Last update 22/08/2019

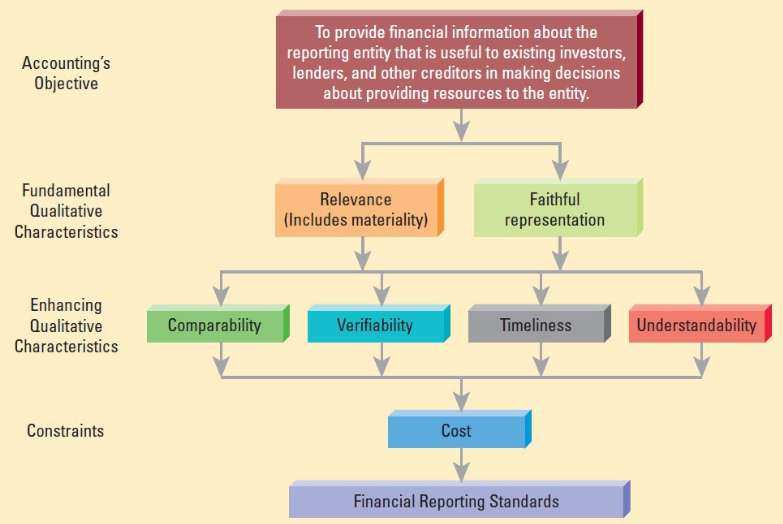

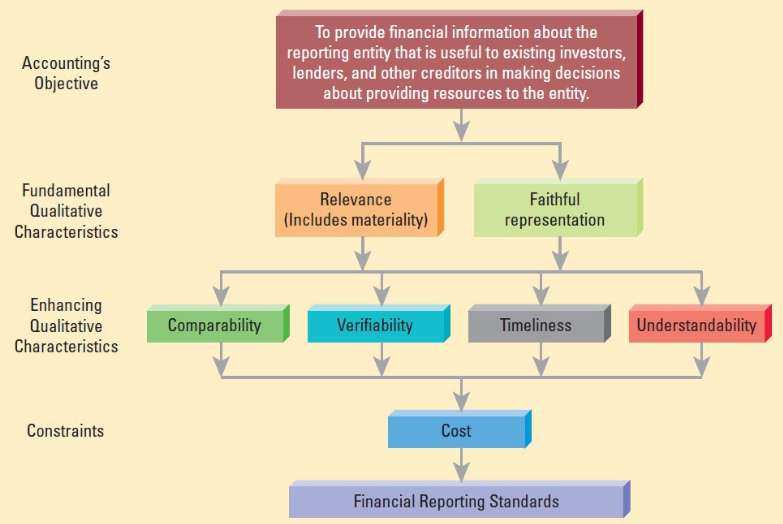

Relevant financial information is capable of making a difference in decisions made by users if it has predictive value, confirmatory value or both.

Predictive value – the financial information is useful because it can be used as an input to processes employed by users to predict future outcomes, in making users’ own predictions.

Confirmatory value – the financial information is useful if it provides feedback about previous evaluations (confirms or changes a previous understanding).

The principle that financial reporting measurements should provide relevant information seems to be indisputable. Two points are worth noting.

- Relevance is subjective. What is relevant to one user of information is not necessarily relevant to another. Even groups of users that are often referred to as though they have identical interests, such as shareholders, are likely in practice to have diverse preferences as to what they regard as relevant

- Relevance frequently conflicts in practice with the achievement of other objectives, such as accuracy and reliability. For example, current values may be more relevant than historical costs, but may be less reliable. Forecasts of future cash flows may be even more relevant and even less reliable. Behavioural factors also tend to make information less reliable the more relevant it is.

And……

IAS 8 14(b) An entity shall change an accounting policy only if the change results in the financial statements providing reliable and more relevant information about the effects of transactions, other events or conditions on the entity’s financial position, financial performance or cash flows.

And……

Any measurement based on estimates is inherently imprecise, whether that measurement portrays the sum of cash flows or their present value. Estimates of the future usually turn out to have been incorrect to some extent, and actual cash flows often differ from estimates. However, neither relevance nor reliability is the paramount characteristic of accounting information. The two must be balanced against one another, and the weight given to each will vary from one situation to the next. However, a simple choice between present value and undiscounted measurement often presents a false dilemma. Techniques like the use of expected cash flows can extend the application of present value to measurements for which it was previously considered unsuitable. The use of simplifying assumptions allows accountants to develop present value measurements that are sufficiently reliable

and certainly more relevant than undiscounted measurements.

Relevance

Relevance

Relevance Relevance Relevance Relevance Relevance Relevance Relevance Relevance