Last update 17/12/2019

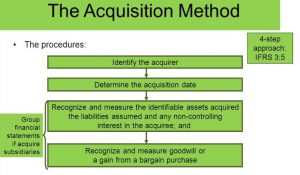

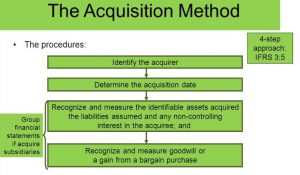

IFRS 3 Business Combinations outlines the accounting when an acquirer obtains control of a business (e.g. an acquisition or merger). Such business combinations are accounted for using the ‘acquisition method’, which generally requires assets acquired and liabilities assumed to be measured at their fair values at the acquisition date.

A revised version of IFRS 3 was issued in January 2008 and applies to business combinations occurring in an entity’s first annual period beginning on or after 1 July 2009.

Key definitions

[IFRS 3, Appendix A] IFRS 3 Business combinations

Business combination – A transaction or other event in which an acquirer obtains control of one or more businesses. Transactions sometimes referred to as ‘true mergers’ or ‘mergers of equals’ are also business combinations as that term is used in [IFRS 3] IFRS 3 Business combinations

Business – An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities (definition narrowed by 2018 amendments to IFRS 3 issued on 22 October 2018 effective 1 January 2020)

Acquisition date – The date on which the acquirer obtains control of the acquiree IFRS 3 Business combinations

Acquirer – The entity that obtains control of the acquiree IFRS 3 Business combinations

Acquiree – The business or businesses that the acquirer obtains control of in a business combination IFRS 3 Business combinations

Scope

IFRS 3 must be applied when accounting for business combinations, but does not apply to: IFRS 3 Business combinations

- The formation of a joint venture [IFRS 3 2(a)] (applies to the accounting for the formation of a joint arrangement in the financial statements of the joint arrangement itself)

- The acquisition of an asset or group of assets that is not a business, although general guidance is provided on how such transactions should be accounted for [IFRS 3 2(b)]

- Combinations of entities or businesses under common control (the IASB has a separate agenda project on common control transactions) [IFRS 3 2(c)]

- Acquisitions by an investment entity of a subsidiary that is required to be measured at fair value through profit or loss under IFRS 10 Consolidated Financial Statements. [IFRS 3 2A]

The current guidance on accounting for business combinations is captured in IFRS 3. Some of the complexities involved in applying ASC 805 include the following:

- The required use of a fair-value model to account for business combinations often requires the involvement of valuation specialists—both related to management’s accounting for a business combination and the auditor’s testing of the amounts recognized. IFRS 3 Business combinations

- It is extremely important for the buyer to determine as early in the acquisition process as possible whether it has acquired a business within the scope of the business combination accounting guidance because whether a business has been acquired or not has significant accounting and valuation implications. IFRS 3 Business combinations

- The definition of a business is one of the more challenging aspects of the business combination accounting guidance to implement in practice because that definition encompasses much more than just a group of assets or net assets that could function together as a standalone business. A significant amount of judgment may need to be exercised in determining whether a business has been acquired. IFRS 3 Business combinations

- The accounting for contingent consideration involves a number of potentially complex steps, including measuring it at fair value initially, classifying it appropriately as either an asset, liability or equity and subsequently adjusting it to fair value if it is classified as an asset or liability.

See also: The IFRS Foundation