Last update 19/08/2019

Definition IFRS 10

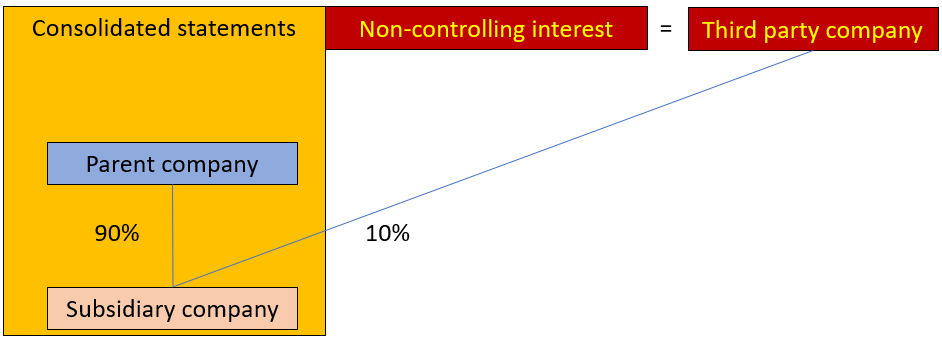

Non-controlling interest or NCI represents equity in a subsidiary not attributable, directly or indirectly, to a parent. AKA: Minority interest

More information/explanation:

More information/explanation:

A parent presents non-controlling interests in its consolidated statement of financial position within equity, separately from the equity of the owners of the parent.

A reporting entity attributes the profit or loss and each component of other comprehensive income to the owners of the parent and to the non-controlling interests. The proportion allocated to the parent and non-controlling interests are determined on the basis of present ownership interests.

The reporting entity also attributes total comprehensive income to the owners of the parent and to the non-controlling interests even if this results in the non-controlling interests having a deficit balance.

Non-controlling interest, also known as minority interest, is an ownership position whereby a shareholder owns less than 50% of outstanding shares and as a result has no control over decisions. Non-controlling interests are measured at the net asset value of subsidiary entities and do not account for potential voting rights in the parent company.

The acquirer in a business combination can elect, on a transaction-by-transaction basis, to measure NCI that are present ownership interests and entitle their holders to a proportionate share of the acquiree’s net assets in liquidation (‘ordinary’ NCI) at fair value or at the holders’ proportionate interest in the recognised amount of the identifiable net assets of the acquiree at the date of acquisition. Other components of NCI are initially measured at fair value, unless a different measurement basis is required by other IFRSs. [IFRS 3 19]

Even though control of an entity takes into account potential voting rights that are substantive, the calculation of NCI is generally based on current ownership interests. The returns associated with an ownership interest, and hence the NCI proportion, do not refer to the wider returns, such as synergistic benefits due to economies of scale and cost savings, that are part of the test of control. [IFRS 10 B89]

Losses that are attributable to NCI are allocated to the NCI even if doing so causes the NCI to have a deficit balance. [IFRS 10 B94]

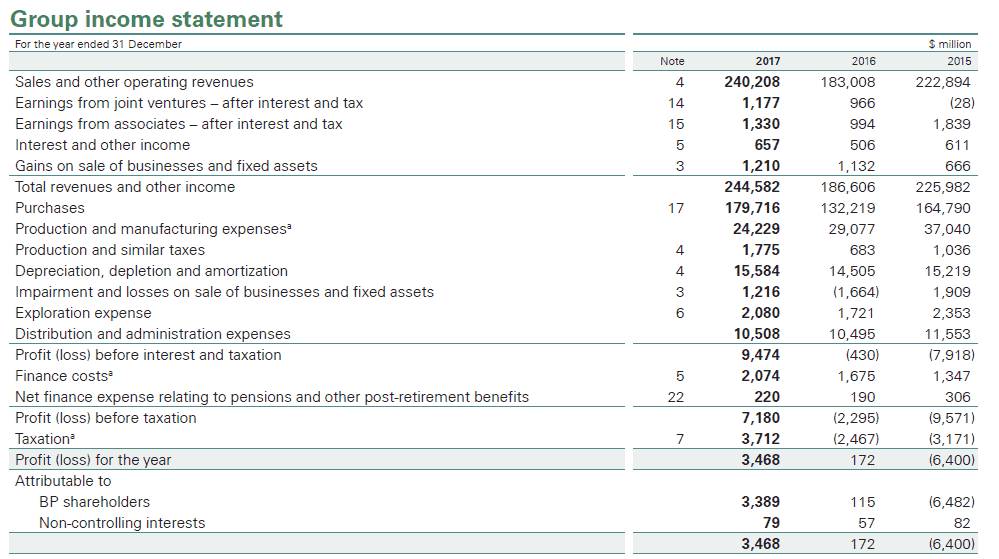

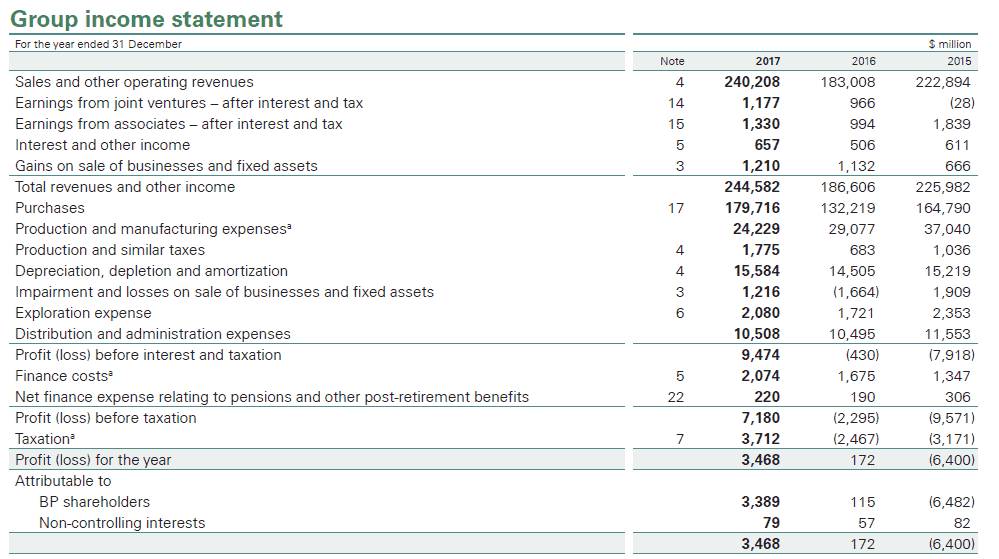

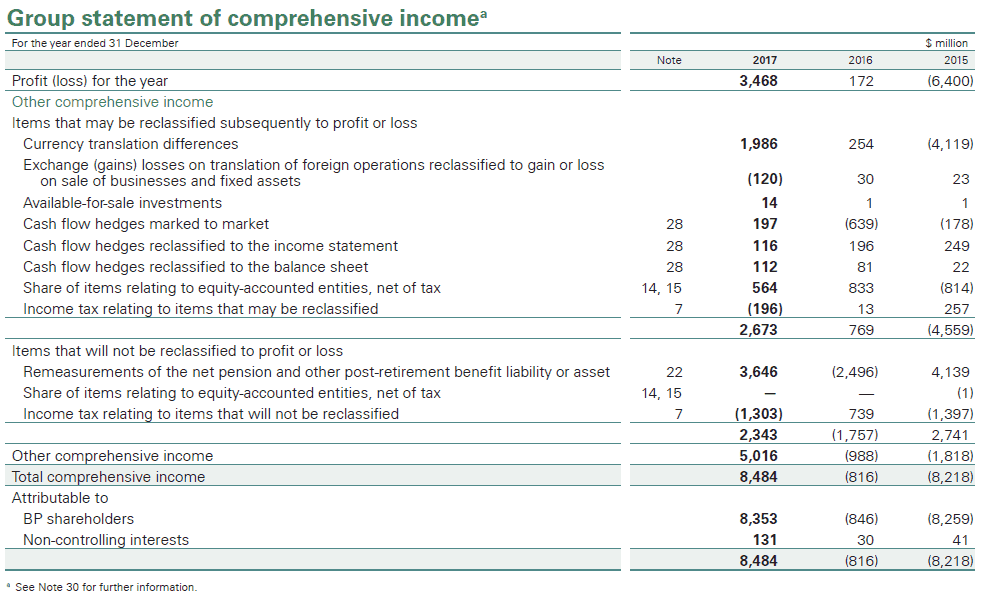

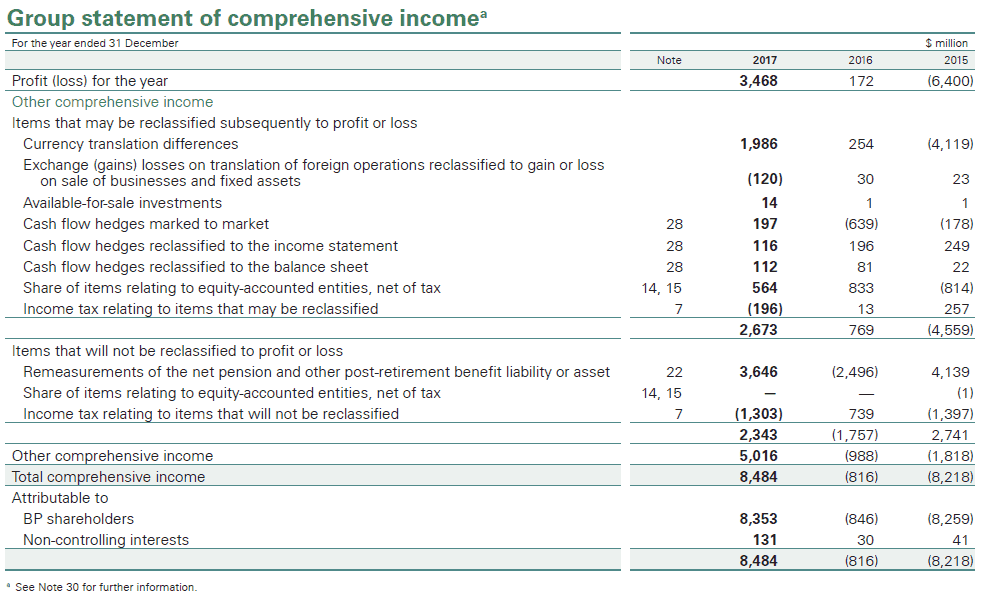

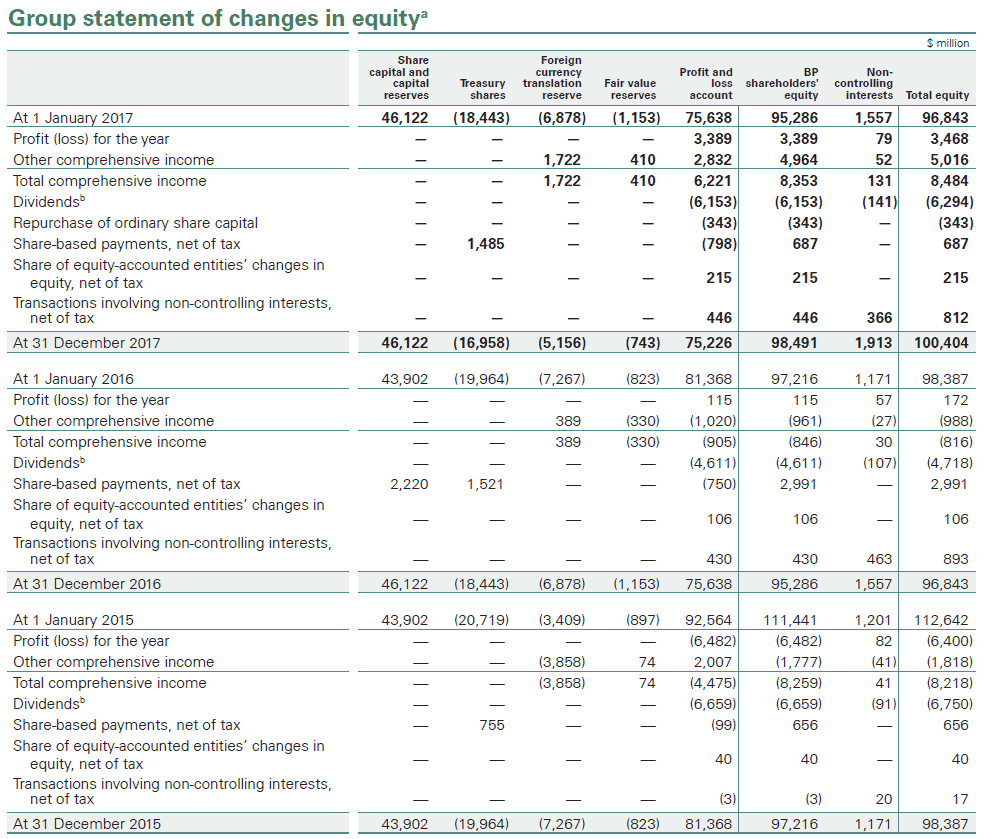

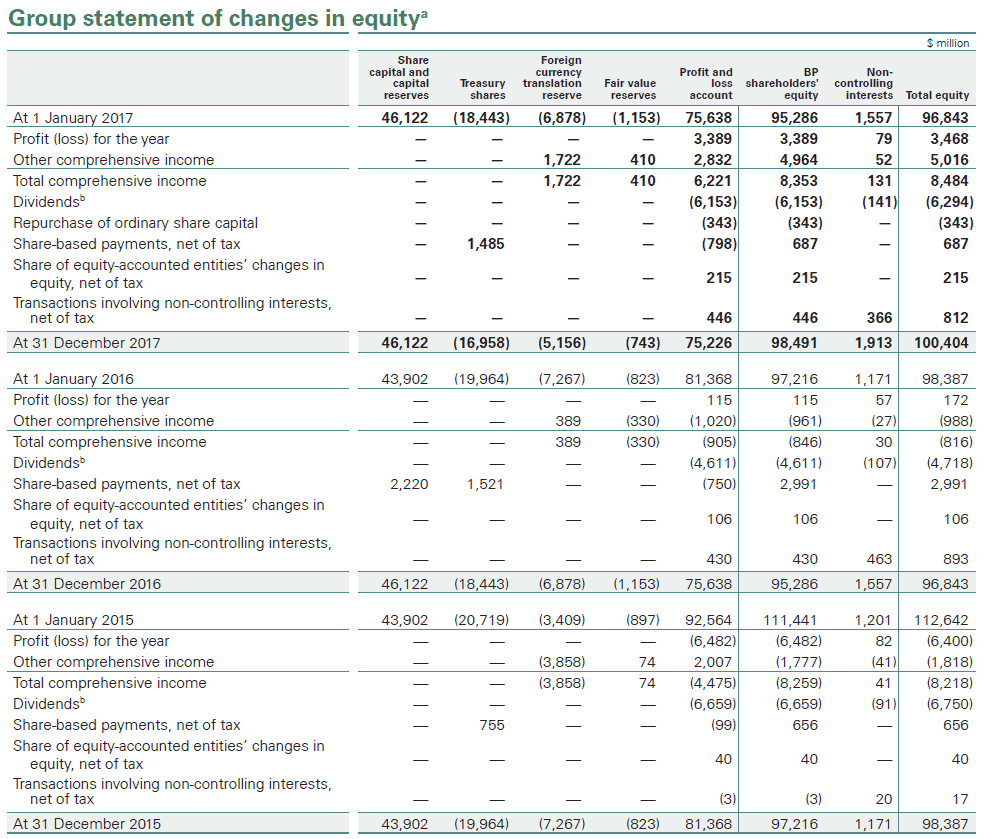

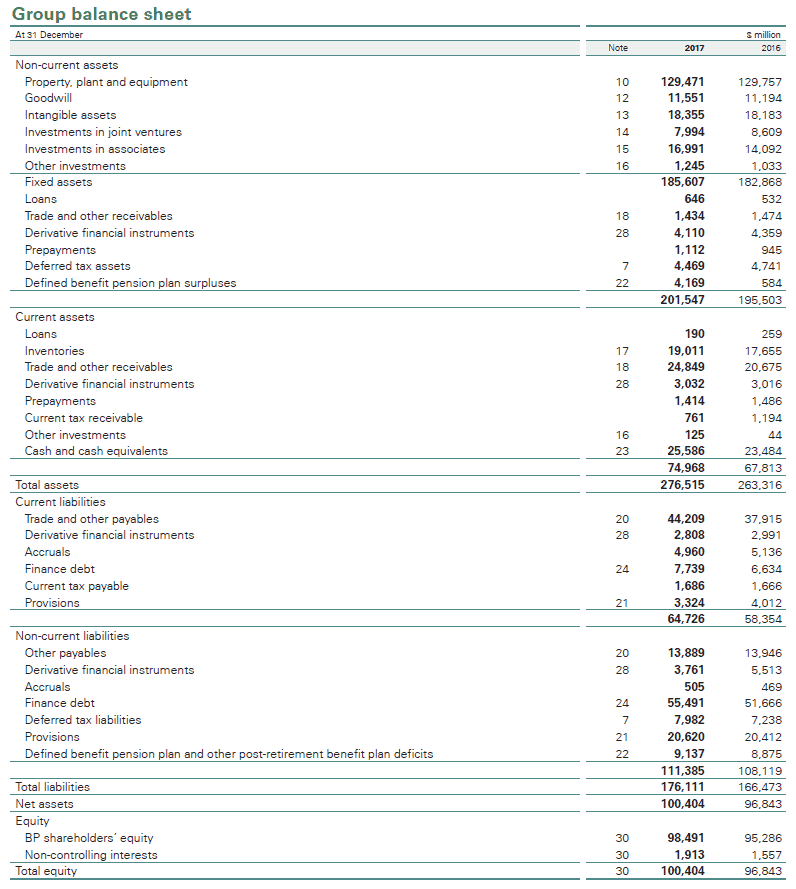

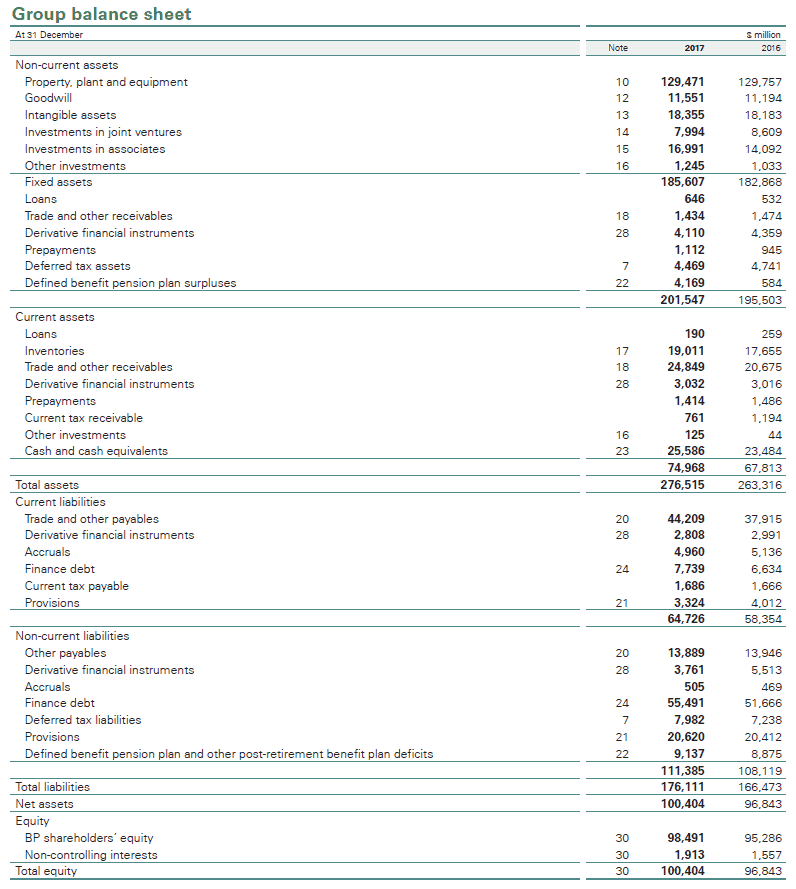

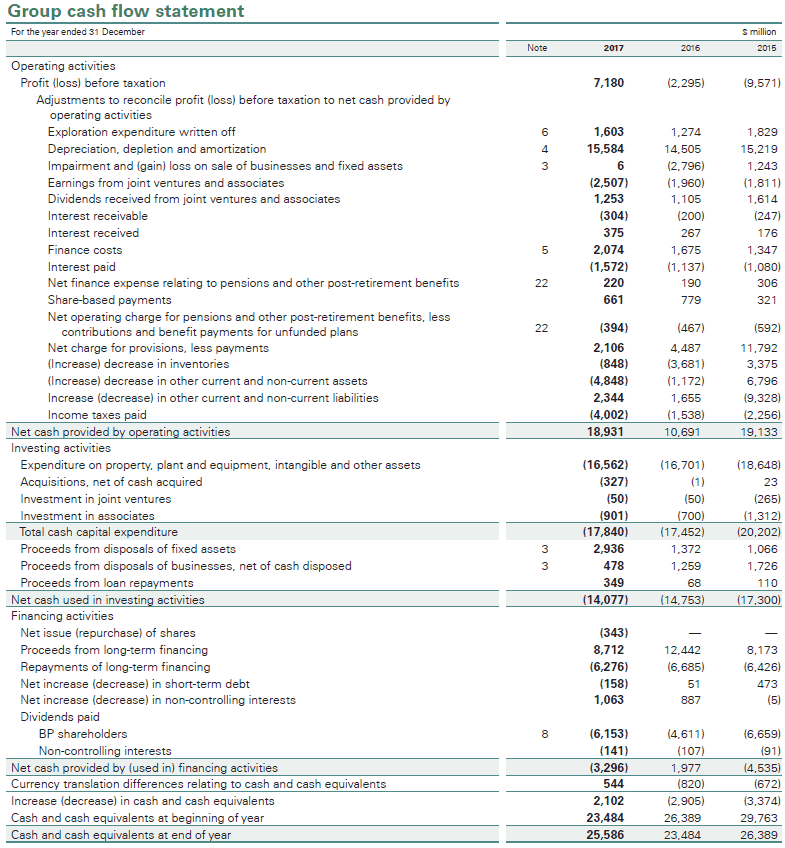

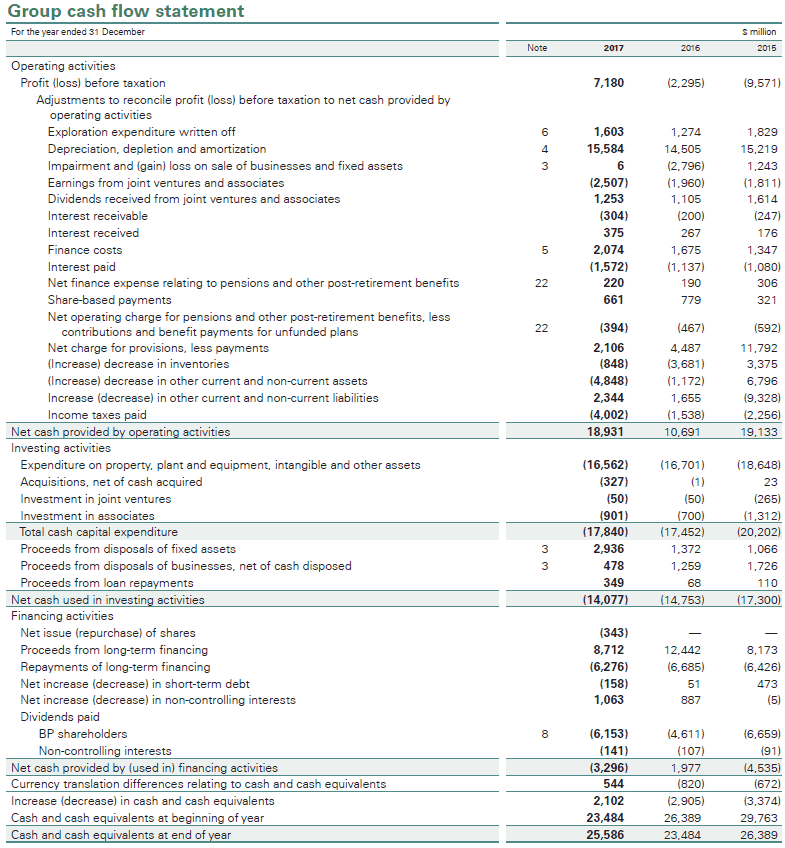

Below are examples of accounting and reporting for non-controlling interest provided for the Group Income Statement, the Group Statement of Comprehensive Income, the Group Statement of changes in Equity, the Group Balance Sheet and the Group Cash Flow Statement, in this case from the Annual Report and Form 20-F 2017 of BP Plc.