Last update 22/08/2019

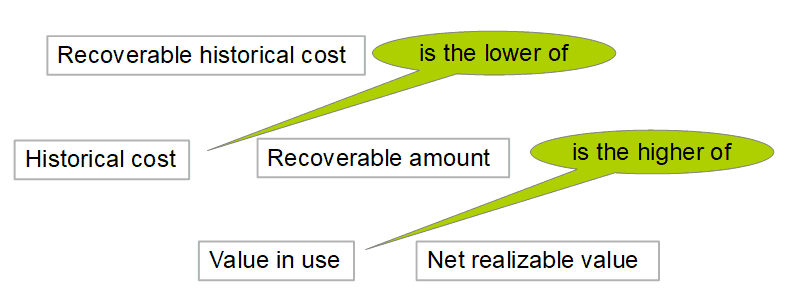

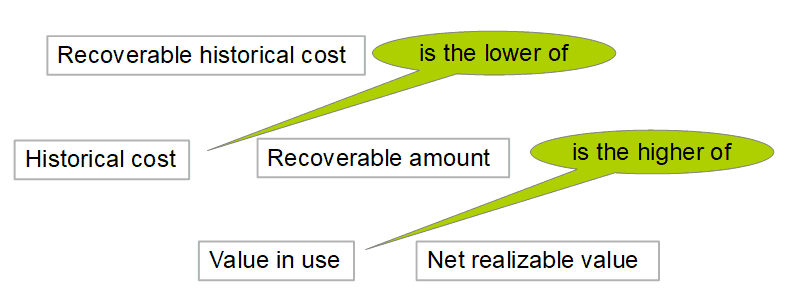

IAS 36 Definition: Recoverable amount of an asset or a cash-generating unit is the higher of its fair value less costs to sell and its value in use.

Recoverable amount is determined for an individual asset, unless the asset does not generate cash inflows that are largely independent of those from other assets or groups of assets. If this is the case, recoverable amount is determined for the cash-generating unit to which the asset belongs (see IAS 36 65–103), unless either:

- the asset’s fair value less costs of disposal is higher than its carrying amount; or

- the asset’s value in use can be estimated to be close to its fair value less costs of disposal and fair value less costs of disposal can be measured. (IAS 36 22)

In a diagram this shows as follows (assuming the carrying amount of the asset or CGU is at (historical) costs less depreciation and/or impairments):

Just a small example to easy the learning/decision making:

Inspire Ltd carries out impairment reviews of three of the company’s assets. The following information is relevant:

|

(Amounts in CU) |

Carrying amount |

Fair value less costs of disposal |

Value in use |

|

Asset A |

9,000 |

6,000 |

7,000 |

|

Asset B |

17,000 |

19,000 |

13,000 |

|

Asset C |

26,000 |

21,000 |

24,000 |

The carrying amount of an asset (A, B or C) is the amount at which it is recognised in the statement of financial position after deducting accumulated depreciation, or amortisation in the case of intangibles, and previous accumulated impairment losses. This amount is simply derived from the trial balance of Inspire Ltd.

Fair value less costs of disposal is the price that would be received from the sale of an asset (A, B or C) in an orderly transaction between market participants at the measurement date, less the costs of disposal – for example, legal costs, stamp duty and the costs of removing the asset. (Example fair value less costs of disposal)

Value in use is the present value of the future cash flows expected to be derived from an asset (A, B or C) in respect of its continuing use and ultimate disposal. (Example value in use)

Which of these assets, if any, will be impaired?

Solution

Asset A

This asset is impaired as the carrying amount of CU9,000 exceeds the recoverable amount of CU7,000 (the higher of CU7,000 and CU6,000).

Asset B

The carrying amount of CU17,000 is less than the recoverable amount of CU19,000 (the higher of CU19,000 and CU13,000), and so this asset is not impaired.

Asset C

This asset is impaired as the carrying amount of CU26,000 exceeds the recoverable amount of CU24,000 (the higher of CU24,000 and CU21,000).

Recoverable amount

Recoverable amount

Recoverable amount Recoverable amount Recoverable amount Recoverable amount