Last update 05/01/2020

The de facto agent assessment is part of IFRS 10 Consolidated financial statements (i.e. assessment of control over an investee for consolidation purposes), the de facto agent is a party engaged to act on behalf of another party (the principal). A principal may delegate some of its decision authority over the investee to the agent, but the agent does not control the investee when it exercises such powers on behalf of the principal (IFRS 10 B58). The decision-making rights of the agent should be treated as being held by the principal directly in assessing control. Power resides with the principal rather than the agent (IFRS 10 B59).

As a result the principal may have to consolidate the investee’s financial statement because the decision making rights of the agent are of a de facto agent who should no consolidated the investee’s financial statements into its consolidated financial statements.

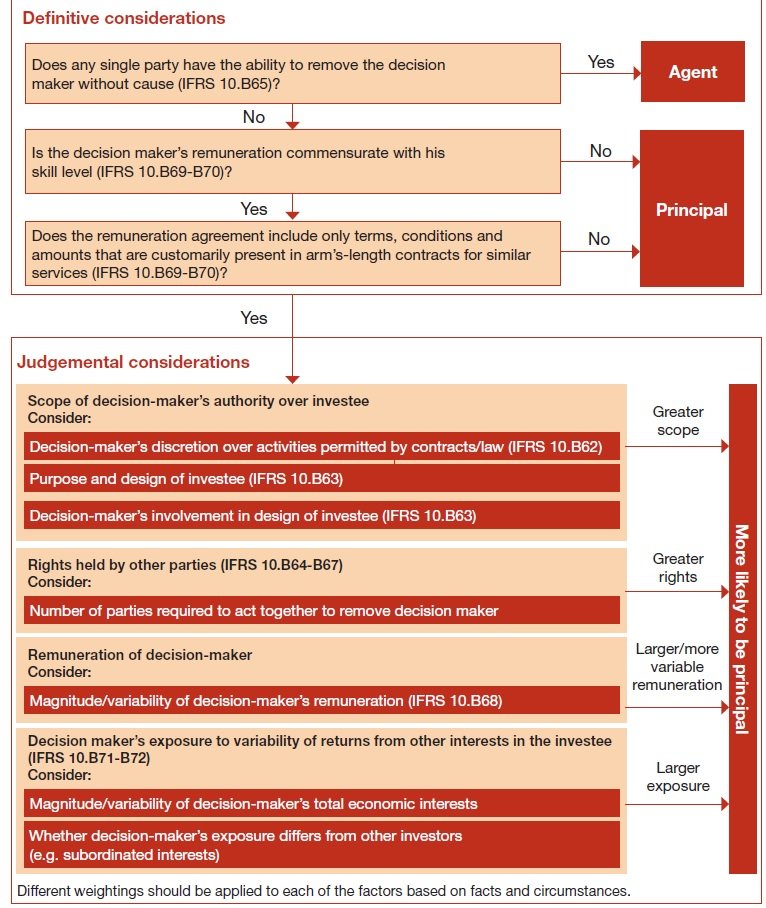

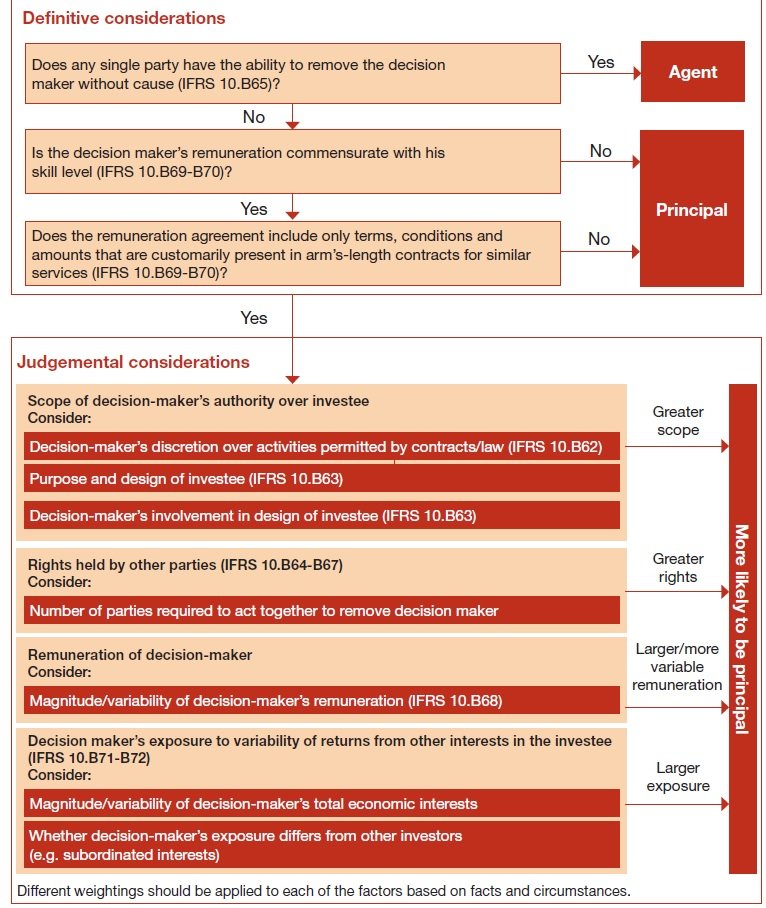

The overall relationship between the decision-maker and other parties involved with the investee must be assessed to determine whether the decision-maker acts as an agent. The standard sets out a number of specific factors to consider; several are determinative, but the majority are judgemental and need to be considered together in assessing the overall relationship.

A party is a de facto agent when the investor has, or those that direct the activities of the investor have, the ability to direct that party to act on the investor’s behalf. The decisions and judgements to be made are summarised as follows:

| .

. . . . . . . . . . |

|

IFRS 10 also requires management to consider whether there are other parties who are acting on behalf of an investor by virtue of their relationship with the investor, that is, whether the other parties are acting as de facto agents of the investor. The rights held by de facto agents, and the returns received by such parties, are considered when evaluating whether an investor has control. IFRS 10 provides examples of parties that might be considered de facto agents of an investor, such as those who are related parties, as defined in IAS 24 Related Party Disclosures, those who maintain a close business relationship with the investor, or those who cannot finance their operations without subordinated support from the investor.

The standard identifies a number of possible de facto agent/principal relationships including:

- IAS 24 related parties of the principal;

- parties that received interests in the investee as a contribution or loan from the principal;

- parties that agreed not to sell, transfer or encumber their interests in the investee without the principal’s approval;

- parties that cannot finance operations without subordinated financial support from the principal;

- parties that have largely similar governing body members or key management personnel as the principal; and

- parties that have close business relationships with the principal.

An agent need not be bound to the principal by a contract. IFRS 10 uses the term ‘de facto agents’ to describe agents who may be acting on behalf of principals even when there is no contractual arrangement in place. Identification of such relationships is expected to be highly judgemental. Consideration should be given to the nature of relationships between the investor and various parties and how they interact with each other (IFRS 10 B73).

An investor with a de facto agent should consider the de facto agent’s decision-making rights, as well as its indirect exposure to variable returns through the de facto agent when assessing control of the investee (IFRS 10 B74).

See also: The IFRS Foundation