Use back button from the brower

Denominator adjustment

–

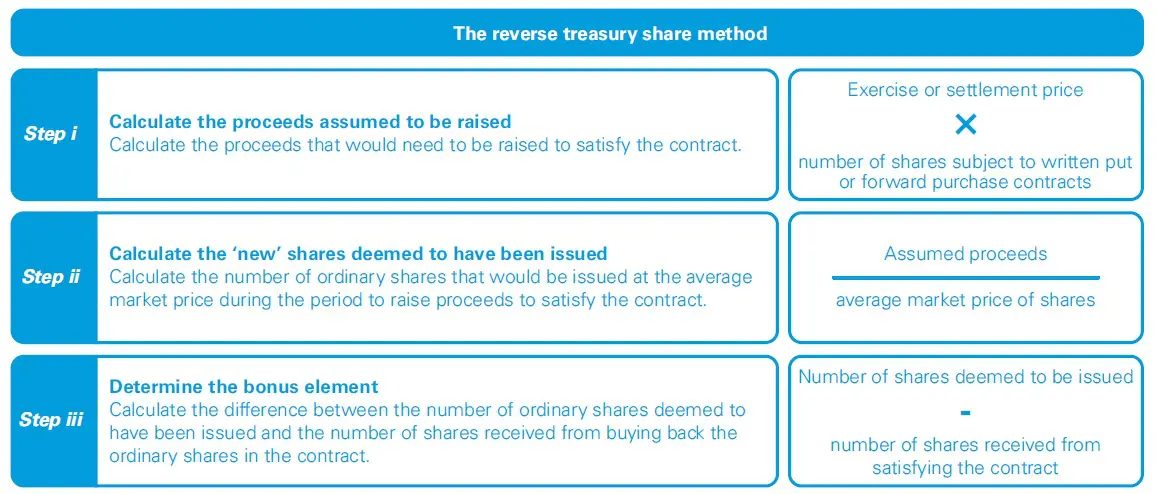

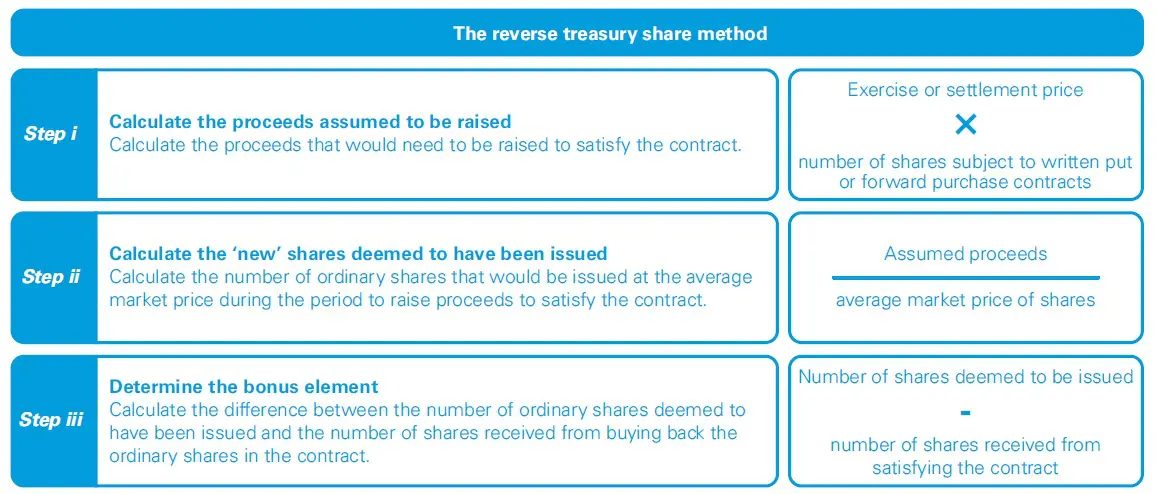

The reverse treasury share method

IAS 33 prescribes a specific method, commonly referred to as the ‘reverse treasury share method’, for determining the dilutive effect of written puts and forwards. This method is similar to the treasury share method that applies to written calls (see 5.9.40), but with an opposite assumption: instead of assuming that the assumed proceeds from the exercise of options are used to acquire ordinary shares at the average market price, as in the treasury share method, the reverse treasury share method assumes that additional ordinary shares are issued to raise enough proceeds to satisfy the exercise or settlement price. The dilutive effect – i.e. the bonus element – is therefore calculated as the difference between:

- the number of ordinary shares that would have to be issued at the average market price during the period to raise sufficient proceeds to fulfil the written puts or forwards; and

- the number of shares that would be repurchased under the terms of the written puts or forwards. [IAS 33.63, IAS 33.A10]

The following diagram summarises the reverse treasury share method.

Consistent with the treasury share method (see 5.9.40), the average market price should be determined based on the full reporting period or, in our view, the period for which the written puts or forwards are outstanding if this is shorter. Additional consideration on the average market price is set out in 5.9.40.

|

Case – Written puts

|

|

The following basic facts relate to Company P.

- Net profit for Year 1 is 4,600,000.

- The number of ordinary shares outstanding on 1 January Year 1 is 3,000,000.

The following facts are also relevant for Year 1.

- On 1 January, P writes a put option on 200,000 of its ordinary shares.

- The put option is exercisable only gross in cash, with an exercise price of 45 each.

- The ordinary shares subject to the written put are entitled to profits, including undistributed profits, to the same extent as shares not subject to the written put.

- P recognises a financial liability for the written put based on the present value of the exercise price.

- The interest expense recognised for the liability during the year is 200,000.

- The interest expense recognised on the written put is tax-deductible. The applicable income tax rate is 40%.

- The average market price of P’s ordinary shares during the year is 30.

Workings

The EPS computations for Year 1 are as follows.

|

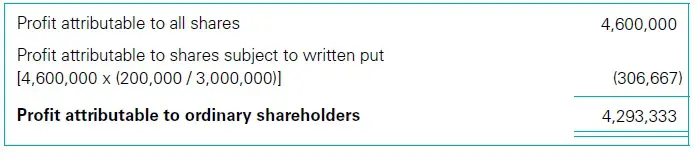

Basic EPS

|

Diluted EPS

|

|

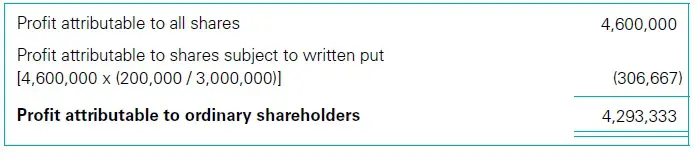

1. Determine the numerator

Because the ordinary shares are subject to a written put with profit rights, they are not considered outstanding (see Step 2); however, the numerator is adjusted for their participating rights (see 5.14.20).

|

1. Identify POSs

Although the shares subject to the written option are excluded from basic EPS, the potentially dilutive effect of the written put should be considered in diluted EPS.

|

|

2. Determine the denominator

Ordinary shares subject to a written put are excluded from the denominator. Therefore, the denominator is the weighted-average number of ordinary shares that are not subject to the written put – i.e. 2,800,000 (3,000,000 – 200,000).

|

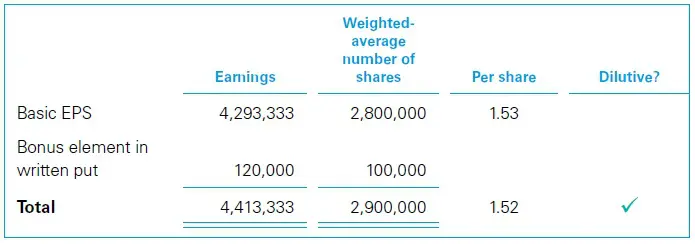

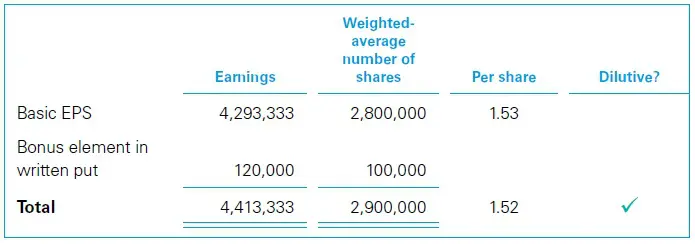

2. For each POS, calculate EPIS

Potential adjustment to the numerator for EPIS: Because the assumed exercise of the written put would settle the related financial liability, the numerator would increase by the amount of expense recognised for the written put, calculated as follows:

(interest expense for the written put liability) x (1 – income tax rate) = (200,000) x (1 – 40%) = 120,000

Potential adjustment to the denominator for EPIS: The adjustment is determined using the reverse treasury share method (see above), as follows.

As noted above, to be consistent with the assumption that the 200,000 shares subject to the written put are not included in the denominator, we believe that there should not be any reversal of the adjustment to the numerator for basic EPS in respect of the earning entitlements of the shares subject to the written put.

Therefore, EPIS is calculated as follows.

EPIS = 120,000 / 100,000 = 1.20

|

|

3. Determine basic EPS

Basic EPS = 4,293,333 / 2,800,000 = 1.53

|

3. Rank the POSs

This step does not apply, because the written put is the only potentially dilutive instrument.

|

|

4. Determine basic EPS from continuing operations

Basic EPS is 1.53 (see Step 3 of basic EPS computation).

|

|

5. Identify dilutive POSs and determine diluted EPS

The potential impact of the written put is determined as follows.

Accordingly, P includes the impact of the written put in diluted EPS.

Diluted EPS = 1.52

|

|

Use back button from the brower

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

The reverse treasury share method The reverse treasury share method The reverse treasury share method The reverse treasury share method The reverse treasury share method The reverse treasury share method The reverse treasury share method The reverse treasury share method The reverse treasury share method The reverse treasury share method