Contracts that may be settled in shares or in cash deals with contracts that contain settlement alternatives at the issuing entity’s or the holder’s option. An example of such contracts is a share warrant that can be settled either gross in ordinary shares or net in cash.

If the contract falls under IFRS 2 Share-based Payment, then the classification depends on which party holds the settlement choice. If the issuing entity has that choice, then the contract is classified wholly as either equity-settled or cash-settled, depending on whether the entity has a present obligation to settle in cash. If the counterparty has the choice of settlement, then the contract is classified as a compound instrument. [IFRS 2.34–43]

If such a contract falls in the scope of IAS 32 Financial Instruments: Presentation, then it can contain a derivative, a liability and/or an equity component, depending on its terms. For example, a conversion option in a convertible bond that on exercise can be settled in shares or net in cash would generally mean that the whole instrument is a liability. [IAS 32.26–27, IAS 33.IE8]

This narrative covers the EPS implications of contracts that may be settled in shares or in cash in general. Additional considerations in the context of specific instruments are set out in the following chapters:

- instruments under share-based payment arrangements: see Chapter 5.17; and

- convertible instruments: see Chapter 5.11.

EPS implications

Generally, contracts that may be settled in shares or in cash impact only diluted EPS. Whether the issuing entity or the holder has the settlement choice affects the settlement assumption in determining EPS; however, the impact is ultimately determined with reference to the guidance that applies to the type of POS. Understanding the accounting for these contracts is also relevant, because it determines whether their assumed conversion would have a consequential effect on profit or loss.

|

Potential impact on basic EPS |

Potential impact on diluted EPS |

|

The numerator and the denominator are not affected. |

The numerator and the denominator are affected. |

|

Contracts that may be settled in shares or in cash are generally ignored because they are not ordinary shares. |

Contracts that may be settled in shares or in cash may entitle their holder to ordinary shares, and are therefore POSs. Depending on whether the entity or the counterparty has the settlement choice, the potential impact on diluted EPS under both the share-settlement and the cash-settlement assumptions may need to be considered (see 5.12.30). |

|

Under a share-settlement assumption:

|

Which party holds the settlement choice?

The treatment of contracts that may be settled in shares or in cash in diluted EPS depends on whether the settlement choice rests with the entity or the counterparty.

The settlement assumption for EPS is independent of the classification of the contracts under IFRS 2 or IAS 32. It is also independent of the entity’s or the counterparty’s intended or (previous/actual) manner of settlement.

– If the entity has the settlement choice

If the entity has the settlement choice, then the entity assumes when determining diluted EPS that the contract will be settled in ordinary shares, and the resulting POSs are included in the denominator if they are dilutive. [IAS 33.58]

This assumption may not be consistent with the classification of the contract under IFRS 2 or IAS 32. Irrespective of this assumption, such a contract may contain a derivative, a liability and/or an equity component under IFRS 2 or IAS 32.

For example, a share-based payment in which the entity has a settlement choice and a present obligation to settle in cash is classified as cash-settled under IFRS 2, yet it is considered a POS for EPS purposes. Instances may therefore arise in which a contract that contains a derivative or liability component under IFRS 2 or IAS 32 is nevertheless considered a POS for EPS purposes.

In this case, it is necessary also to consider adjusting the numerator for diluted EPS for any consequential changes in profit or loss that would result from the assumed conversion to ordinary shares. [IAS 33.59]

– If the counterparty has the settlement choice

If the counterparty has the settlement choice, then the entity uses the more dilutive of cash-settlement and share-settlement in calculating diluted EPS. This appears to suggest that two hypothetical calculations have to be prepared, by assuming that the contract would be settled in cash and in shares, and the one that produces the more dilutive EPS amount is used. [IAS 33.60]

Case – Convertible bond – Entity has the settlement choice |

||||||||||

|

The following basic facts relate to Company P.

The following facts are also relevant for Year 1.

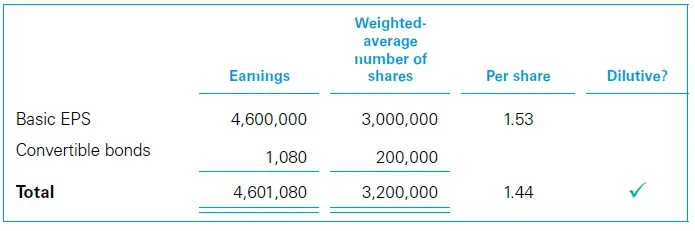

WorkingsThe EPS computations for Year 1 are as follows.

|

|

|

||||||||||

|

The following basic facts relate to Company P.

The following facts are also relevant for Year 1.

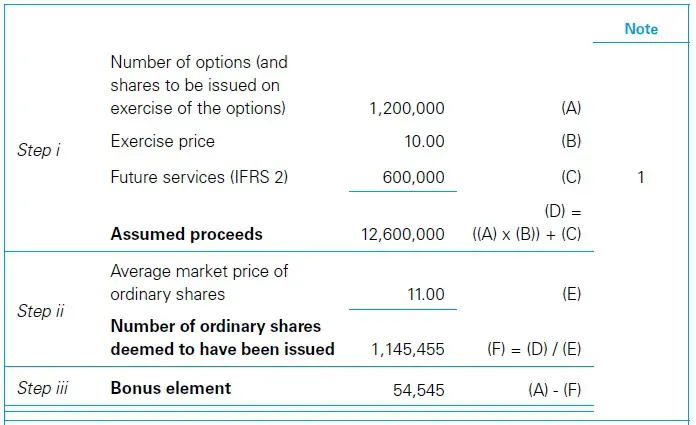

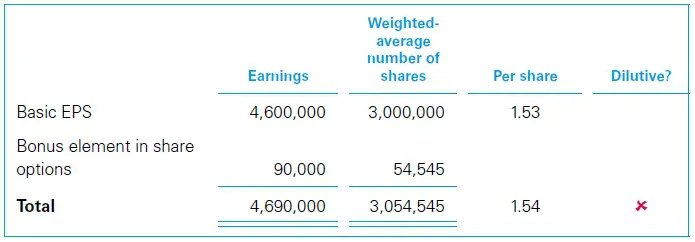

WorkingsThe EPS computations for Year 1 are as follows.

|

Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction.

Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash Contracts settled in shares or cash