Last update 18/08/2019

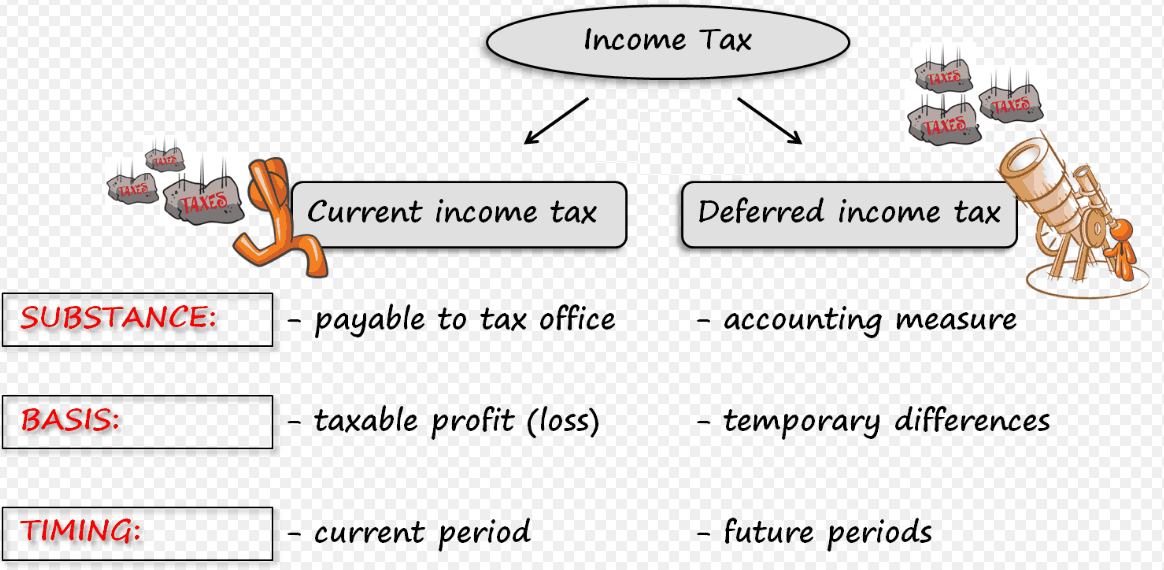

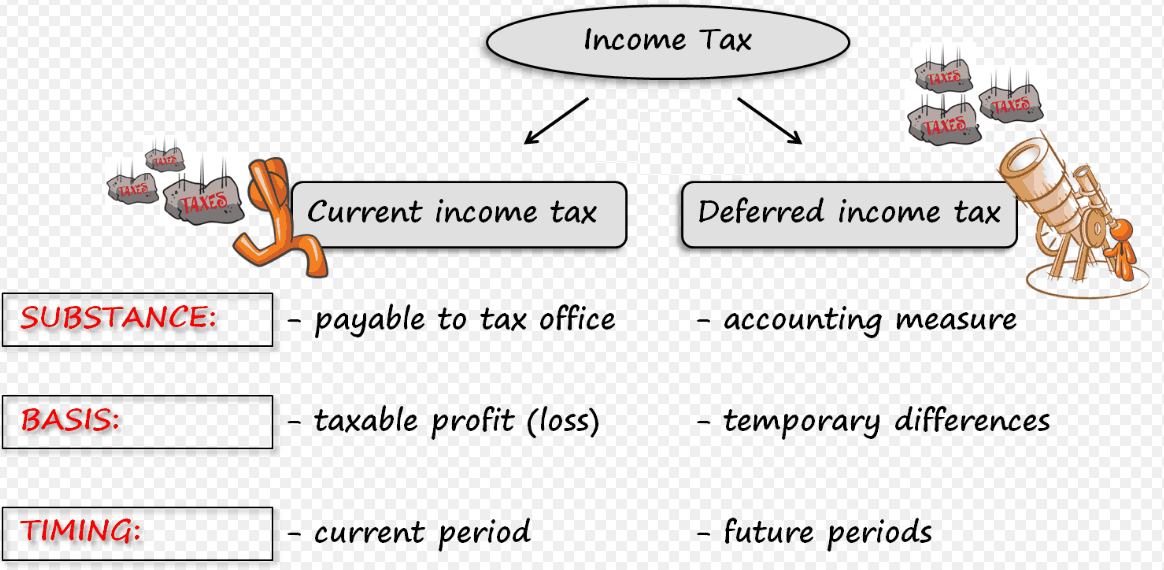

Liabilities (assets) for current tax comprise the amount of income taxes payable (recoverable) in respect of the taxable profit (tax loss) for a period.

Current tax for current and prior periods shall, to the extent unpaid, be recognised as a liability. If the amount already paid in respect of current and prior periods exceeds the amount due for those periods, the excess shall be recognised as an asset.

The benefit relating to a tax loss that can be carried back to recover current tax of a previous period shall be recognised as an asset.

When a tax loss is used to recover current tax of a previous period, an entity recognises the benefit as an asset in the period in which the tax loss occurs because it is probable that the benefit will flow to the entity and the benefit can be reliably measured.

Determining the current income tax payable is the most straightforward, because it represents a business’s tax obligation related to the current period taxable income.

Current income tax obligation = Taxable income × Tax rate

Matching principle of accounting suggests that tax expense for revenue should be recognized in the period in which the relevant revenue was recognized. Similarly, tax shield i.e. the reduction in tax expense due tax deductibility of an expense should be recognized in the period in which the relevant expense is recognized.

We determined that taxable income is different from accounting income. It means that the current income tax payable is not a good representation of total current tax expense. It should be adjusted.

For example:

- Current income tax payable related to revenue that would be recognized under GAAP in future periods should be carried forward;

- Income tax payable related to revenue that is recognized today under GAAP but which shall be taxed in future periods should be included in current period’s tax expense;

- Tax benefit of expenses that shall be recognized under GAAP in future periods but which are allowed as tax deduction in current period should be carried forward; and

- Tax benefit of expenses that are recognized under GAAP today but which shall be allowed as tax deduction in future should be subtracted from current period income tax expense.

Liabilities and assets for current tax

Liabilities and assets for current tax

Liabilities and assets for current tax Liabilities and assets for current tax Liabilities and assets for current tax Liabilities and assets for current tax