settlement date.

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment

Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment Accounting for group share-based payment