Last update 04/01/2020

Purpose of related party disclosures – Related party relationships are a normal feature of commerce and business. For example, entities frequently carry on parts of their activities through subsidiaries, joint ventures and associates. In those circumstances, the entity has the ability to affect the financial and operating policies of the investee through the presence of control, joint control or significant influence.

Key points

- A related-party transaction is an arrangement between two parties that have a pre-existing business relationship.

- Some, but not all, related party-transactions carry the innate potential for conflicts of interest, so regulatory agencies scrutinize them carefully.

- Unchecked, the misuse of related-party transactions could result in fraud and financial ruin for all parties involved.

A related party relationship could have an effect on the profit or loss and financial position of an entity. Related parties may enter into transactions that unrelated parties would not. For example, an entity that sells goods

to its parent at cost might not sell on those terms to another customer. Also, transactions between related parties may not be made at the same amounts as between unrelated parties. Purpose of related party disclosures

to its parent at cost might not sell on those terms to another customer. Also, transactions between related parties may not be made at the same amounts as between unrelated parties. Purpose of related party disclosures

The profit or loss and financial position of an entity may be affected by a related party relationship even if related party transactions do not occur. The mere existence of the relationship may be sufficient to affect the transactions of the entity with other parties. For example, a subsidiary may terminate relations with a trading partner on acquisition by the parent of a fellow subsidiary engaged in the same activity as the former trading partner. Alternatively, one party may refrain from acting because of the significant influence of another—for example, a subsidiary may be instructed by its parent not to engage in research and development. Purpose of related party disclosures

For these reasons, knowledge of an entity’s transactions, outstanding balances, including commitments, and relationships with related parties may affect assessments of its operations by users of financial statements, including assessments of the risks and opportunities facing the entity. Purpose of related party disclosures

IAS 24 Related Party Disclosures requires disclosures about transactions and outstanding balances with an entity’s related parties. The standard defines various classes of entities and people as related parties and sets out the disclosures required in respect of those parties, including the compensation of key management personnel.

An Example of a Related-Party Transaction: The Enron Scandal

In the infamous Enron scandal of 2001, Enron used related-party transactions with “special-purpose entities” to help conceal billions of dollars in debt from failed business ventures and investments. The related parties misled the board of directors, their audit committee, employees, and the public. Purpose of related party disclosures

Definitions

Those persons having authority and responsibility for:

· Planning, directing, and controlling the activities of the entity, directly or indirectly, including all directors (executive and non-executive).

Includes, but is not limited to:

- Children and Dependents

- Spouse/Partner

- Children and Dependents of Spouse/Partner.

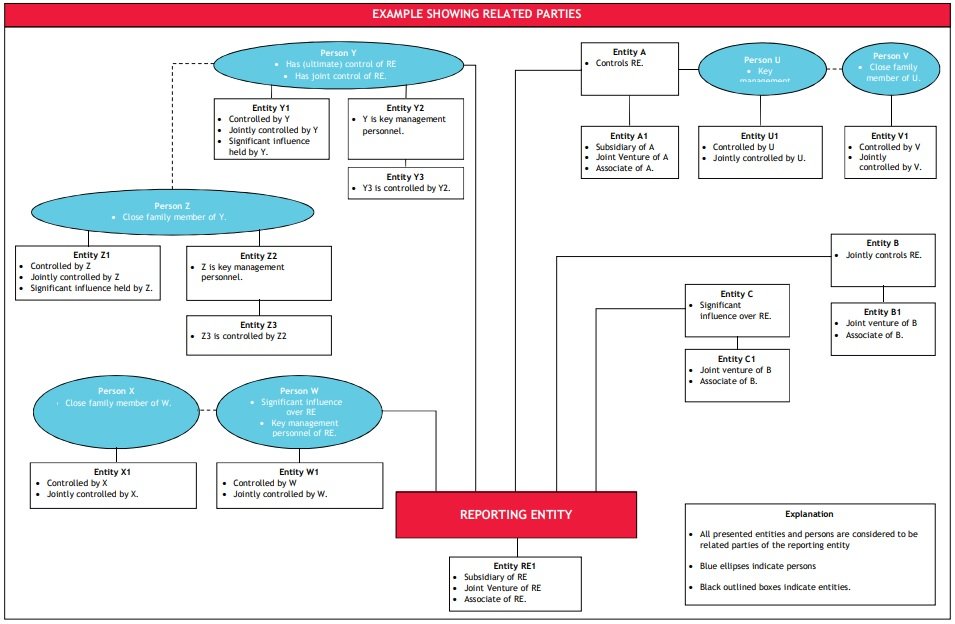

· Refer to diagram below

Transfer of the following between

related parties:

- Resources

- Services

- Obligations between related parties, whether a price is charged or not.

Government-related entity

Entity that is controlled, jointly controlled or significantly influenced by a ‘government’.

Government

Refers to government, government agencies and similar bodies whether local, national or international.