Change in ownership in a subsidiary

Accounting for a subsequent change in ownership in a subsidiary, i.e. a change in the parent’s ownership interest in a subsidiary may result from a purchase or sale of shares by the parent or from transactions between the subsidiary and non-controlling interests.

This narrative discusses the accounting for changes in ownership interests that:

- do not result in loss of control of the subsidiary

- do result in loss of control of the subsidiary

Change in ownership in a subsidiary that do not result in loss of control

Non-controlling interests (NCI) in a subsidiary are presented as a separate component of equity in the consolidated statement of financial position. Consequently, changes in a parent’s ownership interest in a subsidiary that do not result in loss of control are accounted for as equity transactions.

Parent’s accounting treatment:

When the NCI in a subsidiary changes but the same parent retains control: (IFRS 10.23, IFRS 10.B96)

- no gain or loss is recognised when the parent sells shares (so increasing NCI)

- a parent’s purchase of additional shares in the subsidiary (so reducing NCI) does not result in additional goodwill or other adjustments to the initial accounting for the business combination

- in both situations, the carrying amount of the parent’s equity and NCI’s share of equity is adjusted to reflect changes in their relative ownership interest in the subsidiary. Any difference between the amount of NCI adjustment and the fair value of the consideration received or paid is recognised in equity, attributed to the parent [IFRS 10.B96]

- the parent should also take the following into consideration:

- the allocated amounts of accumulated OCI (including cumulative exchange differences relating to foreign operations) are adjusted to reflect the changed ownership interests of the parent and the NCI. The re-attribution of accumulated OCI is similarly treated as an equity transaction (ie a transfer between the parent and the NCI)

- for a partial disposal of a subsidiary with foreign operations, the parent must re-attribute the proportionate share of cumulative exchange differences recognised in OCI to NCI in that foreign operation [IAS 21.48C]

- IFRS 10 has no specific guidance for costs directly related to changes in ownership interests. In our view, costs that are incremental should be deducted from equity (consistent with IAS 32’s rules on other types of transaction in the entity’s own equity).

Examples

The following examples (Sale of shares in a subsidiary, Acquisition of additional shares in a subsidiary and Dilution of a parent’s interest) illustrate IFRS 10’s requirements. Where relevant, the examples also illustrate how the adjustment to the carrying amount of NCI is determined (using the two possible ways, see below in each example).

|

|

|

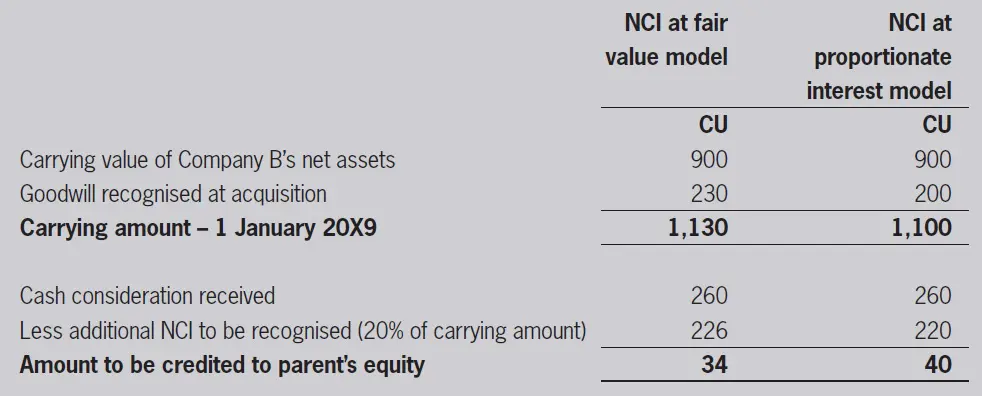

Company A acquired 80% of Company B in 20X6. On 1 January 20X9, Company A sells Company B shares equivalent to 20% of Company B’s outstanding shares for CU260. On that date, the carrying value of Company B’s net assets in the consolidated financial statements, excluding goodwill, amounted to CU900. Goodwill measured using the fair value and proportionate interest model amounts to CU230 and CU200, respectively. Company A’s recorded goodwill is not impaired. Company B has no accumulated OCI. After the sale, Company A still has a 60% interest in Company B and continues to control its operations. NCI measurement options The basis on which NCI is measured affects goodwill at the acquisition date. When the fair value model is used, 100% of the goodwill in the acquiree is recognised (both the acquirer’s and the NCI’s share). This is sometimes described as the full goodwill model. Under the proportionate interest model only the acquirer’s interest in the goodwill is recognised (a lesser amount). Adjustments to NCI and equity:

The choice of recording NCI either using the fair value or proportionate interest model only applies on the acquisition date. Adjustment to NCI is based on NCI’s proportionate share of the subsidiary. |

|

|

||||||

|

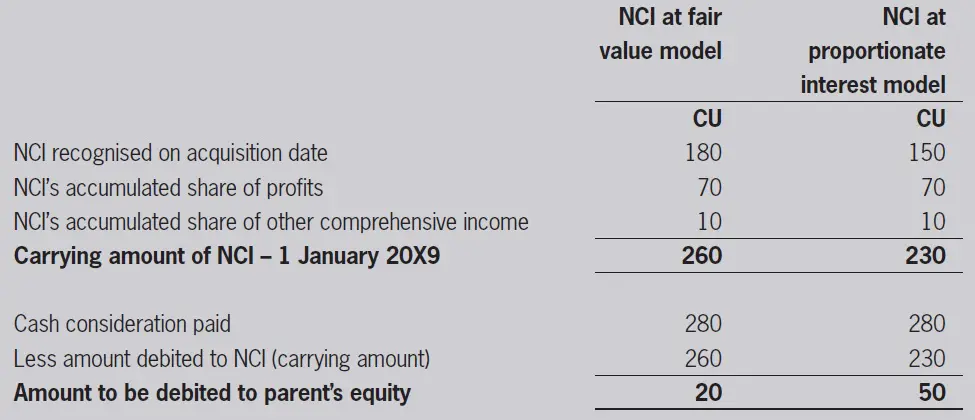

Company A has an 80% interest in Company B. On the acquisition date, NCI measured using the fair value and proportionate interest model amounts to CU180 and CU150, respectively. On 1 January 20X9, Company A purchases the remaining 20% interest in Company B for CU280. Company A’s recorded goodwill is not impaired. From the date of acquisition up to 1 January 20X9, the balance of NCI has increased by CU80 related to the NCI’s share of Company B’s profits (CU70) and other comprehensive income (CU10). NCI measurement options The basis on which NCI is measured affects goodwill at the acquisition date. When the fair value model is used, 100% of the goodwill in the acquiree is recognised (both the acquirer’s and the NCI’s share). This is sometimes described as the full goodwill model. Under the proportionate interest model only the acquirer’s interest in the goodwill is recognised (a lesser amount). Adjustments to NCI and equity:

With the change in ownership interest, the NCI’s share of the accumulated other comprehensive income is re-attributed to the parent and will be included in the balance of accumulated other comprehensive income. Company A will then record the following entry:

|

|

|

|||||||||

|

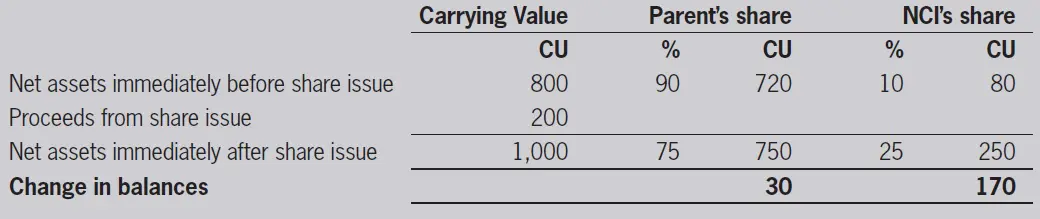

Company Q owns 90% of 100 outstanding shares of Company R. On 1 January 20X9, Company R issued 20 new shares to an independent third party for CU200. This diluted Company Q’s ownership interest from 90% to 75% (90/(100+20)). The carrying value of the identifiable net assets (excluding goodwill) of Company R in the consolidated accounts immediately before the new share issue is CU800, of which CU720 is attributable to Company Q. The carrying value of the NCI at the same date is CU80. Accounting for the change in ownership interest:

In the consolidated financial statements of Company Q, the following entry will be recorded:

|

Change in ownership in a subsidiary that do result in loss of control of the subsidiary

The loss of control of a subsidiary usually occurs when the parent sells or otherwise transfers its controlling interest in a single transaction or as a result of multiple transactions. However, other events may also result in the loss of control, such as:

- expiration of a contractual agreement that conferred control of the subsidiary

- the subsidiary becomes subject to the control of a government, court, administrator or regulator (without any change in the ownership interest in the subsidiary) or

- the subsidiary issues shares that dilutes the parent’s controlling interest.

Regardless of the nature of the transaction or event, the loss of control represents a significant economic event that requires the parent to stop consolidating the subsidiary and to recognise any gain or loss. IFRS 10’s requirements are summarised below, along with an illustrative example of their application.

On the date when control is lost, the parent is required to (IFRS 10.25, IFRS 10 B97-B99):

- derecognise the assets (including goodwill) and liabilities of the subsidiary at their carrying amounts

- derecognise the carrying amount of any NCI (including any components of OCI attributable to them)

- recognise the fair value of the consideration received, if any, and any shares distributed as dividends as part of the transaction that resulted in the loss of control

- recognise any investment retained in the former subsidiary at fair value

- reclassify to profit or loss (if required by other IFRS) or transfer directly to retained earnings, any amount included in OCI

- recognise any resulting difference as a gain or loss in profit or loss attributable to the parent

The following example illustrates how IAS 27’s guidance is applied:

Disposal of a subsidiary while retaining an investment |

|||||||||||||||||||||||||||||||||||||

|

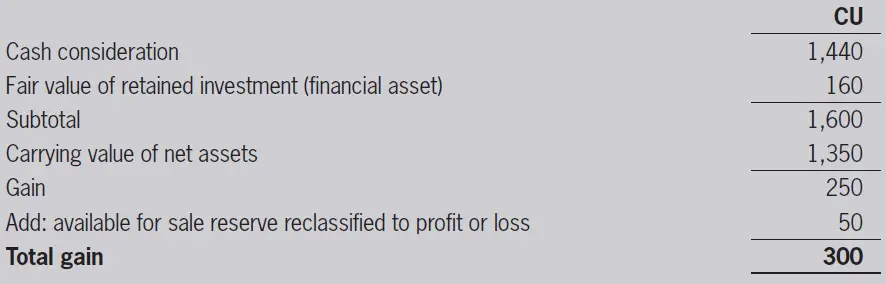

Company Q acquired its wholly-owned subsidiary, Company R for CU1,000 on 1 January 20X5. On 31 December 20X9, Company Q sold 90% of its interest in Company R for cash of CU1,440. On that date, the carrying value of the net assets of Company R is CU1,350. These net assets include goodwill and a financial asset classified as an available for sale investment with a fair value of CU200 and original cost of CU150. Company R applied the revaluation model of IAS 16 for its property, plant and equipment and has a revaluation reserve balance of CU60. For the purposes of this example, income tax on the gain on sale of the subsidiary is ignored. Accounting for the sale of the subsidiary:

Entry to record the sale:

Accounting for the subsidiary’s revaluation reserve: IFRS 10.B98(c), IFRS 10.B99 also applies to the subsidiary’s revaluation reserve related to its property, plant and equipment. IAS 16 Property, Plant and Equipment requires that the revaluation surplus included in equity may be transferred directly to retained earnings when the asset is derecognised (IAS 16.41). Upon sale of the subsidiary, any revaluation reserve is then transferred directly to retained earnings and does not form part of the gain on sale of the subsidiary. Entry to transfer the revaluation reserve to retained earnings:

The CU300 gain calculated above comprises (1) the gain on sale of the controlling interest and (2) the gain on the retained investment. IFRS 10 requires separate disclosure of these two components, together with the line item in the income statement in which the gains or losses are recognised IFRS 10.B98(c), IFRS 10.B99 . This will require a separate calculation of the gain on the retained investment, as follows:

The total gain recorded by Company Q comprises:

|

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Change in ownership in a subsidiary Change in ownership in a subsidiary Change in ownership in a subsidiary Change in ownership in a subsidiary Change in ownership in a subsidiary Change in ownership in a subsidiary Change in ownership in a subsidiary Change in ownership in a subsidiary Change in ownership in a subsidiary Change in ownership in a subsidiary