Last update 04/08/2019

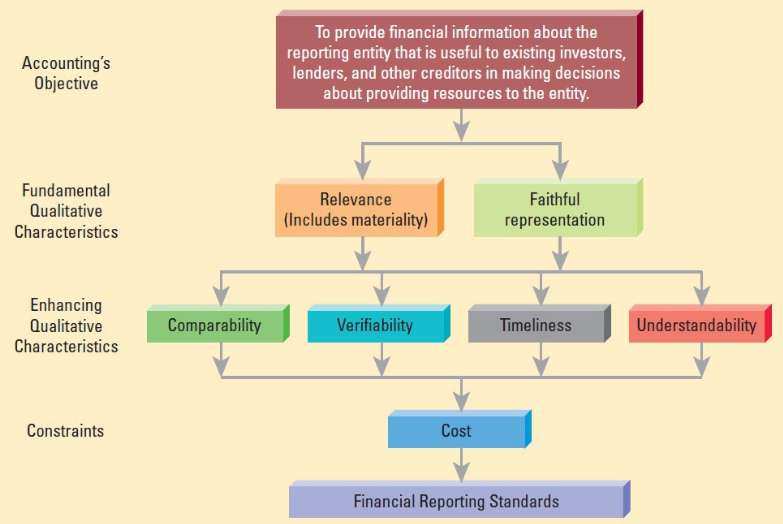

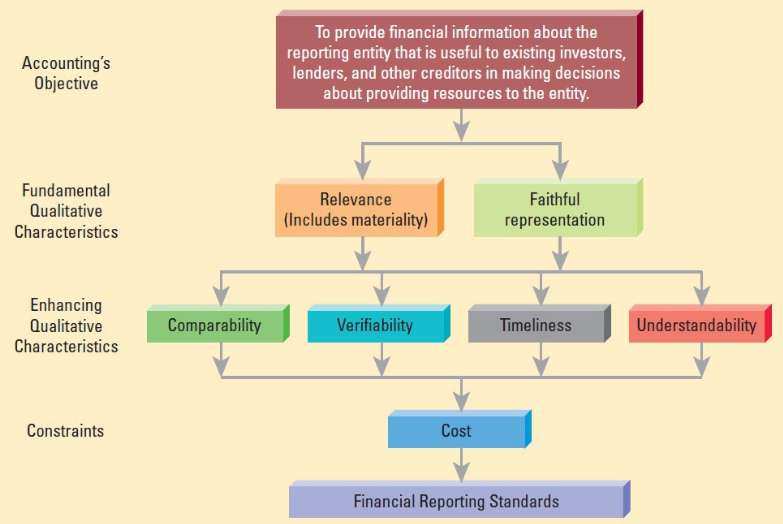

Financial information that faithfully represents the phenomena that it purports to represent. A faithful representation provides information about the substance of an economic phenomenon instead of merely providing information about its legal form. A perfectly faithful representation would be complete, neutral and free from error. Providing a faithful representation is one of the two fundamental characteristics of useful financial information (see diagram).

Reliability is not specifically mentioned in the Conceptual Framework IASB has explained that this characteristic is included in faithful representation [IASB 2010 BC 3 24].

An example of applying faithful representation :

Faithful representation of conditions at the reporting date and changes in the period in using current estimates

If conditions have not changed in a period, shifting a point estimate from one end of a reasonable range at the beginning of the period to the other end of the range at the end of the period would not faithfully represent what has happened during the period. If the most recent estimates are different from previous estimates, but conditions have not changed, an entity should assess whether the new probabilities assigned to each scenario are justified.

In updating its estimates of those probabilities, the entity should consider both the evidence that supported its previous estimates and all newly available evidence, giving more weight to the more persuasive evidence. An entity should not update probabilities for claim events to reflect actual claims that took place after the reporting date but before the financial statements are finalised.

For example, there may be a 20% probability at the end of the reporting period that a major storm will strike during the remaining six months of an insurance contract. After the end of the reporting period, but before the financial statements are authorised for issue, a major storm strikes. The fulfilment cash flows under that contract should not reflect hindsight (i.e., the storm that occurred in the next period). Instead, the cash flows included in the measurement should include the 20% probability apparent at the end of the reporting period (with disclosure applying IAS 10 Events After the Reporting Date that a non-adjusting event occurred after the end of the reporting period).

And….

Reversal of an impairment

A reversal of impairment loss, if done properly, could be relevant to capital providers in assessing future cash flows of an entity because the reversal serves as a signal about an increase in expected future benefits of these assets. On the other hand, the requirement that impairment loss shall be reversed if, and only if, there has been a change in the estimates used to determine the asset’s recoverable amount since the last impairment loss was recognised is quite judgemental, and may be abusively used by preparers to inflate earnings. Such potential abusive use violates “free-from-error” and neutrality, two important elements of faithful representation of accounting information. Massaged numbers would also lose their predictive and confirmatory value, and would not be relevant and useful for decision making. Reversals of impairment losses coupled with the use of discounted cash flows (value in use) in determining whether an asset is impaired could introduces a volatile element into the income statement, therefore making it harder for investors to understand the performance of an enterprise and to predict its future profit.

Faithful representation

Faithful representation

Faithful representation Faithful representation Faithful representation Faithful representation Faithful representation Faithful representation