Last update 18/12/2019

Example Variable fee approach for measurement – The variable fee approach (VFA) is applied to insurance contracts with direct participation features that contain the following conditions (‘eligibility criteria’) at initial recognition:

- the contractual terms specify that the policyholder participates in a share of a clearly identified pool of underlying items;

- the entity expects to pay to the policyholder an amount equal to a substantial share of the returns from the underlying items; and

- a substantial proportion of the cash flows the entity expects to pay to the policyholder should be expected to vary with cash flows from the underlying items.

In order to be in scope of the VFA, an insurance contract would need to meet all the three eligibility criteria stated above, and this eligibility test is only performed at inception. In addition, it is noted that the definition refers only to the terms of the insurance contract, and therefore it is not necessary that the entity holds the identified pool of underlying items.

In contracts that qualify for the VFA, the entity has an obligation to pay to the policyholder an amount equal to the share of the return on the fair value of the underlying items less an insurer’s fee in exchange for the future services provided by the insurance contract.

Any changes to the insurer’s fee (as a result of changes arising from financial risk and non-financial risk that affect the underlying items) are taken to the contractual service margin (‘CSM’) and recognised in profit or loss via the release/allocation of the CSM to profit or loss.

EXAMPLE

An entity issues 100 contracts with a coverage of 3 years which for this example are assumed to meet the definition of insurance contracts with DPF. Each policyholder pays a premium of CU 200 at the beginning of the coverage period.

Beneficiaries will receive either (i)CU 220 or the account balance, if higher, if the policyholder dies during the coverage period, or (ii) the value of the account balance at the end of the coverage period if the policyholder survives.

Per contract terms, the entity charges a 2% annual charge of the policyholder account balance at the end of each year.

At initial recognition, the entity expects that one policyholder will die each period. The entity purchases the specified pool of assets and measures them at fair value through profit or loss. It expects that the pool will yield an annual return of 10%; determines the risk free discount rate at 8%, and estimates the risk adjustment to be CU 50.

The specified pool of assets yield 10%, 8% and 10% in years 1, 2 and 3 respectively.

The entity has calculated the fair value of the underlying items in which the policyholders participate as follows:

Account balance (underlying items)

| Example Variable fee approach for measurement |

Year 1 CU |

Year 2 CU |

Year 3 CU |

|

Opening balance (A) Example Variable fee approach for measurement |

20,000 |

21,344 |

22,363 |

|

Change in fair value (B) Example Variable fee approach for measurement |

2,000 |

1,708 |

2,236 |

|

Annual charge ( C = 2% x (A+B)) |

-440 |

-461 |

-492 |

|

Death claims deduction D=y[n] x(A+B+C); y1 = 1/100, y2=1/99, y3=1/98) |

-216 |

-228 |

-246 |

|

Payment on maturity Example Variable fee approach for measurement |

-23,861 |

||

|

Closing balance Example Variable fee approach for measurement |

21,344 |

22,363 |

0 |

In year 1, the entity will pay the guaranteed benefit of CU 220, which is bigger than the account balance of CU 216.

The entity has measured the expected present value of cash outflows to reflect the characteristics of the expected cash flows including an estimate of the time value of guarantees for providing a minimum death benefit as follows:

| Example Variable fee approach for measurement |

Year 1 CU |

Year 2 CU |

Year 3 CU |

|

Present value of expected cash outflows |

19,578 |

20,548 |

21,886 |

Based on the above information the entity measures the contracts on initial recognition as follows:

| Example Variable fee approach for measurement |

Year 1 Initial recognition CU |

||

|

Expected present value of cash inflows |

20,000 |

||

|

Expected present value of cash outflows |

-19,578 |

||

|

Expected present value of net cash flows |

422 |

||

|

Risk adjustment for non-financial risk |

-50 |

||

|

Fulfilment cash flows Example Variable fee approach for measurement |

372 |

||

|

Contractual service margin (CSM) |

-372 |

Applying the Standard, the entity will recognise the following balances in relation to the CSM in the following periods:

Contractual service margin

| Example Variable fee approach for measurement |

Year 1 CU |

Year 2 CU |

Year 3 CU |

|

Opening balance |

-372 |

-784 |

-460 |

|

Changes in the fair value of underlying items |

-2,000 |

-1,708 |

-2,236 |

|

Change in the fulfilment cash flows related to future coverage |

1,190 |

1,567 |

2,221 |

|

CSM before release (E) Example Variable fee approach for measurement |

-1,182 |

-925 |

-475 |

|

Release for the year Example Variable fee approach for measurement |

398 |

465 |

475 |

|

Closing balance Example Variable fee approach for measurement |

-784 |

-460 |

0 |

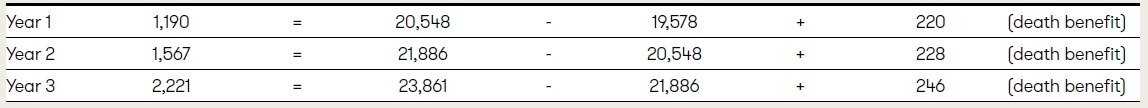

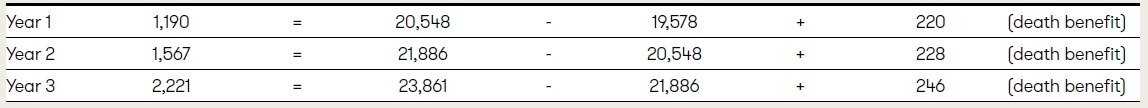

Changes in the fulfilment cash flows related to future coverage have been calculated as follows:

The release of the CSM has been calculated as follows:

| Example Variable fee approach for measurement |

Year 1 CU |

Year 2 CU |

Year 3 CU |

|

% of coverage provided in the year (F) (y1 = 100/(100+99+98);y2=99/(99+98) |

33.67% |

50.25% |

100.00% |

|

CSM allocated based on the above (E x F) |

The example assumes that the entity chooses as an accounting policy to include insurance finance income and expense for the period in profit or loss.

See also: The IFRS Foundation