Derivative meaning

A derivative, by definition, is a financial instrument or other contract within the scope IFRS 9 with all three of the following characteristics:

- its value changes in response to the change in a specified interest rate, financial instrument price, commodity price, foreign exchange rate, index of prices or rates, credit rating or credit index, or other variable, provided in the case of a non-financial variable that the variable is not specific to a party to the contract (sometimes called the ‘underlying’).

- it requires no initial net investment or an initial net investment that is smaller than would be required for other types of contracts that would be expected to have a similar response to changes in market factors.

- it is settled at a future date.

Accounting |

|

A derivative financial asset is always classified as held at fair value through profit or loss (FVPL). A derivative financial liability is also always classified as held at fair value through profit or loss (FVPL). Always is at initial recognition and subsequent measurement Fair value changes of a derivative financial liability attributable to own credit risk is recognized in OCI except if this creates or enlarges an accounting mismatch. |

Example derivatives

Typical examples of derivatives are futures and forward, swap and option contracts. A derivative usually has a notional

amount, which is an amount of currency, a number of shares, a number of units of weight or volume or other units specified in the contract. However, a derivative instrument does not require the holder or writer to invest or receive the notional amount at the inception of the contract.

amount, which is an amount of currency, a number of shares, a number of units of weight or volume or other units specified in the contract. However, a derivative instrument does not require the holder or writer to invest or receive the notional amount at the inception of the contract.

Alternatively, a derivative could require a fixed payment or payment of an amount that can change (but not proportionally with a change in the underlying) as a result of some future event that is unrelated to a notional amount. For example, a contract may require a fixed payment of CU1,000 if six-month LIBOR increases by 100 basis points. Such a contract is a derivative even though a notional amount is not specified.

Gross/Net Settlement

The definition of a derivative in this Standard includes contracts that are settled gross by delivery of the underlying item (eg a forward contract to purchase a fixed rate debt instrument). An entity may have a contract to buy or sell a non-financial item that can be settled net in cash or another financial instrument or by exchanging financial instruments (eg a contract to buy or sell a commodity at a fixed price at a future date).

Such a contract is within the scope of this Standard unless it was entered into and continues to be held for the purpose of delivery of a non-financial item in accordance with the entity’s expected purchase, sale or usage requirements. However, this Standard applies to such contracts for an entity’s expected purchase, sale or usage requirements if the entity makes a designation in accordance with paragraph 2.5 (see paragraphs 2.4–2.7).

Small initial net investment

One of the defining characteristics of a derivative is that it has an initial net investment that is smaller than would be required for other types of contracts that would be expected to have a similar response to changes in market factors. An option contract meets that definition because the premium is less than the investment that would be required to obtain the underlying financial instrument to which the option is linked. A currency swap that requires an initial exchange of different currencies of equal fair values meets the definition because it has a zero initial net investment.

Non-financial variables

The definition of a derivative refers to non-financial variables that are not specific to a party to the contract. These include an index of earthquake losses in a particular region and an index of temperatures in a particular city. Non-financial variables specific to a party to the contract include the occurrence or non-occurrence of a fire that damages or destroys an asset of a party to the contract.

A change in the fair value of a non-financial asset is specific to the owner if the fair value reflects not only changes in market prices for such assets (a financial variable) but also the condition of the specific non-financial asset held (a non-financial variable). For example, if a guarantee of the residual value of a specific car exposes the guarantor to the risk of changes in the car’s physical condition, the change in that residual value is specific to the owner of the car.

Hedge accounting qualification criteria

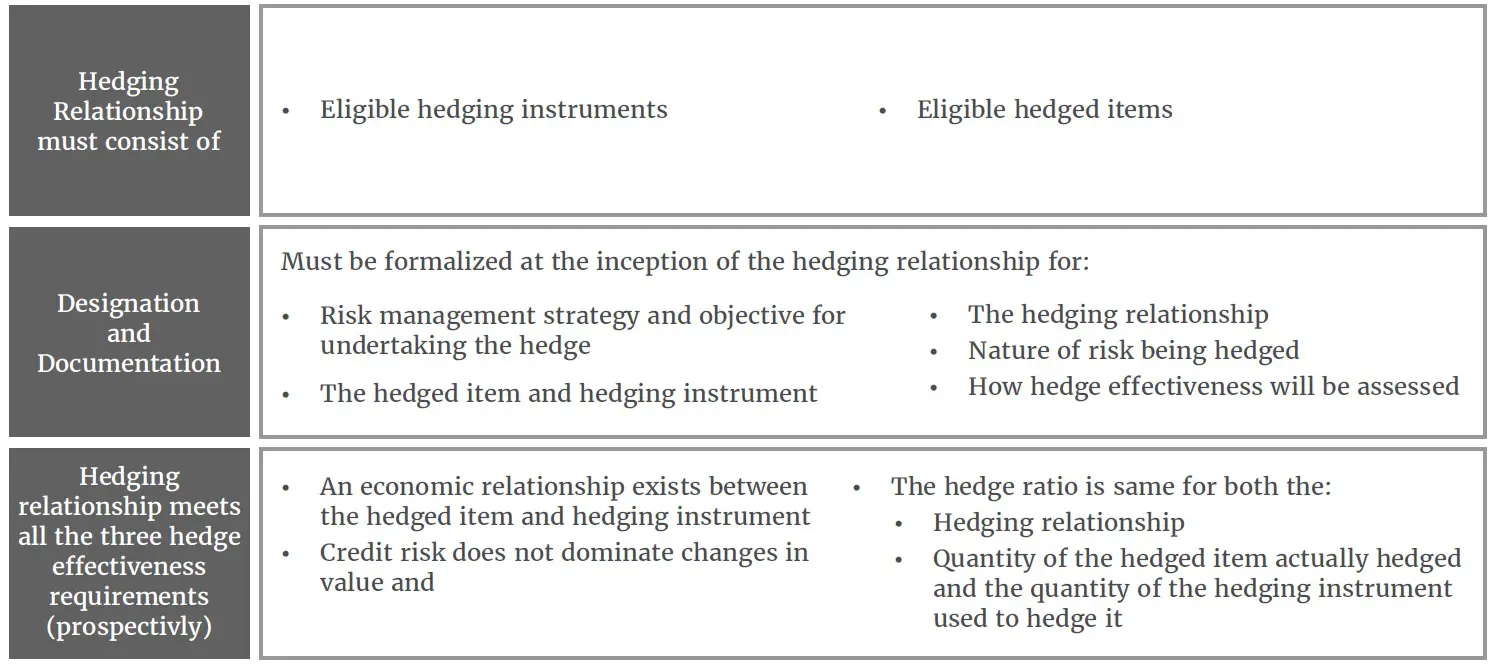

To qualify for hedge accounting a derivative must meet all of the following criteria:

Hedge effectiveness

The assessment of credit risk for hedge effectiveness purposes, which in many cases may be carried out on a qualitative basis, should not be confused with the requirement to actually measure and recognise the impact of credit risk on the hedging instrument and the hedged item.

The effectiveness of a hedging relationship is the extent to which changes in the fair value or cash flow of the hedging instrument offset changes in the fair value or cash flows of the hedged item.

Under IFRS 9, it is necessary for a hedging relationship to consist only of eligible hedging instruments and eligible hedged items. In addition, on inception of the hedging relationship there must be formal designation and documentation of the hedging relationship and the entity’s risk management objective and strategy for undertaking the hedge.

IFRS 9 requires that the hedge relationship meets all of the following hedge effectiveness requirements:

-

Economic relationship – An economic relationship exists between the hedged item and the hedging

instrument – meaning that the hedging instrument and the hedged item must be expected to have offsetting changes in fair value. For example, an entity with a Sterling functional currency might sell goods or services to customers that use US dollars. If the entity entered into a forward contract to exchange US dollars for Sterling on a specified future date (to coincide with the expected date of US dollar payments by customers), changes in the fair value of that forward contract would be expected to offset changes in the fair value of cash to be collected that is denominated in US dollars.

instrument – meaning that the hedging instrument and the hedged item must be expected to have offsetting changes in fair value. For example, an entity with a Sterling functional currency might sell goods or services to customers that use US dollars. If the entity entered into a forward contract to exchange US dollars for Sterling on a specified future date (to coincide with the expected date of US dollar payments by customers), changes in the fair value of that forward contract would be expected to offset changes in the fair value of cash to be collected that is denominated in US dollars. - Credit risk – The effect of credit risk does not dominate the fair value changes – i.e. the fair value changes due to credit risk should not be a significant driver of the changes in fair value of either the hedging instrument or the hedged item.

- Hedge ratio – The hedge ratio is required to be designated based on actual quantities of the hedged item and hedging instrument (unless doing so would create deliberate hedge ineffectiveness) – i.e. the hedge ratio applied for hedge accounting purposes should be the same as the hedge ratio used for risk management purposes. For example, an entity hedges 90% of the foreign exchange exposure of a financial instrument. The hedging relationship should be designated using a hedge ratio resulting from 90% of the foreign currency exposure and the quantity of the hedging instrument that the entity actually uses to hedge the 90%.

Under the new requirements, although retrospective testing will be required in order to determine the extent of any hedge ineffectiveness to be recorded in profit or loss, in order for an ongoing arrangement to qualify for hedge accounting only prospective hedge effectiveness testing is required.

- For simple hedge relationships, entities are expected to be able to apply a qualitative test (e.g. critical terms match where the risk, quantity and timing of the hedged item matches the hedging instrument).

- For more complex hedging relationships, such as where the hedged item is of a different grade to the hedging instrument (e.g. where a basis difference exists, such as between GBP LIBOR and USD LIBOR) a more detailed quantitative test is likely to be required.

For a simple interest rate swap and for foreign exchange contracts in which the currency, amounts, maturity and other critical terms match, the IFRS 9 requirements are easier to apply and make qualifying for hedge accounting more likely.

Hedging instrument

Under IFRS 9 derivative financial instruments and non-derivative financial assets and liabilities that are accounted for at FVPL are allowed to be designated as hedging instruments. However, this excludes financial liabilities at FVPL where fair value changes resulting from changes in own credit risk are recognized in OCI.

Hedged Items

Non-Financial Items

IFRS 9 allows hedging a risk component of a non-financial item if that component is separately identifiable and measurable. If in part, only the following types of parts (components) of hedged items can be hedged:

- One or more selected contractual cash flows

- Parts (components) of a nominal amount

- Separately identifiable and reliably measurable changes (cash flow or fair value) that, based on the context of the market structure they relate to, are attributable to a specific risk(s)

For example: Jet fuel is one of the classic example of non-financial item. Jet fuel has various risk components like price risk, foreign currency risk and other risks. Prior to applying IFRS 9 an entity was allowed to hedge only crude oil in its entirety and not just any risk component. IFRS 9 allows hedging of a benchmark crude oil price risk component without hedging entire crude oil risk.

Net Positions

Under IFRS 9 net positions (including net nil positions) are allowed as hedged items under some circumstances.

Group of Items

Under IFRS 9 the use of layers as hedged item are allowed for both cash flow hedges and fair value hedges in some circumstances.

Discontinuation of hedge accounting

Under IFRS 9 an entity can discontinue hedge accounting only if:

- Economic relationship ceases to exist

- Credit risk dominates the hedging relationship or

- Risk management objective has changed

Aggregate exposures

Under IFRS 9 an aggregated position that incorporates a derivative along with a non-derivative exposure can be designated as a hedged item.

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning

Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning Derivative meaning