Last update 10/08/2019

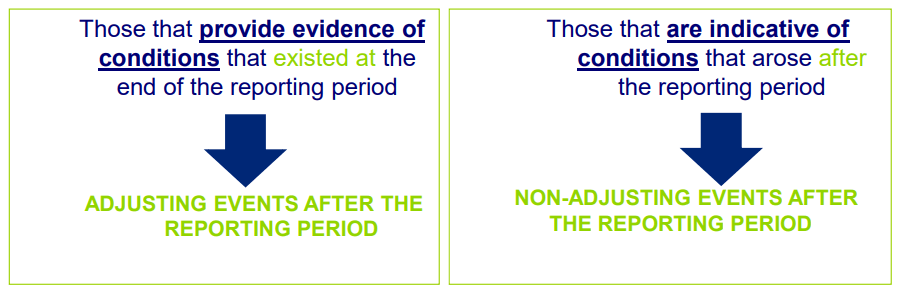

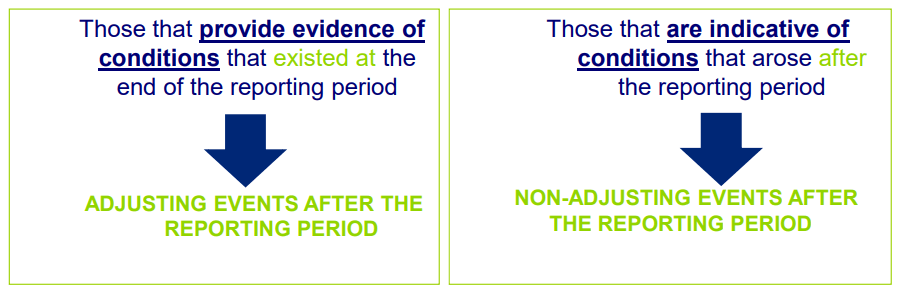

Those events, both favourable and unfavourable, that occur between the reporting date and the date when the financial statements are authorised for issue. Two types of events can be identified:

- Those that provide evidence of conditions that existed at the reporting date (adjusting events after the reporting date); and

- Those that are indicative of conditions that arose after the reporting date (non-adjusting events after the reporting date).

Adjusting events

The financial statements are adjusted to reflect events that occur after the reporting date but before the financial statements are authorised for issue, if those events provide evidence of conditions that existed at the reporting date (adjusting events) or if they indicate that the going concern basis of preparation is inappropriate. [IAS 10 3, IAS 10 8, IAS 10 14]

Material adjusting events require changes to the financial statements.

Examples of such events given in IAS 10 are:

- the resolution of a court case, as the result of which a provision has to be recognised instead of the disclosure by note of a contingent liability;

- evidence of impairment of assets:

- bankruptcy of a major customer;

- sale of inventories at prices

suggesting the need to reduce the balance sheet figure to the net value actually realised.

Non-adjusting events

Financial statement amounts are not adjusted for events that are a result of conditions that arose after the reporting date (non-adjusting events). An exception is when events after the reporting date indicate that the financial statements should not be prepared on a going concern basis. [IAS 10 3, IAS 10 10, IAS 10 14]

The following is disclosed in respect of significant non-adjusting events: the nature of the event and an estimate of its financial effect, or a statement that an estimate cannot be made. [IAS 10 21] Detailed information about business combinations effected after the reporting date is disclosed. [IFRS 3 59–60, IFRS 3 B64–B66]

Non-adjusting events do not, by definition, require an adjustment to the financial statements, but if they are of such importance that non-disclosure would affect the ability of users of the financial statements to make proper evaluations and decisions, the enterprise should disclose by note:

- the nature of the event;

- an estimate of its financial effect, or a statement that such an estimate cannot be made.

Examples of such events given in IAS 10 are:

- decline in market value of investments;

- announcement of a plan to discontinue part of the enterprise;

- major purchases and sales of assets;

- expropriation of assets by government;

- destruction of a major asset by fire etc;

- a major business combination after the balance sheet date;

- sale of a major subsidiary;

- major dealings in the company’s ordinary shares;

- abnormally large changes in asset prices or foreign exchange rates;

- changes in tax rates with a significant effect on current and deferred tax assets;

- entering into significant commitments or contingent liabilities;

- commencing major litigation arising solely out of events after the balance sheet date.

Events after the reporting date

Events after the reporting date

Events after the reporting date Events after the reporting date Events after the reporting date Events after the reporting date Events after the reporting date Events after the reporting date