Last update 04/08/2020

What are Consolidated Financial Statements in IFRS 10 and the relations with IFRS 11 IFRS 12 IAS 27 IAS 28 and disclosures for consolidation and investments.

Look hereIAS 27 Separate Financial Statements, IFRS 10 Consolidated Financial Statements, IFRS 11 Joint Arrangements, IAS 28 Investments in Associates and Joint Ventures and IFRS 12 Disclosures of Interest in Other Entities are all relating to or are otherwise intertwined with IFRS Types of Investments in (Consolidated) Financial Statements. To better understand these 5 IFRS Standards and their interactions, co-relations, and maybe contradictions, here are all the important thins summarised. |

What are Consolidated Financial Statements in IFRS 10 What are Consolidated Financial Statements in IFRS 10 What are Consolidated Financial Statements in IFRS 10 What are Consolidated Financial Statements in IFRS 10

IAS 27 Separate Financial Statements

|

A parent of a group of companies may elect (or is required by local regulations) to prepare separate financial statements (in addition to the Consolidated Financial Statements (in IFRS 10)). IAS 27 applies in accounting for investments in:

in such separate financial statements. IAS 27 Valuation of subsidiaries, joint ventures and associates in separate financial statements is treated below. Joint Operations (in IFRS 11) and Other Entities (in IFRS 12) are accounting for based on those standards. |

What are Subsidiaries Joint Ventures and Associates in IAS 28 What are Subsidiaries Joint Ventures and Associates in IAS 28 What are Subsidiaries Joint Ventures and Associates in IAS 28 What are Subsidiaries Joint Ventures and Associates in IAS 28 What are Subsidiaries Joint Ventures and Associates in IAS 28 What are Subsidiaries Joint Ventures and Associates in IAS 28

IFRS 10 Consolidated Financial Statements |

To establish principles for the presentation and preparation of consolidated financial statements when an entity controls one or more other entities. These other entities are (or may be) Subsidiaries (IFRS 10), Joint Operations (IFRS 11) and Consolidated Structured Entities (IFRS 12) – Note – Consolidated Structured Entities are also called subsidiaries.

Investment entityAn investment entity is defined as ‘an entity that

An investment entity shall NOT consolidate its subsidiaries but rather measure an investment in a subsidiary at fair value through profit or loss in accordance with IFRS 9. |

What are Separate Consolidated Financial Statements in IAS 27 What are Separate Consolidated Financial Statements in IAS 27 What are Separate Consolidated Financial Statements in IAS 27 What are Separate Consolidated Financial Statements in IAS 27 What are Separate Consolidated Financial Statements in IAS 27 What are Separate Consolidated Financial Statements in IAS 27

IFRS 11 Joint Arrangements |

No single party controls the arrangement = Joint control (see below IAS 28) |

|

A joint arrangement can be classified as a

Determination of this classification:Judgement will need to be exercised when making this classification. In arriving at the classification, the rights and obligations of the parties to the arrangement must be assessed. In making this assessment, the following shall be considered

|

Consolidation replacement/alternative

– Joint operation, the investor consolidates:

– Joint venture, the investor having joint control uses an one-line consolidation method, i.e. the equity method defined in IAS 28 or if exempted from using the equity method (see below) using IAS 27 (cost or fair value method). A party that participates in, but does not have joint control of a joint venture is required to account for its interest in the arrangement in accordance with IFRS 9 Financial Instruments (fair value), unless it has significant influence over the joint venture, then it shall account for it in accordance with IAS 28 (equity method) |

What are structured entities What are structured entities What are structured entities What are structured entities What are structured entities What are structured entities What are structured entities What are structured entities

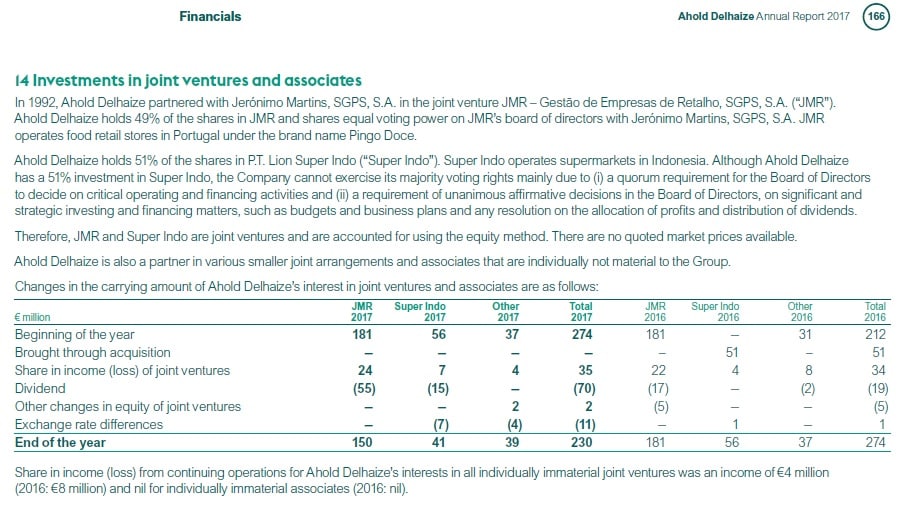

IAS 28 Investments in Associates and Joint Ventures |

Significant influencePower to participate in financial and operating policy decisions of the investee. AssociateAn entity over which the investor has significant influence. But not control (see below) or joint control over those policies. |

Joint controlThe contractually agreed sharing of control of an arrangement – decisions require the unanimous consent of the parties sharing control. Joint arrangementArrangement of which two or more parties have joint control. This means in 9 out of 10 an investment in a non-legal entity (however, see above Determination of this classification). Joint ventureA joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement. This means in 9 out of 10 an investment in a legal entity (however, see above Determination of this classification). |

| Types of control |

Control |

The control model – the parent/investor CONTROLS the investee IF and ONLY IF all the following three elements are met:

9 out of 10 times the control model is clear, it is that 1 you need to worry about i.e. verify and completely understand. |

Joint control

|

Joint control is defined as ‘the contractually agreed sharing of control of an arrangement, which exists only when decisions about the relevant activities require the unanimous consent of the parties sharing control’ All the parties or a group of parties control the arrangement collectively when they act together to direct the relevant activities that significantly affect the returns of the arrangement Judgement will need to be applied when assessing whether all the parties or a group of parties have joint control over a joint arrangement. This assessment shall be made by considering all facts and circumstances. If these facts and circumstances change, an entity shall reassess whether joint control of the arrangement still exists |

Significant influence

|

The rebuttable presumption is that 20% – 50% shareholding gives rise to significant influence Evidenced in one or more of the following ways:

|

Overview Determine control or….?

|

1 Identifying the investee, consideration of its purpose and design |

As said before 9 out of 10 are evident – Investee controlled by means of equity instruments – An investor controls an investee when the investor holds majority of the voting rights and is able to exercise these rights to determine the investee’s operating and financing policies and no additional arrangements that alter this decision making are present. The riskier 1 out of 10 – Where voting rights are not the dominant factor in determining control, the investor would need to consider the design of the investee in terms of:

And more or less by definition risk exposure is with the investor (in court terms: the investor is by default guilty as investor unless certainly proven not to be guilty as investor) – By implication if the investee’s risk exposure is high, it passes part of it on to the investor and the investor is exposed to some of that risk, it is likely that the investee has been set up under the power of the investor. |

2 Identifying the relevant activities of the investee |

‘Relevant activities’ are defined as ‘activities of the investee that SIGNIFICANTLY affect the investee’s returns’. Examples of relevant activities include, but are not limited to:

|

3 Identifying how decisions about the relevant activities are made |

The definition of “power” requires consideration whether the investor has the current ability to direct the relevant activities, therefore it’s important that we consider how decisions about the relevant activities are made. Examples of how decisions about relevant activities are made (not only limited to these);

|

Assessing whether the investor controls the investee |

CONTINUOUS ASSESSMENT – An investor must continuously assess whether it controls an investee |

| Determine control – in Detail…. |

CONTROL – 1 – Power over the investee |

||||

|

Power arises either individually or in combination, from substantive rights (not protective rights):

Case – Protective rights and controlThe board of directors of ABC Plc have decided to dispose of a major subsidiary that accounts for a significant portion of their revenues and assets as they have decided to restructure the entity. For this decision to be passed, it will require the approval of 75% voting rights held by shareholders. One of the shareholders of ABC Plc, CDEF Plc holds a 15% stake in the group and has a “golden vote” (deciding vote). CDEF Plc is unhappy with the proposed transaction. CDEF Plc can veto/block the decision (it has protective rights), it cannot make an alternate suggestion, therefore this is representative of CDEF Plc having significant influence over ABC Plc but not control. |

||||

Power – voting rights

Power – more than a passive interestSometimes there will be indications that an investor has more than simply a passive interest. This may indicate that the investor has other related rights sufficient to give it power or provide evidence of existing power over an investee. Examples that suggest that the investor has a more than passive interest:

|

||||

CONTROL – 2 – Exposure or rights to variability in returns

|

||||

CONTROL – 3 – Link between power and returnsAn investor with decision making rights therefore has to determine whether it is a principal or an agent. An ‘agent’ is defined as ‘a party primarily engaged to act on behalf and for the benefit of another party or parties (the principal(s)) and therefore does not control the investee when it exercises its decision making authority’. Thus, sometimes a principal’s power may be held and exercisable by an agent, but on behalf of the principal. An investor that is an agent does not control an investee when it exercises decision making rights delegated to it. |

||||

Special CONTROL situations – Principal versus AgentAn investor with decision making rights therefore has to determine whether it is a principal or an agent. An ‘agent’ is defined as ‘a party primarily engaged to act on behalf and for the benefit of another party or parties (the principal(s)) and therefore does not control the investee when it exercises its decision making authority’. Thus, sometimes a principal’s power may be held and exercisable by an agent, but on behalf of the principal. An investor that is an agent does not control an investee when it exercises decision making rights delegated to it. |

||||

|

Special CONTROL situations – Principal versus Agent To determine whether a decision maker is an agent, it shall consider the overall relationship between itself, the investee being managed and other parties involved with the investee. ALL the following factors also need to be considered unless a single party holds substantive rights to remove the decision maker without cause.

Example – Principal versus agentPluto owns 68% of Jupiter and the remaining 32% is owned by Mars. Pluto appoints Mars which is a management company to run its investment entity Jupiter. Mars is paid fixed and performance fees in relation to the services provided. This, in combination with the return on investment creates exposure to variability in return. Pluto has the right to remove Mars as the management company of Jupiter if it so wishes. Pluto has power as Pluto has substantive rights to remove Mars if it so wishes therefore Mars is an agent and not a principal therefore Mars would not need to consolidate Jupiter. For further principal versus agent examples, refer to IFRS 10, application examples, example 14. |

||||

Special CONTROL situations – Relationship with other parties (”de facto agents”)When assessing control, an investor needs to consider the nature of its relationship with other parties. In doing so the investor must consider whether those other parties are acting on the investor’s behalf (i.e. they are ‘de facto agents’). Such a relationship need not have a contractual arrangement. Examples of other parties that may act as “de facto agents” for the investor:

|

Disclosure and accounting treatment of non-controlling interestsA parent must present non-controlling interests in the consolidated statement of financial position within equity, separately from the equity of the owners of the parent. Changes in a parent’s ownership interest in a subsidiary that do not result in the parent losing control of the subsidiary are equity transactions. |

Accounting treatment – loss of controlIf the parent loses control of a subsidiary, the parent shall: IFRS Types of Investments in (Consolidated) Financial Statements

|

IAS 27 Valuation of subsidiaries, joint ventures and associates in separate financial statements |

|

An investor accounts for investments in subsidiaries, joint ventures and associates either in accordance with IAS 28 (equity method), in accordance with IFRS 9 (fair value), or in accordance with IFRS 12 (cost method (passive investment or unreliable other valuation methods)). The entity is required to apply the same accounting for each category of investments. IFRS Types of Investments in (Consolidated) Financial Statements Exemption valuations: IFRS Types of Investments in (Consolidated) Financial Statements An entity that is exempt in accordance with IFRS 10 4(a) from consolidation or IAS 28 17 from applying the equity method may present separate financial statements as its only financial statements Held for sale: IFRS Types of Investments in (Consolidated) Financial Statements When investments are classified as held for sale or for distribution to owners (or included in a disposal group that is classified as held for sale or for distribution to owners), they are accounted for: IFRS Types of Investments in (Consolidated) Financial Statements

Investments in associates or joint ventures at fair value: Investments in associates or joint ventures that are measured at fair value in accordance with IFRS 9 are required to be measured in the same way in the separate and consolidated financial statements (i.e. at fair value). Dividends received: IFRS Types of Investments in (Consolidated) Financial Statements Dividends received from subsidiaries, joint ventures, and associates are recognised when the right to receive the dividend is established and accounted for as follows:

|

IAS 28 Exemption from equity methodIf the entity is a parent that is exempt from preparing consolidated financial statements, as set out in IFRS 10 Consolidated Financial Statements paragraph 4(a), or if:

|

IAS 28 Equity methodThe investment is initially recognised at cost Subsequently, the carrying amount is increased or decreased to recognise the investor’s share of the profit or loss of the investee after the date of acquisition (IAS 28.10):

The equity method is used from the date significant influence arises, to the date significant influence ceases. IAS 28 Equity method – keep in mindPotential voting rights are taken into account to determine whether significant influence exists, but equity accounting is based on actual interest only Financial statements of the investor and investee used must not differ by more than 3 months in terms of the reporting date (the same as for IFRS 10) The investors’ share in the investee’s profits and losses resulting from transactions with the investee are eliminated in the equity accounted financial statements of the parent Use uniform accounting policies for like transactions and other events in similar circumstances If an investor’s share of losses of an investee exceeds its interest in the investee, discontinue recognising share of further losses. The interest in an investee is the carrying amount of the investment in the investee under the equity method, and any long-term interests that, in substance, form part of the investor’s net investment in the investee. E.g., an item for which settlement is neither planned nor likely to occur in the foreseeable future is, in substance, an extension of the entity’s investment in that investee If ownership interest is reduced, but equity method remains, the entity reclassifies to profit or loss the gain or loss that had previously been recognised in OCI. IAS 28 Equity method – Discontinuation of the equity methodAn entity is required to discontinue the use of the equity method from the date when its investment ceases to be an associate or a joint venture as follows:

|

Impairment lossesEntities apply IFRS 9 Financial Instruments to determine whether an impairment loss with respect to its net investment in the investee NAGAAN Goodwill that forms part of the carrying amount of an investment in an investee is not separately recognised and therefore not tested separately for impairment – instead the entire investment is tested as ‘one’ in accordance with IAS 36. |

IFRS 12 Disclosures of Interest in Other EntitiesAn entity shall present information separately for the following interests (i.e. aggregation is only allowed for remaining (non-material) interests)

Non-controlling interests in group activities and cash flows result in specific disclosure requirements. Nature of risks in consolidated structured entities in respect of financial support and potential exposures Nature and extent of significant restrictions in a parent, subsidiary relationship Consequences of changes in a parent’s ownership interest in a subsidiary – 2 options: 1. loss of control and 2. no loss of control (see above) |

||

IFRS 12 Parent of a Group of Companies – Disclosures for subsidiariesAn entity is required to disclose information that enables users of its consolidated financial statements to Obtain sufficient understanding of:

In order to enable users to evaluate:

|

||

|

IFRS 12 Investment entities – Interest in unconsolidated subsidiariesAn investment entity shall disclose the following for each unconsolidated subsidiary:

The above disclosures shall also be provided by an investment entity parent for investments that are controlled by its investment entity subsidiary. An investment entity shall also disclose:

|

||||

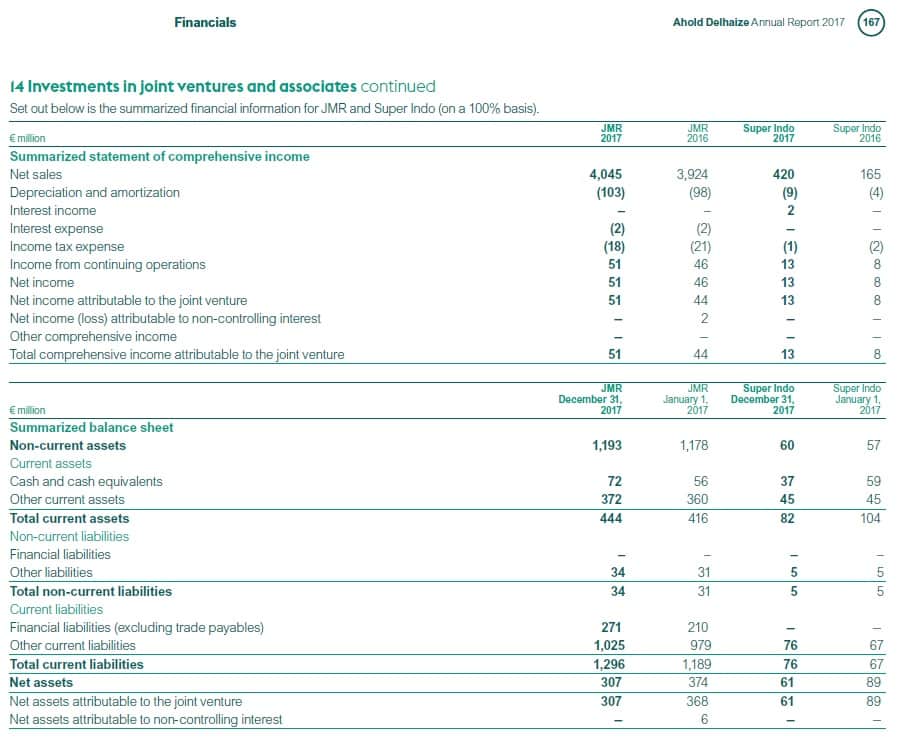

IFRS 12 Interest in Joint arrangements and AssociatesObjective An entity is required to disclose information that enables users of its financial statements to evaluate:

Disclosure Nature, extent and financial effects of an entity’s interests in joint arrangements and associates

|

Nature, extent and financial effects of an entity’s interests in joint arrangements and associates

Risks associated with an entity’s interest in joint ventures and associates An entity shall disclose

|

IFRS 12 Interest in unconsolidated structures entitiesObjectiveAn entity is required to disclose information that enables users of its financial statements to:

DisclosureThe information below should be disclosed in a tabular format unless another format is more appropriate.

|

|

IAS 27 Disclosures in Separate Financial Statements An entity is required to apply all applicable IFRSs when providing disclosures in its separate financial statements.

|

See also: IFRS Community